I’m gonna keep this short, but…

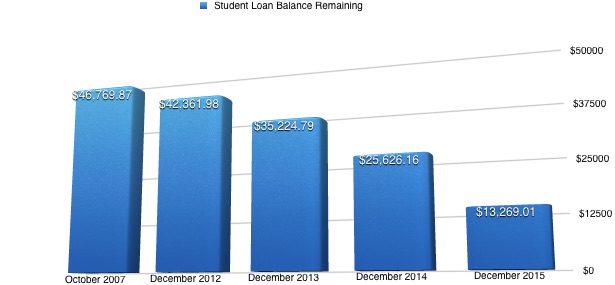

Since I started this blog I’ve paid over $29k not including interest on my student loans. Sort of like with compounding interest, I will see the biggest improvement in my later years. In 2010 and 2011 I paid either 0 or a portion of interest as part of the income based repayment program.

Been a tough road, but I can do this. I am doing it. The finish line is getting closer and closer.

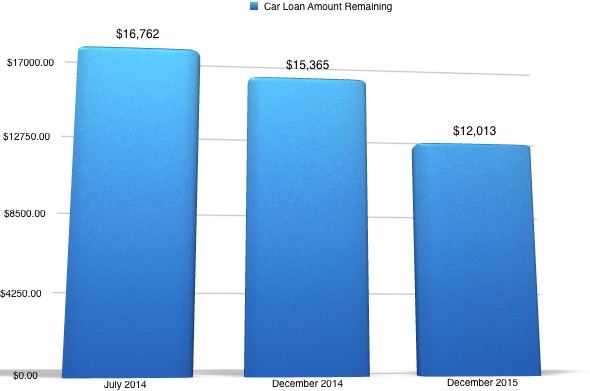

And for my car… Down $4,749 from my original loan balance of $16,762. If you’re going to not be smart and buy a slightly used but more depreciated value vehicle. Doing what I did, negotiating down, getting a good deal on a trade (or selling it separately) getting a 0% financing option is the next best thing. When every payment goes to principal the outstanding balance drops pretty quickly.

I repeat myself a lot on this blog. Habits are everything and repetition is the mother of skill.

Absolutely nothing wrong with repetition and you were smart to buy it slightly used. I bought a brand new one once and then had to sell it a year later, and of course I took a major hit on depreciation. Pretty much sucked, having to pay out money just to get the monkey of the loan off of my back.

Keep it up -slow and steady wins the race, right?