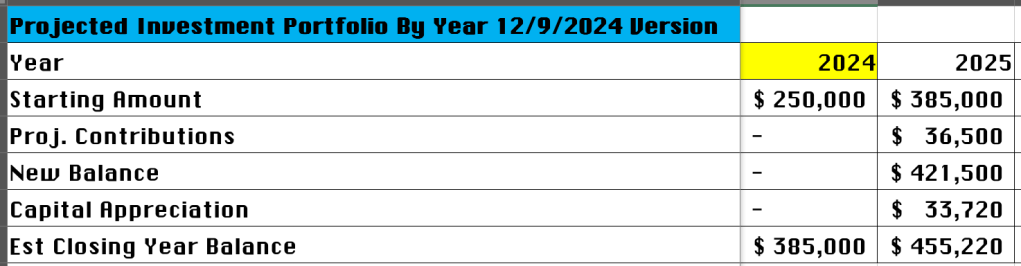

On December 9th 2024 I posted: “Personal Finance happens in the background of the rest of my life. I’m also a believer that if you don’t set goals, you have nothing to strive for and it becomes very easy to get off track.

My Net Worth target for the end of 2025 is $455k. These numbers are very conservative. Does not include 2 more paychecks this month and any additional income. $36-$37k with 401k matching, Roth max is about $3k/month. I have no $1400/mo car payment, no $200/mo Equinox membership, two big things I *did* have for a good portion of 2024. This year was unprecedented, I started off at $250k and as of last month was at $385k. It’s unlikely I’m going to see that kind of unprecedented growth. I found this old chart I saved in 2021 and updated it with my current numbers.“

Fast forward to today Dec 21, 2025. Here we are one year later. I own a house, I lost ~12lb. since the election last year. My bf now lives with me, we went to Europe and saw 5 different cities. My credit card balance is still $0. Personal finance is more at the forefront of my life than the backdrop.

What’s Planned

1. I’d like to fund more future investments to helps support my lifestyle *before* I hit retirement age. The house is my biggest monthly expense with a mortgage of $2,880 so my investments will be focused on easing some of that burden. I will do a hybrid of dividend-based investments and index funds. I haven’t decided exactly how much I’m setting aside but it will be a big bump from the $50/week I’ve been doing spread across 2 taxable accts. I already started with some SCHD (Schwab High Yield Dividend Fund) – https://www.schwabassetmanagement.com/allholdings/SCHD and still own VYM (Vanguard High Dividend Yield ETF), US Treasury Bonds, and BRK.B (Berkshire Hathaway Class B shares). I get about $7/mo right now in dividends that get reinvested off a $1,780 acct.

2. Provided I have continuous employment for the year I will maximize 401k contributions to the tune of $24,500. Employer match came down slightly for 2026 but the plans offered are still funds I’d consider buying except from Vanguard through a broker instead of Fidelity.

3. Roth IRA will be maxed for 2026, that’s $7,500.

4. Replenish the emergency fund. 6 months would be ideal. That’s a balance of $18k at the bare minimum. Goal is to have that balance keep going up instead of treading water. Ballpark I’m thinking $700/mo. which will get me there by the Fall.

5. Triple principal payments – ~$620 of the $1300 my bf gives me monthly will go to mortgage principal each month. Combine that with the roughly $300 I’m making to principal in my regular payments will allow me to get rid of PMI a lot sooner. By default that would happen after 12 years of payments. Doing it this way could cut down to 4. Plus cutting back the total interest payments *significantly*. One year will be like making 3 years of payments. Having 2 incomes will drop the amount of money I set aside biweekly for mortgage payments from $1,450 to $1,110 or 23%.

Of course all of that is just speculative provided I still have a job for the duration of 2026. Hoping I do get another raise, if so it likely would kick in again in November. I also want to feel like I’m enjoying myself more, saving and investing everything isn’t fun.

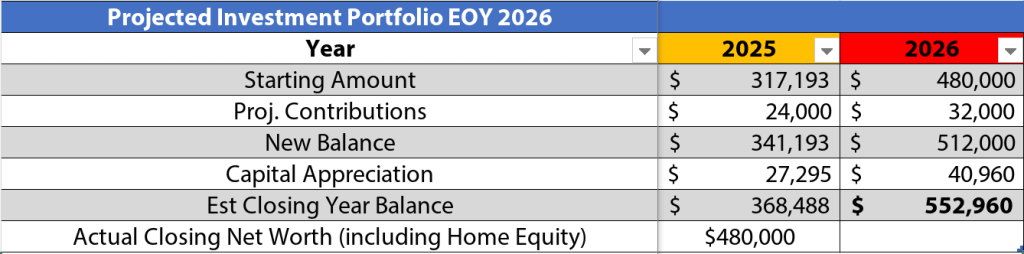

Onto the financial projections piece. My target last year for 2025 was to end the year with a net worth of $455,220. I exceeded that hovering around $480k right now

This is a super simple and conservative estimate but thinking I land north of $550k next year. I’m more likely to be up another $100k like I was last year but let’s not bank on that. Breaking the $500k ceiling will be a huge accomplishment for me from where I started out with. I want to be a good steward of what I have so I’m setup for the rest of my life. I’m well on that path. The median 60 year old has around $185k. At 42 I have $480k. I need some breathing room and my vacation can’t come soon enough. I took one day off since July for my mental health. Ok it’s 3am here and time for bed…