June – What a month. I’m a mixed Black gay man from New York living in Texas. I had written a super long post but decided to leave it in the draft folder as it doesn’t tie into the purpose of this blog. Short answer – systemic racism is still a problem in america, Black people had it difficult in this country for centuries, it’s great to see whites, corporations, organizations all rallying together to bring about progress, consider all options on the table to end police brutality, and encourage equality under the law. In the dawn of everyone having a recording device, many of these injustices are now being brought to light. Social struggles lead to economic struggles which if not corrected leads to generational poverty. So it’s all connected.

I also believe individuals play a role in determining their fate. Just because someone else has the same skin tone or upbringing as me doesn’t mean I need to take responsibility for their poor decisions and the reverse holds true. I don’t expect the government to bail me out unless it’s for a short period of time while I get back on my feet.

In a capitalistic society it’s challenging to force equality. On one hand you should hire based on merit / would they be a good fit. On the other many people from disadvantaged backgrounds may have had a lot more obstacles to face, be the only minority on the whole team, and one could argue why should they get special treatment when everyone is working their ass off to get ahead. No simple answer here but these steps are definitely an improvement over where we were even 3 months ago.

Onto finances….

401k: $76,223.30

Roth IRA: $4,536.63

HSA: $561.65

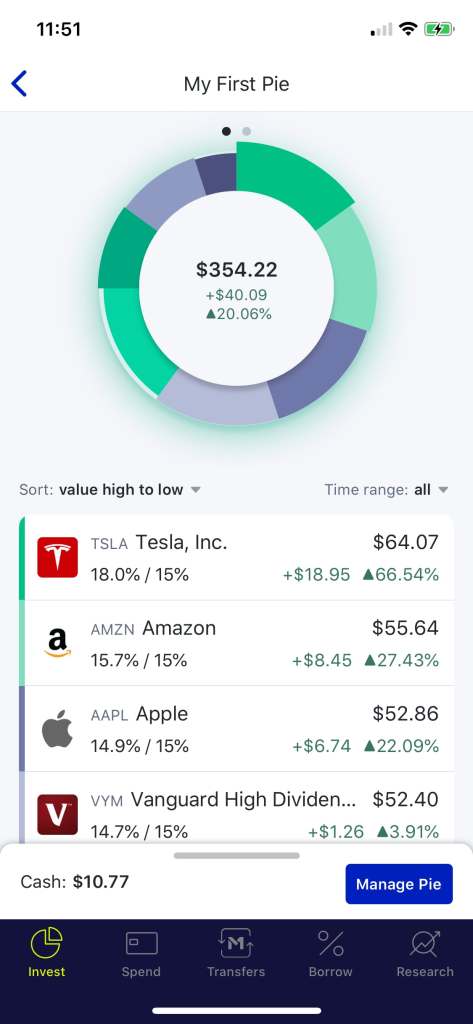

M1: $342.78

June 2020 Total Retirement: $81,664

(up $7,596 or 8.8% from last month)

iPhone 11 Pro : $842.56

Credit Card: $145.90

Total Debt: $988.46

I made a couple of good choices in my M1 taxable stock investing app. Not a lot of money but sheer insanity that the Tesla stock I bought 2 months ago already is up a whopping 66%. Even Amazon up 27%. I know these numbers are insane. When I started this 3rd investment portfolio I decided to just put in some “play money” to see what would happen. It could drop like a rock tomorrow but I’m still putting minimum $25/week in. If the market takes a dip on a particular day I buy more and schedule buys in my pie to happen the following morning. By the time I turn 38, a little over a year from now I hope to have $100k in my portfolio. By 50 I want to have at least $500k and a $1MM by 60.

I made a large dollar ticket purchase during June. I bought a Cannondale CAAD 13 Road Bike for $1800 plus tax, and sold my Fuji Roubaix 1.3 for $600 cash on FaceBook Marketplace. The old bike sold within 3 hours of me buying the new one. My original listing price was $800, then knock it down to $720 and negotiated down again. It had some light wear and tear, probably needed some new tires in a few months. Supply and demand never fails. During the month of June I’ve ridden over 200 miles of it. Yesterday I popped an inner tube and a friend was kind enough to give me a ride. The old bike wasn’t bad but I did pop a few spokes on it. Changed my riding technique a bit and that problem has esssentially gone away. The rims on the new bike are a higher quality and I haven’t had an problems so far. The bike was paid for the last time I got paid.

I haven’t worked with other people in an office since March 13th give or take. Still thankful I have a job when the unemployment levels are so high. I know a lot of others in this country aren’t so lucky. The days really have been flowing together. At times I do get lonely and I haven’t had nearly the amount of interaction with other humans as I should. Still working through the best ways to work through it. My “friends” are often extremely difficult to make any type of plans with. I’d have better luck with a complete stranger… 😀 I won’t let that discourage me though.

What is currently on my mind from a money standpoint?

1 – Does it make more sense to continue going guns blazing with retirement or should I look at Real Estate. A 401k has a lot of pros but also may be the slower path to wealth outside of Covid.

2 – Should I focus on having more fuck you money? I don’t have that much money sitting in a bank account, mostly because of inflation and I’d rather delay paying taxes now to get a break later on. So at least I’m deliberate about not having months and months in an emergency fund. Maybe 3 months and I’d sleep a little easier.

3 – When do I leave Texas? Is there a better place to live? I just renewed my apartment lease for $890/mo. The new complex several miles away I considered was closer to $1435/mo plus a month free, but with a $200 pet deposit, $300 pet fee and $10/mo pet rent. Really not worth it for zero equity.

4 – Will I get another stimulus check? Would be a nice buffer but in no means am I banking on that happening.

Brainstorming other topics that aren’t related to politics. Have a couple of ideas. Be healthy, safe, and have a happy 4th of July weekend!!!

Hi again! Wow-you’re retirement balances are impressive. I’m behind in retirement contributions. I was with my previous employer for 8 years and they did not offer any type of retirement or 401K. That was also the time when I was throwing literally everything at my student loans, so I just ignored it and thought I was doing the right thing. I started with a new company last June and have started a 401K with employer match. I will say though at 29, I feel behind. I’m hoping to payoff my credit card and car loan by the end of the year so the only debt I will have is my mortgage so I can put more towards retirement.

I feel you about being lucky to still have a job with the high unemployment numbers. I’m still working from home and go into the office for about an hour once every two weeks. Luckily my job decided they are going to give us our backpay from where our pay was cut. It starts this month and will go through the end of the year.

Also I would love another stimulus check, but I am also not banking on it.

Stay well!

Hey there Will! Thanks for your comment, wasn’t sure if I scared you off with my last reply.😁 I meant to reply earlier but then I had a bad case of food poisoning. Thankfully it wasn’t covid… 8 years is a long time for an employer not to offer a 401k or retirement account. Hopefully they paid you a little bit more to help offset that. You can’t turn back the past. In the few months working from home and becoming debt free, I realize how quickly I can invest aggressively. $545 car payment + $80 tolls + $100 in gas savings = $725 in money that’s now back in my pocket. Or $8,700 in a year. Granted some of those expenses will still be coming back it’s still a huge change over where I used to be.

As Mr. Money Mustache says, your debt is an emergency. I can’t fault you for being aggressive at paying it off instead of investing. I started a 401k after falling hard in my 20s with investing right when I turned 30. I also was doing that at the same time as paying off the student loans, and car loans.

That’s pretty sweet your employer is going to provide backpay for the periods when your pay was cut. I think many employers would just say be happy you still have a job and leave it at that. Yeah, another stimulus check would cover the cost of new brakes on my car. I have a feeling the rotors and pads are both shot since the car comes to a stop abruptly. I also cheaped out on some aftermarket brakes last time around and they never last as long as OEM.

Most important thing you can do is focus on what you control now. A little bit over time does go a long way. In 20 years if you’ve invested $10k a year and earn 6.5% a year you’ll have $408k by the age of 50. I’m sure you know a lot of people who work well past that. If you get super aggressive and do $15k that’s $613k. Nothing is guaranteed but you’ll still be ahead of 90% of people out there who get close to retirement age and wish they would’ve saved more. Maybe even start a blog or heck even an Excel sheet to keep track of what you’ve been investing. The world is yours.

Not at all! 🙂

Glad it was just food poisoning and not Covid! It still blows my mind how insane the whole situation is. I live in the bible belt (yay me, right) and people just act like we aren’t in the middle of a pandemic. People refusing to wear masks and social distance. It’s beyond frustrating! I was supposed to fly to one of my best friends wedding in Texas in May, but then it was postponed to September and now it’s been moved to June of 2021 because the venue was only going to allow a small amount of people to attend and nobody could dance because ya know, social distancing.

Yeah, ot was a smaller company in town and consisted mostly of people over the age of 48-ish, so I was the only one who actually pressured the boss for the 401K which is why I think it never happened. Nobody else was concerned about it. I have saved so much money as well because of working from home. I use to go out and eat out lunch everyday at work so between that and the gas I’m not spending- it’s adding up quickly.

Yes I’m going to start contributing more as soon as possible. My one credit card has a smaller balance so I’m tackling that and then paying off my car. I also keep an excel spreadsheet of all of my bills and update them daily because I’m a nerd like that. It’s so freeing to talk about finances, even if you are a stranger on the inter webs. 🙂 None of my friends like discussing it.

We’ve almost made it to Friday!