12/9/24 End of Year Preduction

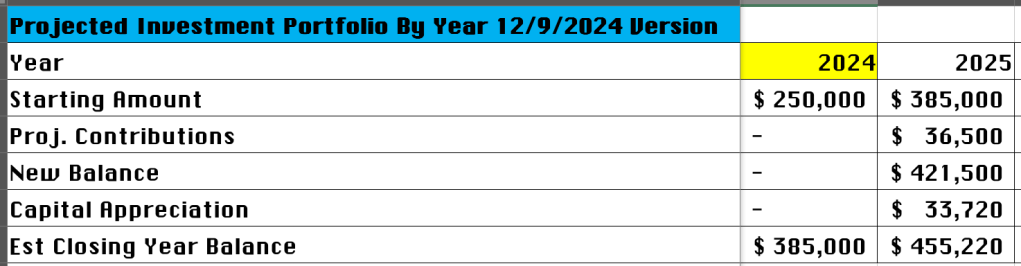

Almost 8 months I predicted I would have $455k net worth by the end of the year. Currently I am about a stone’s throw away from that or up $66k from the start of the year. My goal is closer to $2M come retirement age. That doesn’t necessarily have to be all investments though, one could argue I should diversify just a little bit.

Home purchase updates:

1. Offer made on a home, final selling amount is down to about $351k, my mortgage payment estimage is just under $2,900 including insurance, taxes, and interest. I originally offered full asking price before asking for another $3k which will be covered by a concession made with the agent’s commission.

2. Concessions – There are quite a few including: Replacing 24 year old microwave with stainless steel model, redoing tile in the bathroom to replace cheap fiberglass, replacing defective dishwasher, (didn’t ask for it but cost prohibitive to repair) fixing or replacing the garbage disposal, replacing flex pipes under sink with PVC, installation of a dryer vent in the garage, have a licensed plumber do needed repairs to fix low water pressure, have HVAC system serviced by licensed professional, adding ground and neutral wires to the sub-panel box, cleaning out gutters, repair a damaged sewer cleanout cover

3. Massive cleanout of clothes that either don’t fit or were out of style. Bf helped me with the majority of packing. 90% of things I am not actively using right now are packed away.

4. Setup – Water and electricity switched over, Pest control appointment made, alarm system provider chosen,

5. Furniture delivery date set, ordered a loveseat, sofa, bookcase, and swivel chair from Nebraska Furniture Mart for ~$1,030 plus a $140 shipping charge. I ordered the furniture 4th of July but the prices dropped since then so I was able to place a new order through a super helpful store associate. The chair was on clearance for a whopping $80. If I had just that item shipped it would’ve been $140 to do so but with the other order they were able to just get it added to that.

6. Moving company and time + date selected

7. Electric lawnmower, blower, and trimmer tools purchased. Got an incredible deal for all 3 from Lowe’s. $566 less card cashback and 2% cashback from an affiliate link

8. Bf isn’t moving in with me right away but we decided on $ a rough amount he would contribute toward the payments that would be win-win for him as well as me. Utilities I said could be TBD but planning to cover on my own.

The main thing I’m trying to do right now is make sure not to overextend myself. The lawn equipment I sold some investments to cover. I also pulled $10k from my Roth IRA for a first time homebuyer credit where I won’t have to pay a penalty to the IRS. I really debated for a while whether I should run lean and just let that money grow or keep it as an emergency fund to help me sleep better at night. I chose the latter. Having less than 2 months of cash in hand is cutting it dangerously close. With mortgage payments being roughly $1600/mo more than my rent I knew it would take me significantly longer to build up reserves.

Other notable things this month

-I dropped about $471 on my car after driving hard in the rain caused the plastic undercarriage piece to unlatch from the car and drag on the ground. Also decided to get an alignment at the same time. They had my car for 8 days which I wasn’t thrilled about.

-We saw a lovely artist Mereba live in concert. She’s fusion of different genres, R&B, Rap, Soul, Folk music. Very unique experience, definitely recommend.

-4th of July pool part with friends despite the rain, coincidentally was at Home Depot buying gloves to help bf move into place when the fireworks went off. Got some really good shots in.

-Went to New York for work and saw family for a few days. It was a low budget trip to me. Flights, hotel, meals covered by work during the 3 day period. Then time with my parents doing dinner / eating out regulary and putting on 8 pounds which I subsequently lost in a week.

| 7/30/2025 | 7/1/2025 | Difference | % Change | 8/3/2024 | YoY Diff | % Change | |

| 401K | $ 360,084 | $ 348,738 | $ 11,346 | 3.3% | $ 271,447 | $ 88,637 | 32.7% |

| Roth IRA | $ 49,304 | $ 57,216 | $ (7,912) | -13.8% | $ 42,544 | $ 6,760 | 15.9% |

| Brokerage Accts | $ 1,805 | $ 3,710 | $ (1,905) | -51.3% | $ 3,520 | $ (1,715) | -48.7% |

| Cash | $ 35,018 | $ 23,743 | $ 11,275 | 47.5% | $ 3,759 | $ 31,259 | 831.6% |

| HSA* | $ 4,901 | $ 4,691 | $ 211 | 4.5% | $ 3,617 | $ 1,284 | 35.5% |

| Total | $ 451,113 | $ 438,098 | $ 13,015 | 3.0% | $ 324,888 | $ 126,225 | 38.9% |

| Credit Cards | $ – | $ – | $ – | #DIV/0! | $ – | $ – | #DIV/0! |

| Auto Loan | $ – | $ – | $ – | #DIV/0! | $ 7,497 | $ (7,497) | -100.0% |

| Net Total | $ 451,113 | $ 438,098 | $ 13,015 | 3.0% | $ 317,390 | $ 133,723 | 42.1% |

They say a lot can happen in a year and it’s true. I never would’ve imagined my net worth would be up $133k in a year. Compounding is a powerful force. At this rate if the forces behind my come up continue I will break $500k NW in 2027, $600k in 2029, and $1M in 2032.

Sharing a few pictures…

I had a 70 year old woman that lives on the same block I grew up on who I haven’t seen in 25 years suddenly take an interest in who I was dating. I posted a pic of my great grandparents from around the 1930s and she in all caps had the nerve to ask what would they think if they knew you were gay. Her son is special needs and her other son died in his sleep when he was 7 so she of all people shouldn’t try to tell others how to live their life. Nope. Before that she commented on a pride related post of mine saying she didn’t know I was gay even though I’d been out 21 years at that time. The son also left me a voicemail on fb messenger saying we’ll always be friends but don’t be promiscuous or something to that effect. Just blocked them both. The moral of the story is life is too short and life with peace not drama. Someone I worked with died at age 40 just a day or 2 earlier, I was her boss around 2007/2008. Managing her with a chronic health / lung condition was very challenging but she was still a very kind-hearted person who made lots of friends along the years. I wish the best to her husband and family. The service is about 4 days and 1600 miles away I def won’t be able to attend. Death has become all too familiar over the years, I still like to think in terms of what’s possible in life and living to the fullest.

Signing off, I should be asleep now. This is all uncharted territory for me and I’m taking it one step at a time. I desperately am craving the additional space. 5+ years working from home in my 1 bedroom or living room in a 700 sq ft. is tough. Over a decade living here in general. I’m just done. They never fixed the spot where the water leaked, tub looks so rundown. A friend came by to drop over boxes and was like I can’t believe you stayed here that long. I never invited her over though I’ve known her for about 4 years. No one can say I didn’t sacrifice.