These are the roaring 20s, 2020s. I’m not even sure where to even begin.

- After owning a 13 inch MacBook Pro M1 the past year, I decided to buy one of the 16″ 2021 models because of features that I would definitely use over the course of the next year. Originally I had ordered the higher price model which is $3,199 not including taxes, but in full transparency that was a bit of sticker shock for me. For the most part I don’t spend anything above $2500 for my computers which typically last me 1 to 2 years and then get traded in for roughly half the value. The way tech is advancing these days, that high end model from 1-2 years ago is now surpassed by a system half the price. My older system commanded me a trade in value of $900, so the splurge and spending additional $700 on the higher end model kind of seem like a bit of reckless spending. I also don’t use this system to make a living. Why did I buy one?

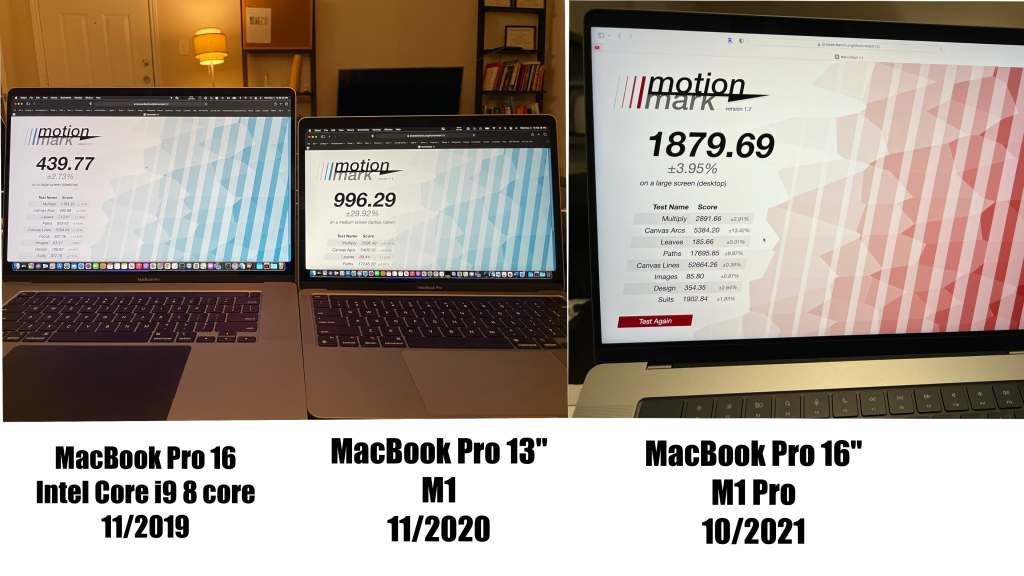

- The processor is significantly faster, it has over double the memory bandwidth, double the performance cores, and literally twice the number of graphic cores at 16 vs 8. Certain legacy games I had would choke on the older system.

- The screen is 16.2 inches versus 13.3 inches and it’s a mini LED display versus a more standard LCD. In the real world with that means is I can keep more windows open on one screen at a time, everything is a bit more legible to me since it’s brighter, and overall my eyes are less fatigued after looking at the screen for hours on end. When I bought the previous system I had a 16 inch model that I had traded in due to a number of issues including the system having a loud fan and overheating.

- The SSD on the system is also significantly faster meaning everything is snappier from opening to copying, or if the system has to read/write to swap memory.

- Ports. The previous system only had two USB4 Ports, one of which was used to supply power.A s a result, I often was unplugging one device and plugging in another device, I wasn’t able to plug in my tablet as a secondary screen and do a time machine back up, or connect to a device like my SD card reader or my USB microphone, or even just plug my phone into my computer to do a back up or to supply power.

- Built in SD card reader. This one is definitely more of a want versus a need but it’s nice to be able to just slide the card into the computer versus looking for the USB reader and plugging that in.

Cost = $2499 + $9 expedicted shipping + $206.91 tax = $2,714.91. Less $900 + Tax = $974.25. I also signed up for the Apple Card which offers me 3% cashback on all Apple purchases at a 0% interest rate. So that’s an additional $84.15 to take off. So $1,058.40 off the initial price leaves me with a cool or not so cool $1,656.51 out of pocket to pay. First payment is due November 30 and I can cashflow that in the next 45 days so not considering it part of my debt.

- Roth IRA – I made a large contribution into the Roth IRA to max it out for 2021. It was $3,636 which to me was a significant amount of money, but I’m thinking in terms of the long-term growth of those dollars and how me at age 50 will appreciate the diligence turn my younger years. Pulled from my emergency fund account which with the high levels of inflation recently has been losing value in terms of purchasing power.

- Crypto – In September I bought $1070 worth of Solana, October I purchased some Shiba Inu – $35, as well as Ethereum – $125, and Bitcoin for $371. I pulled most of the dollars out of my emergency fund to cover these purchases as well. The signals and my gut instinct were telling me to buy and stop sitting on the sidelines. So that’s exactly what I did. I do plan on building that account back up again soon. However these gains are freaking rediculous. No more than 5% of my portfolio will I invest in these speculative investments.

- 401k – Basically I’m staying the course with the 401(k), with my recent raise it looks like I may end up reaching my contribution limit for 2021 a little bit earlier than planned. Between my contributions the the market being up, I’m up about $10k since my last net worth update.

- Guilt – I have a little bit of guilt with where I’m at right now versus where I see others in my circles or my distant family.The stories range the gamut, I know one person who is currently on disability and literally at or below the poverty line. I partially blame his ex partner who because of his reckless behavior lead my friend to health issues that eventually contributed to his depression. With family I know a few people who are either long-term unemployed or recently unemployed. One of my old neighbors developed kidney failure and is also on disability and unable to work. Then I know a few others still in the service industry. The pandemic has turned everything upside down for them, and in some cases they are still expected to help their parents make ends meet. Then just older people in general who don’t have enough saved in retirement and have to deal with a toxic workplace.

At my current contribution levels and an 8% rate of return by the time I’m 50 my net worth will be $1,056,000. By the time I’m 60 assuming the other same inputs it will be $2.78MM. If I were to literally 100% stop investing today I’d have $479k. The older I get the more I just see money as a tool and a way to be free. Shiny new things are nice but they also can trap you if you’re not smart about it. I’m literally tired a lot these days wondering how in the hell people work until their 60s. Then again I work from home and live alone.

I was watching a video from Matt D’Avela about Why your life feels like it’s flying by. Basically he hit the nail on the head, almost every single thing I do week in week out is part of a routine. Wanting to change that for the sake of having more variety in life feels foolish in a way. Yet I am human and keeping things status quo for a decade seems sort of like a prison sentence. Between dating, career, health,

10/29/2021: 401K: $157,340 Roth IRA: $20,721 M1 Acct: $3,693 Crypto: $2,372 Buffer Fund: $379 HSA: $1,427 Total: $185,932

10/1/21: 401K: 147,601 Roth IRA: $15,921 M1 Accoun: $3,133 Crypto: $1,433 Buffer Fund: $4,314 HSA: $1,758 Total: $174,160

+$11,772 Month-Over-Month or +6.76%. The HSA total is down because I had to get an annual physical and do some lab work. Also had some other health issues I’ve been working through but still have been a major inconvenience. Two years ago I had a net worth of $54,681 so more than 3x improvment since then

Don’t let me outlook come across as me being all doom and gloom, there have been some good things happening in October too. I got dressed up as Maverick for a Halloween party last week.

Ferris Wheel – Texas Fair Park

Close to bedtime. I may post a video this weekend if I feel up to it. Take care! ❤