Month 51 Update:

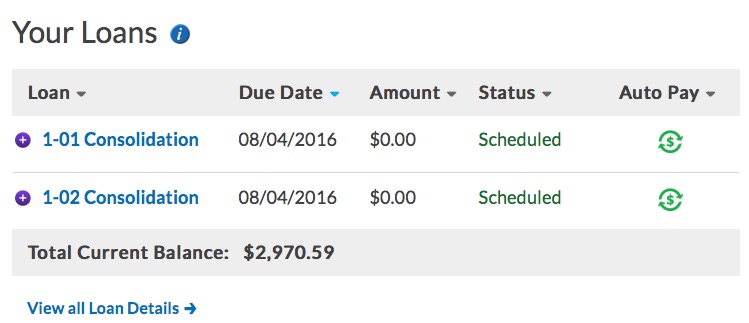

Student loan is down to $2,970, as most of you viewers know…I have been extremely impatient to get rid of this one debt. Still made some great progress since last month… That’s $4,529 down. Still chipping away, chip chip chip…. 😛

Making progress on the car loan at $30,190, another payment is coming out in a week, but as I mentioned before it’s 1.9% and I see little reason to pay it off early. Opportunity costs brah! Plus the emergency fund needs to be cranked up a few notches.

The stock market has been volatile with Brexit, oil prices fluctuating, shaky consumer confidence and the fact it’s an election year… My 401k is still at $16,521 though at +6.62% YtD RoR. So I’m still outpacing the market for now. The Roth is slowly going up at $125. Kind of a joke now, but it’s all about habits. The habit of continually investing extra money into retirement.

Going back to reading mode where I study people who are financially independent and pulling in large salaries. Not sure what my plan of action is right now, but it is inspiring me. I do wonder if I have it in me to work 60-80 hours a week. During the full time work and part time grad school days I easily put in 60 total hours each week on my goals. Some things have changed but a lot has remained the same. No kids, single, also still driven for success. My day job takes more out of me and I’m packing a lot more weight these days but at my core I’m still a driven personality. Just need to keep tapping into that hunger.

Went on a frugal trip with some friends for a day to Granbury, TX. Drove the Maxima a little about 250 miles round trip. The car drove like a dream, soaking up the country roads at 80mph. The hotel was $60, then paid for meals. On the first night there I had duck with roasted potatoes and carrots at this shack-like place called Let’s Eat. Food was amazing and almost worth the drive alone. Went to a winery and a brewhouse Between this trip and some shopping I did, spent around $200 in total.

You don’t have a ton of money to have fun! I got invited to Napa in August with friends and the more I learn about the trip the more I’m glad I declined. It’ll be between $1500-$2000 and right now that is money they will get me one step closer to completing my 15 year goal… Next year though we’ve discussed going on a cruise. The verdict is still out on that one, but I think I’m going to go.

You are making such great progress on your student loan!! When do you think you will have it paid off?

Thanks for the Comment! I expect to be done paying off the student loans in October assuming everything goes according to plan. Paying 453/mo and then a self imposed balloon payment at the end.

I couldn’t comment on the most recent post so I will comment here! You are doing so well on the debt repayment! It will definitely be gone by the end of this year – you can just feel the fire burning in you by reading through your posts.

Who cares if you are paying it off in your 33rd year and not your 32nd? 🙂 Things come up and life changes and goals and dreams change, as I am finding out. I love how you went on that trip and had fun – I am definitely finding that sometimes a day trip or quick overnight trip to places like Flagstaff have a great impact on me. Make me feel more motivated and happy and excited to make changes in my life. If you constantly focus on not spending/not spending/not spending, it can get really overwhelming and things start to get into that negative energy field. At least that’s the way it is for me. Little indulgences can go a long way sometimes. Good for you!

Thanks much for your comments as always! Yeah I’m keeping at it as much as I can. It’s still a burden but one I will be glad to be rid of. After I pay it off, plan to put more money in an emergency fund and into retirement. It’s so funny when I lived with my folks I was putting away $1k/mo easy. Now close to 10 years later it’s been such a challenge. Though I guess it’s a lot easier when there is no $800/mo rent payment plus $200 or so in cable & utilities. I gave my mom $200/mo and she was fine with it. Those were the days…..

I’m trying to have a more abundant mindset. I find that scarcity makes me resent a life of doing things that are fun. I recently went on a date with someone who made me look super wasteful with spending. He is an intern here from India, lives with 5 other people, spends roughly $10/wk on food, nor does he drive a car. There is frugal and there is **dirt poor cheap**. The idea of working decades and pinching pennies on everything isn’t appealing to me. I grew up that way and prefer to think there is a better way.