This is a long post. You’ve been warned. 😛 Let’s have a momentary flashback. 2012 when I started this blog I had massive debt proportional to my income. Shit, I just started my first full-time job in Marketing. My salary was in the mid $30s and my debt was over $45k. I had to count every dollar, and use everything I could to get out of debt. The numbers were too out of whack. All this debt and lack of career prospects were big motivating forces to leave New York and move to Texas. On paper it made sense even though I gave a lot of things up including being in close physical proximity to my parents and good friends at the time. I was 29 then and having a bit of a mid-life crisis. I didn’t want to be that millennial who had student loan debt for the rest of their life and racked up massive interest. Then hope the federal government bailed me out. My father was disabled and lived off an SSI check every month and a couple extra bucks from babysitting. God willing I would use the power of my mind and physical abilities to support myself in life and become independent.

So I did. I went from a total net worth of -$50k to over $200k. 5x higher net worth, better paying jobs and hitting the much coveted six figures. During a period of record inflation, covid deaths, monkeypox, international unrest, a very polarized America, what I consider a national crisis with gun violence in the country, a time when I wonder if my rights to marry the man of my dreams will be taken away. I got caught up in external factors and neglected myself.

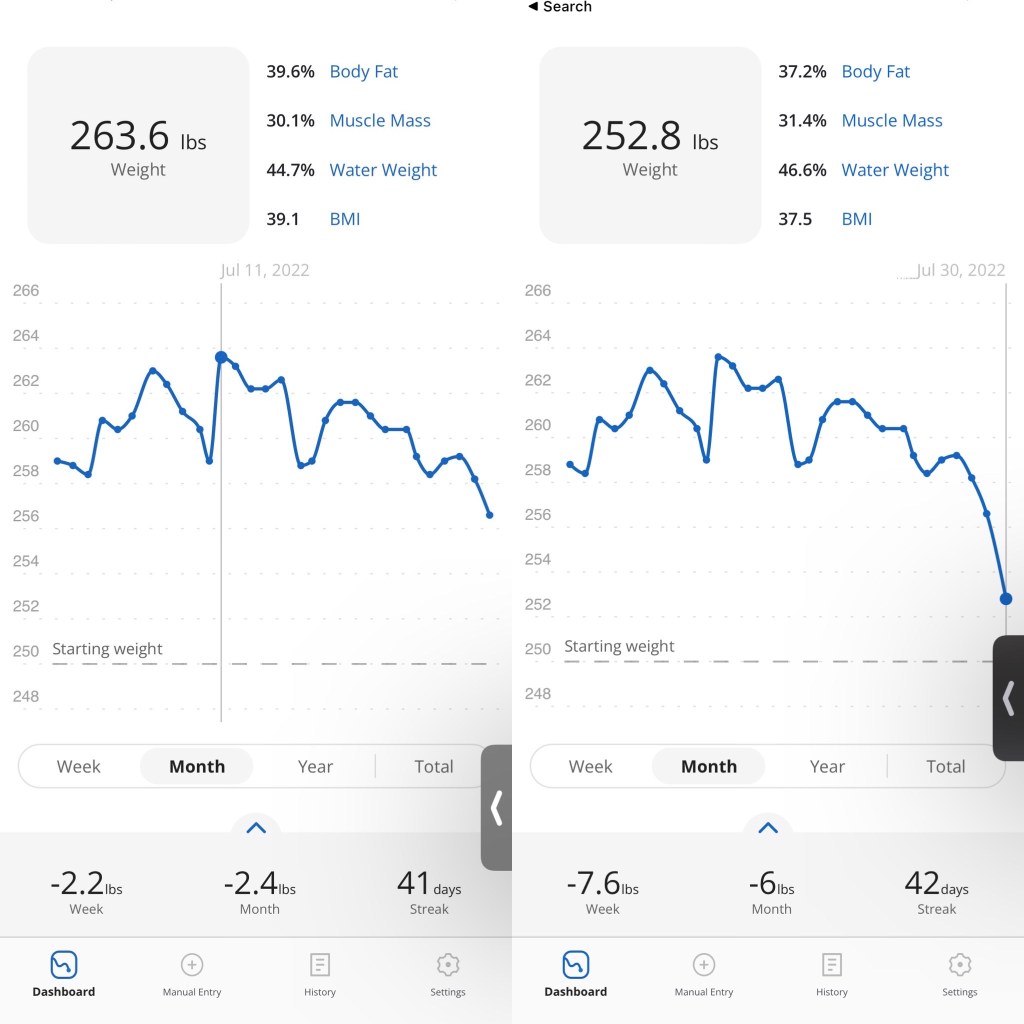

How? Well the most visible was my weight, I hit the highest weight of my entire life on July 11, 2022 a massive 263.6 pounds. Then I got serious about cutting back on sugar and eating a normal amount of calories. Fucked around with Intermittent Fasting again. Now 18 days later I dropped 10 pounds and am still going at it. Before Covid times I was 240 and I know I can get back there again. In a completely supportive healthy non-obsessive way. With that weight comes high blood pressure, risk of stroke, lack of energy, sweating profusely in moderate intensity activities including the sports I play. So it’s a huge quality of life item.

What is my breakthrough moment? I went *too* far the other way though with saving and investing. Counting every dollar for every decision. Leaving myself just a couple of hundred dollars to spend on things outside of investments every 2 weeks. You can do that for a while but overall it’s not healthy in my opinion. So I’m making some changes. People might not agree with them but for me it’s what I need to do at least right now to bring more joy into my life.

I’m continuing to max out my Roth IRA each year at $6k/year and doing $300/mo to my M1 account. The M1 contributions might increase to $500/mo or more, have to see how I feel about it. My 401k contributions are dropping to 6% of my salary. $1625 a month was too high and didn’t give me enough free cash on-hand. Why do I need cash?

1. My current car has been pretty reliable with a fairly low cost of ownership. Aside from gas that is… It has 72k miles. Every 30k miles I need to do a $200+ CVT fluid change to make sure it doesn’t blow up, the shocks, and brakes are probably going to need replacement soon, new spark plugs, and normal things like oil changes. This car is also being discontinued by Nissan. 15k miles per year / 23mpg = 652 gallons of gas per year, at $4/gallon is $2,608 a year… Times 5 years that’s $13k just to fill the car up. I’ve driven Nissans for 19 years and internal combustion engine cars for 21. Nissan as a company has had multiple class action lawsuits related to the transmissions in their cars, mine squeaks and rattles when it gets cold. The service experiences I’ve had are kind of disappointing including one where I spent the better part of half a day trying to get a new tire and having the service person put in the wrong address for my Lyft ride back to the station. Used car prices are going to start dropping and a car with over 100k on the odometer I also expect to drop even more.

Last month I did try to buy an Acura Integra, but… While much better on gas, it’s still going to need to burn it. Then the power is only 200hp and it has a CVT with a turbo on top of that. 14 years of CVT transmissions I didn’t want to buy a car with one of those ever again if I can avoid it. Plus the backseat room isn’t so great and many dealers are adding thousands to the price due to market conditions. So scratch that option…. Looking at some EVs – The Tesla model 3 interior is too spartan for me, basically no buttons and you need to turn your head to the side to see your speed, and still build quality issues. It also doesn’t qualify for the current federal tax credit. Polestar is almost impossible to find, Rivian / Lucid too expensive. After an acquaintance died after a Kia / Hyundai fire I refuse to buy one even their EVs. Chevy Volts are tiny, catch on fire, and GM/Ford build quality… Mercedes EQS is too expensive. Toyota bZ4X can’t be preordered and they stopped production for August.. Hybrids like Honda Accord Hybrid are an option but more mechanically complicated and much less horsepower, torque, and fun one by comparison.

I placed an order on is the low end BMW i4 eDrive 40. The car is selling at MSRP (no markup) and there is a 10-12 month wait time. So that’s June-August 2023. The selling price is $59,570, out the door price is $64,821. It’s not cheap. From that $64,821, take $7,500 off for the federal tax credit and another $2,500 for a Texas state rebate. So now we’re down to $54,821. My trade could get $17k in a year I estimate so that’s effectively $38k being financed. Then roughly $10k in gas savings over 5 years. Those savings won’t all happen at once though. I’m trying to cashflow as much as I can starting now to not have an $800/mo payment. An extra $10k would drop that to $630/mo, $20k would be $463/mo. The tax credit / rebates would essentially knock off another $166/mo. While not super unreasonable, it’s still debt and I’d rather keep that payment as low as possible. Thinking I save $10-$15k for the down payment depending on when the car becomes available. I’ve wanted to buy an electric car since 2014 but the options just haven’t been great to me. BMW has been manufacturing them in a limited / testing capacity since 1972 and the first electic cars were in-use in America in 1897. Big oil won the battle and the electric vehicles disappeared by 1920. In 2006 the documentary Who Killed The Electric Car came out.

What about charging?

Option 1 – Most expensive – there is literally an app for that called Currently EV Charging (https://apps.apple.com/us/app/currently-ev-charging/id1624940687?see-all=reviews) that works on a monthly subscription model. They charge by the kWh. The i4 has an 84 kWh battery, so that’s 67 to get it to 80%. So let’s use the Commuter option at $15/mo / $0.58 per kWh and we schedule a fill up 3 times a week. That’s $40 + $3.75 for the most expensive option. They say they’ll deliver up to 100 miles per delivery.

Option 2 – There are more and more places to charge up. EVgo near me is $0.20/minute, charges at 50 kW. That would be 1.34 hours a week to hit 80% from absolutely 0%, 60 x $0.20 + 4.95 = $21.03

Option 3 – Another charger at 7/11 charges at 90 kWh, so that is 45 minutes. $0.55 per kWh or $37.

Option 4 – Tesla is going to open up their supercharger network at the point in the future. The assumption is they’ll start charging more than for their own vehicles. This likely will start happening before my delivery date.

Option 5 – A permit was applied for a nearby shopping area for charging (presumably free) to happen in May 2023.

Option 6 – A bunch of free / slow as shit chargers at 6 kWh throughout the area.

Option 7 – A Chevy dealer will be opening 8 high speed chargers that will operate at 120 kWh and do a full charge in 35-45 minutes. From what I’ve read at $0.14 per hour that’s $3 for a full charge.

Option 8 – It comes with 2 years of free charging through electrify america. The nearest one to me is in Fort Worth and kinda far but there is a possibility more will be built closer to me in the next 12 months.

*Option 9 – Charge at home when I eventually buy one. This option is at least 2 years out and would be the most cost effective option. Particularly if it is semi powered with solar energy.

2. I’m going to start saving for a home. I know I’ve been talking about it for years now but I’ve reached the breaking point. The housing market is slowly correcting. I can probably get some type of downpayment assistance but not sure if I will need it. In my mind I’m still thinking 10% on a $200-250k property whether it be a townhouse or a condo. That’s roughly $20-25k by summer of 2024. Given my income I think this is doable. I don’t want to be in my 40s renting unless I’m getting some killer investment returns. The last year that hasn’t happened haha. Renting elsewhere is an option but $1700/mo and no equity would be a real bummer. At some point I’d probably inherit my parent’s / childhood home but I’m not banking on that and hopefully that’s not for a couple decades from now. The goal would be to have the house paid for completely (or at least have the money set aside to do it) by the time I’m 50.

So here’s to making some changes that I think will bring a little more excitement to my life. I’m still going to be investing. Just cutting myself some more slack for a bit.

Last but not least I’m turning 39 in just over a week on Monday. A lot of my more formidable years are behind me. The struggles of being an in the closet teen, dealing with loss, coming of age and completion of 3 college degrees in my 20s, enlightenment / slowing down / self-awareness of my 30s. I still like to think I have a lot of life ahead of me in my 40s and beyond. I’ve also seen a lot of the reverse. Stay happy, healthy, and much love. Time for bed…