Today is October 1st – I am in the process of getting over some really bad allergies. Almost took me out of commission with work but I powered through as best I could. This happens to me with every seasonal change. Napped a lot today and ate a pasta soup dinner my bf made for me ❤️. Doing what I can to doctor on myself and hope these feelings are temporary.

My mortgage is due today but I paid it in full about 2 weeks ago so don’t owe anything until November. I like this lower stress approach of ownership. The mortgage got sold to a different company that has mixed reviews. I figure as long as I pay them on time we won’t have a problem. I put aside $1500/paycheck and overall that has been working. well so far.

One of the larger expenses for me this month was paying off the alarm system. It was showing up on my credit report as a credit card with super high utilization. So I paid it off nearly 58 months early. A whopping $2,822.72. It was 0% but I just hated the idea of having that amount loomnig over my head. I still need to pay for the service monthly but at least the big part is out of the way.

My electricity bill was also up there at $258.26 during the hottest month of the year. It is what it is and has been paid in full. September is projected to be close to $200 with quite a few days where the high was in the 90s.

This past weekend we took a trip to Brenham TX and Houston TX for our 2nd anniversary. It was much needed for me to get away from DFW. I’d say the trip overall cost $3-400 including a bit of clothes shopping and activities. We saw the Galleria, Cistern, Blue Bell HQ and Homestead Heritage in Waco.

Trip pictures

I did get AirPods Pro 3s to replace my PowerBeats Pro that I got at the start of 2020. Still getting used to the feeling of not having giant clips around the back of my ear but the sound quality is great and I feel a little more free. And yes I pitched ip for the AppleCare+ coverage. $249 broken out in $41.50/mo installments and $20.54 tax. Verdict is still out on whether my old buds will get me any cash back, even $40 would be nice .

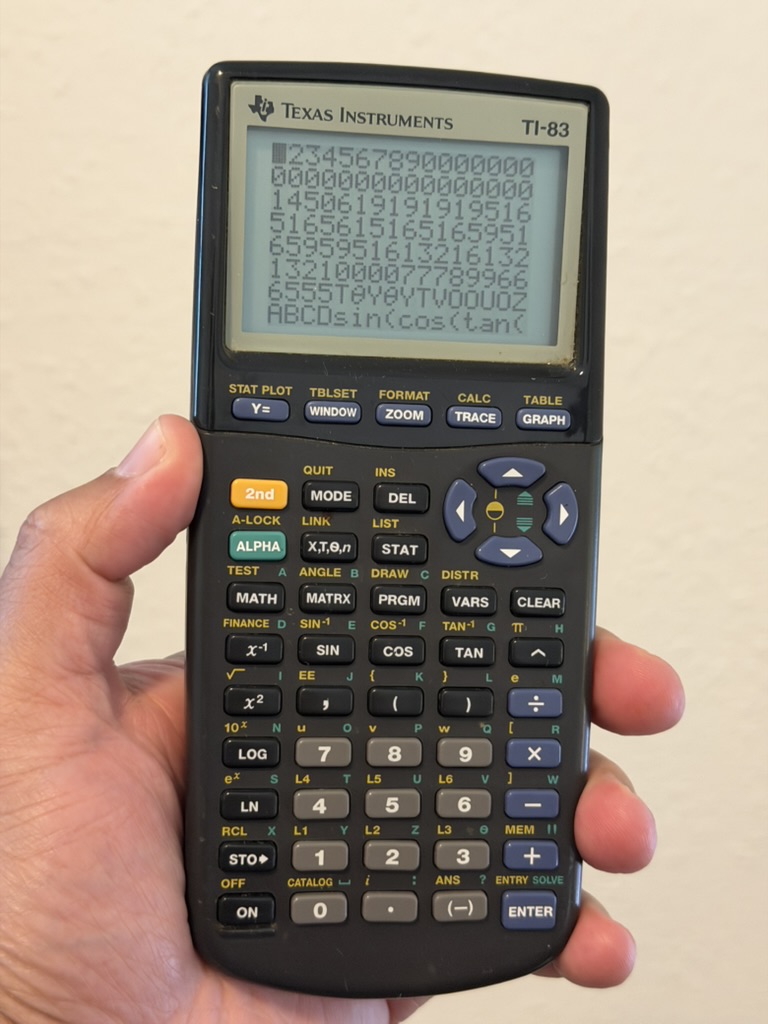

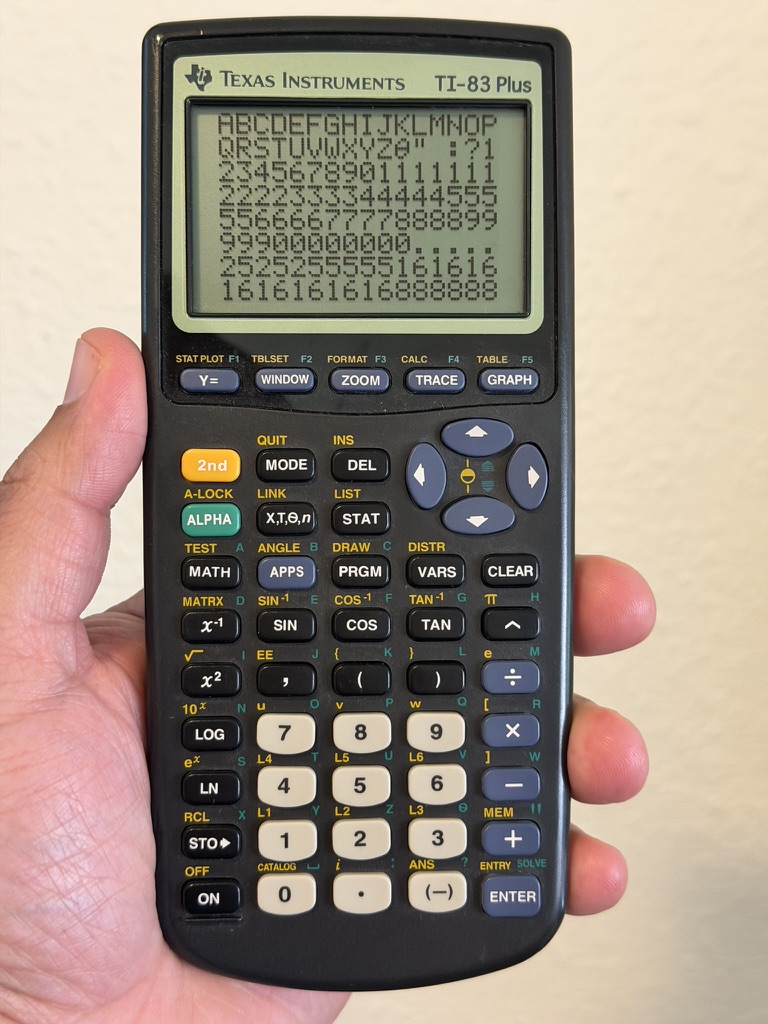

It’s been some time since my school days but I had 2 TI calculators, an 83 from high school and 83-Plus from college. I was going to chuck the older one out since it wouldn’t turn on but the Internet came to the rescue and I was able to revive it. The 83 I’m keeping for nostalgia but got about $16 for the 83-Plus. Also keeping my dad’s old HP 10-B Business calculator stamped 1987 on the back.

I sold a hose for the grill on Facebook Marketplace that I couldnt’ return on Amazon. Let me tell you that was the hardest I ever worked for $10 in my life. On the listing people asking if someone is still for sale then radio silence or wanting to meet during sketchy times. I sold the defective grill my friends gifted me for $20 on Marketplace too and sweat outside for a good 45 minutes while these guys dismantled it and put it into an older Lexus ES model. I was asking for more but at point just take it away. It also amazes me people would show up to buy something and not have all the money with them.. I also did a swap through Blue Rhino for a new propane tank just to rule that out.

With the sale of the grill I wanted a new one and to buy it before it started getting cold out. So another Char-Broil it was given the cost. 5 burners, stainless steel, and a side rack. $299 plus tax, shipping, delivery fee. $365.89 less cashback through an Affiliate link and my credit card rewards. I bought a cover too for $38. Used it a few times already and really happy with the results.

At the start of the month we decided to go to a Jazz concert in downtown Fort Worth. The lady singing was good other than forgetting the words to some of the songs. We also had a nice romantic dinner at a restaurant called Walloon’s. I think that was the first time we ate out the entire week.

Early in the month I had a nice little housewarming party. My friends were so generous in their gifts I felt blessed beyond my wildest dreams. I used some of their gifts to buy things for the house including a storage rack from Home Depot to help with the garage. My car almost fits but is about 4 inches too long. We can fix that… 😀 We’re also planning to accelerate the time my bf is going to move in with me. Instead of July it will be more like March. He spends a lot of time here and I could definitely use the money to help with some of the expenses.

Getting back into the flow of cycling when I feel inspired.

We also saw The Wiz life at Fair Park. Everything was top notch including the choreography and singing.

I also bough the New Apple Watch Ultra 3 mostly because my 1 was growing long in the tooth after 3 years plus I wanted better battery life and a brighter screen for direct sunlight. My phone is on the Apple upgrade program and would get hot all the time so I replaced that out too. Had a little hiccup where I shipped the phone in a box for the watch but it got where it needed to thankfully.

I also signed back up for kickball again. My body is going to need to adjust to playing again but I got this..

Work-wise found out about an incentive plan I’m potentially eligible for but still waiting to hear back on any kind of merit increase. I’m on the lower end of the range for my position but also thankful to have a job in this economy. Today I recieved a $200 check from my old apartment which was perfect timing considering I had to transfer $200 after paying off that alarm system. Surprised I got anything considering how much work the old place needed.

| 10/1/2025 | 9/1/2025 | Difference | % Change | 10/1/2024 | YoY Diff | % Change | |

| 401K | $383,633 | $366,372 | $17,261 | 4.7% | $ 297,589 | $ 86,043 | 28.9% |

| Roth IRA | $53,212 | $50,470 | $2,742 | 5.4% | $ 47,091 | $ 6,121 | 13.0% |

| Brokerage Accts | $2,516 | $1,636 | $880 | 53.8% | $ 549 | $ 1,967 | 358.5% |

| Cash | $12,067 | $15,420 | -$3,353 | -21.7% | $ 3,547 | $ 8,520 | 240.2% |

| HSA* | $5,659 | $5,220 | $440 | 8.4% | $ 3,465 | $ 2,195 | 63.3% |

| Total | $457,086 | $439,118 | $17,968 | 4.1% | $ 352,240 | $ 104,846 | 29.8% |

| Credit Cards | $433 | $3,245 | -$2,812 | -86.7% | $ 832 | $ (399) | -48.0% |

| Auto Loan | $0 | $0 | $0 | #DIV/0! | $ – | $ – | #DIV/0! |

| Subtotal | $456,653 | $435,873 | $20,780 | 4.8% | $ 351,408 | $ 105,245 | 29.9% |

| Mortgage | $340,170 | $341,000 | |||||

| Zillow Estimate | $347,700 | $351,000 | |||||

| Equity Estimate | $7,530 | $10,000 | |||||

| Net Worth | $464,184 | $445,873 |

So there you have it. 42 years old, $464k net worth. I estimated $455k to close out the year and we’re ahead of that so this is good. I’m still maxing out 401k / Roth but it is def a stretch since I keep spending money at a fairly high rate. Need to switch back to the aggressive savings mode again soon. We are eating more meals at home and I try to find deals on everything I buy including clothes. I still have a couple more years in the tank. Projected to hit $1M in 2031, $1.5M in 2034, $2M in 2041. My goal is to have a paid off house by 59.5 and be able to leave the workforce then if I so please.

That said it’s past my bedtime. There are lots of things happening in the world, I can’t keep up. I continue to focus on what I have control over. We all have 24 hours in a day, what I choose to focus on becomes my identity. I used to spend that time chasing after people who wouldn’t give me the time of day. There is some truth to the expression you can’t relive your 20s. I believe it and I’m glad I’ve moved past a lot of things that ultimately weren’t the best for me long term. Still a work in process. Peace.