I made another video, enjoy. Surprised my last one got 25 views!

Author Archives: Debt Free Alpha

March 2021 Update – $130k & Bad News…

The post I’ve been putting off for weeks. I experienced some recent losses lately…

The second was the loss of someone I’ve been friends with for over 15 years. His name was Ryan, he lived just a couple miles away from me when I lived on Long Island. Like me, he started out working in a regional grocery store and wasn’t sure about his future career. He eventually started landing writing gigs, moved to NYC, and became CEO of the site Manhattan Digest. He also was into food blogging and wasn’t ashamed about being who he was. I saw some messages from 2011 we exchanged where he was struggling to make any money from writing. Only 34 years old and it was Covid-related. It all happened so quick, he posted regular social media updates of what was happening. Then all of a sudden the posts stopped. I learned he passed from one of our mutual friends, and saw several posts from his sister on his status later on. I cried and just wasn’t sure how process it all. I thought maybe I’d see him again next time I went to NYC.

The first was the loss of one of my aunts, she was 74 and had some health problems. I was a lot closer to her as a child and leading up to the time my father passed away. Then we kind of lost touch. I called her once after I moved to Texas, she was friendly as always. We just didn’t have a ton to talk about. No one in the family told me either via phone or even sent me a message. I learned 2 weeks after it happened via Facebook. I was quite upset about that, felt like the wind got knocked out of me. I also wasn’t able to attend or even see the service, there also was a bad snowstorm in NY at the same so even if I flew it probably would’ve been delayed. I planned to visit last year during my planned trip to see my mom for her 60th birthday. Then Covid happened and that trip got cancelled. I haven’t seen family on my father’s side in almost 5 years (I wish we were closer than we are but it is what it is), have no siblings, and on my mom’s side no one in person for over 800 days.

Then yesterday a guy I went on two dates with and messaged back and forth daily for 2 weeks said he felt like something was missing and didn’t think another date was right for us. I read the text literally after I finished brunch with a friend and was grabbing a few drinks. Maybe I drank a little more than I should have. It’s hard to date during a pandemic, and the last couple guys I had a strong interest in dating really left me feeling broken. I try to forget bad past experiences, but they seem to keep happening over and over again. Then a different guy I matched with, exchanged some messages with for half the day and was having a somewhat normal conversation with drops “sorry to do this but I just ended a relationship recently and I thought I was ready but I don’t think so now”. We were just supposed to meet for a beverage… Straight people have it a lot easier. February has been a rough month, I’m glad it’s almost over.

So let’s move onto personal finances.

2/28 Update:

401K: $117,738 (including my pending contribution)

Roth IRA: $10,239

M1 Acct: $1,452

Crypto: $181

HSA: $1,037

Total Investments $130,647

I was tempted to touch the emergency fund to cover a small credit card balance or more quickly contribute to the Roth IRA 2020 cutoff but decided not to. The market had a couple of rough days last week. Still managed to grow my portfolio by $4,606 or 3.65% higher than last month. Had another vet bill to the tune of $250, this time for some annual tests plus treatment for some growth in her ear. So that, plus a $195 tax bill, several dates, the $200 dehumidifer, and a meal plan service I signed up for. Just a year ago I had $80k in retirement and $6,975 in debt. My net worth is up 79% from 2/22/2020, still not where I want it to be, but still nothing to scoff at. I read somewhere that once you pass the age of 30 you should only compare yourself to where you were previously, not to others. In your 20s, you and your peers are beginning from generally the same starting line but so many things are unique to individual situations after that.

I’m probably on the border of a mid-life crisis. Not sure if I should stay in this apartment, in this city, heck even in the state of Texas. Not sure if I should go for a low cost STEM related degee online, or maybe work on my skills in my current industry. Maybe I need to travel somewhere, been super stir crazy. Still no word yet on a date for the vaccine. I registered in two separate counties, one last week and the first in late January. Things could be a lot worse I know. I didn’t lose power, or get stuck with a $700 electricity bill like Harlan of Out and Out (terrific travel / points / lifestyle / personal finance site) did. I watched someone I follow on YouTube whose girlfriend got sick and had to be hospitalized. He paid for her rent for a month but he’s also on unemployment. Yikes!

In spite of this I did have a good weekend in Deep Ellum. Cool place but a bit more congested than I’m used to in the burbs. Anywhere you have to circle the streets 4 or 5 times to find a paid parking spot on the street or pay even more to use a parking lot a bit extra to me. Either way cool place to grab drinks/food, shoot the shit, and admire the art. North Dallas lacks culture. I’m looking forward to March, doing a mental reset and to start making some solid gains.

Last but not least I hope good things are happening in your lives. Hard to believe I’ve been blogging here for almost 9 years. Net worth is up almost 4X in that timeframe and that’s with buying 2 new cars…. I was such a hot mess back in the early days…

Texas Y’All – Winter Cometh

I recently experienced my coldest week in Texas on record. We had two major snowstorms in the area. In a state like New York these would have been an inconvenience but after a day or two most of the snow would have been shoveled and the roads cleared. However here…

There were sheets of ice covered by snow. This of course led to abysmal driving conditions. In Fort Worth there was a 100+ car pileup in addition to accidents spread out all over the country. It also lead to record breaking energy consumption, leading to ERCOT (lectric Reliability Council of Texas) to initiate rolling blackouts. In reality many of these blackouts weren’t rolling and people in some cases didn’t have power for days.

I briefly left my apartment with the washing machine running to go to the gym, and grab a couple of groceries on my way back. This in retrospect was a huge mistake. With groceries in hand I stepped in water, both on the tile near the door, and in the carpet, all the rugs I had were literally soaking wet. I panicked and had to quickly think of the best way to extract the water quickly. I don’t own a wet/dry vac and it was questionable whether Home Depot or Lowes would even be open. My carpet cleaner saved the day and I effectively was able to suck up literally 11 gallons of water from the flooring.

A very panicked phone call was left with apartment maintenance along with an online ‘Critical” severity ticket. Tried to pick up a dehumidifer that night with no luck. The next day I drive to HD on ice and they have none, and a f’ing fire alarm goes off literally the moment I walk into the door at Lowes. After 15 minutes sitting in the parking lot in freezing temps I head home. A friend tells me to try Ace Hardware and they only have 2 in the whole store. The cheapest one was $199 plus tax. It pained me to spend so much when I could shop around and save $40 potentially but I was in a pinch.

I filled the 22 pint dehumidifer with water at least twice since Tuesday. Luckily all electronics and furniture were spared, the water didn’t make it to my bedroom. A carpet cleaning company came by to do a half ass job cleaning the carpet, over the next 4 weeks they’ll replace the water soaked padding.

It could be a whole lot worse, I’ll be the first to admit that. Still had electricity, water, internet access, and heat the entire week. Many other Texans were not so lucky, so I’m counting my blessings. There’s also been a lot of conversation surrounding how Texas is not connected to the national power grid, is not deregulated, and the system isn’t really weatherproofed. Then one of our state senators flies out to Cancun when millions of people in his state have no power. Poltiics aside, I’m hopeful something good will come out of these recent experiences.

Montinique Monroe / Getty Images

New Video – February 2021 Net Worth Update

February 2021 – $126k

I’m not sure about you but January felt like one of the longest months ever. Between the rioters that tried to takeover the US Capitol Building, the inauguration of a new president, uncertainty about what was happening with the elections in Georgia, the continued ongoing uncertainty with Covid.

2/2/2021 Update:

401K $114,241

Roth IRA $9,447

M1 Acct $1,498

Crypto $168

HSA $687

Total Investments $126,041

12/31/2020 my total was $119,276, so I’m up $6,765 or 5.6%. Going back to 1/22 I had $76k in investments and $7266 in debt so effectively $68,939. So I’m up $57k or 82.8%. Excluding my emergency fund account from these balances going forward but it is still helpful when looking at my total net worth. I did buy 3 shares of SLV, the iShares Silver Trust in my Roth IRA since I missed the rise of Gamestop and I think silver is smart to hold as a long-term investment.

Credit Cards: $475

I don’t usually carry a credit card balance, but I had a $700 vet bill. My 14 year old dog needed to have 6 teeth pulled, in addition to her dental cleaning, associated anesthesia and pain medication. Pets aren’t cheap but I still love mine regardless.

I’ve been taking a bit of a break from social media, Facebook specificially. Deleted the app from my phone and suspended my account for a while. I was definitely addicted to it. I felt a need to check it at least once or twice per hour. Doing that I started compare my life to others, some of whom are friends / acquaintences I know. Basically almost none of them have messaged me the past year. A few I haven’t seen in multiple years. I nautrally ended up comparing my life to theirs and feeling bad in the process seeing their anniversaries, vacations in Puerto Vallarta, Hawaii, Florida and other places. Or seeing them have celebrations as a group that I wasn’t invited to. Rinse repeat like 30x a day. No thank you…

Keeping myself busy has been a big help, in addition to working on my 1:1 communication with others. Online isn’t the same as in-person but it’s way better than being completely solo. I also will go back to playing kickball in a few months. That really helped me improve my mood quite a bit.

So let’s move onto a topic that was the bane of my existence last week. I kept stepping into a wet spot on the carpet. It was right near my dog’s water bowl so I assumed she was just drinking water sloppily. However the amount of water was steadily increasing. I stepped in it multiple times. It didn’t have a sewage smell so I didn’t immediately put two and two together. I eventually put in a maintenance request…

The maintenance man had to rip several holes in the sheetrock to get to the pipe. He confirmed there was a leak but a plumber had to get involved, adding a day… Then had to come back the following day to patch up the sheetrock he cut up and spackle back over it. Add one more day for the carpet guy to replace the padding under the carpet before they could do a cleaning. The truck had some type of loud diesel-smelling generator I could definitely smell inside. Also they’ve been doing some patio fencework repair so lots of sawing and hammering while I’m on conference calls. I guess it could always be worse and none of this came out of my pocket.

I continue cutting my own hair. I honestly don’t need to pay a pro to do it. This is like Corona-cut number 9 or 10, I lost track.

Started going to a gym closer to my apartment. It’s pretty empty most of the time and clean, two things that I really appreciate in this current climate. I also am wanting to lose 1% of my body fat a week. That’s about 2-3 pounds a week. The cold has been ruining my plans but I think it’s doable.

I know I sound like a broken record here but I’m extremely thankful for all the things that are going well in my life right now. I know people were furloghed, laid off, working multiple low paying jobs to make ends meet, trying to live off unemployment without any kind of safety net, got their car repoed. I hope they are able to figure things out. Still not a millionaire but I can at least plant more and more seeds with the goal of becoming one eventually.

Last but not least I highly recommend How Not to Become a Millennial: Learning from America’s Largest Sociological Disaster and The Black Man’s Guide Out of Poverty: For Black Men Who Demand Better. I’m lucky to have a mother who lectured me ad nauseum about what not to do… and knew enough people in my family who made decisions that ended up negatively impacting them later in life. The sad thing is a lot of people don’t want to acknowledge the truth. I can be stubborn as the rest of them but knowing is liberating in a way. When you know where your finances are, what your career trajectory is, what your weight, blood tests and blood pressure look like, you can start making the necessary changes.

Alpha M., a popular YouTuber recently had a health scare. He was inspired to get tested in light of what happened to Chadwick Boseman and they found some potentially much more serious issues had they gone unattended. Even more recently Dustin Diamond who many of use in our 30s and 40s grew up watching on Saved by Bell passed away from a rare but aggressive form of lung cancer. Not everything is preventable as was evident from my father and aunt’s genetic autoimmune disorders but lots of things are.

I hope I live a rich long life like the dearly departed Cicely Tyson, Hank Aaron, and Cloris Leachman. It’s midnight again and time for me to get ready for bed.

My 2021 Financial Goals

Maybe some overlap between the blog and my YouTube channel, but linking to this video as well.

Life Struggles With Money

I was feeling emotionally vulnerable when I posted this video on Jan 13, 2021. I should post a part 2 since a lot has happened since. For now the part 1 will have to do. It’s 32 minutes but it felt great to get it out of my system.

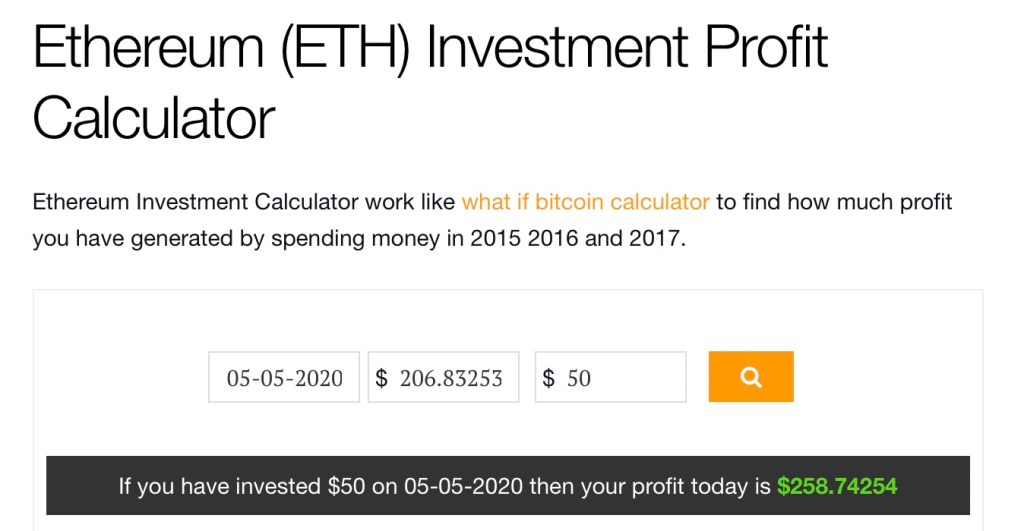

Cryptocurrency – My First Investment

I made my first Cryptocurrency earlier this week, 5 days ago in fact on January 5, 2021. I created an account on one of the platforms back in May 2020 but didn’t pull the trigger. Had I made my current $150 contribution here is where I would have fared.

I have an itemized breakout below.

BTC: 226.91

ETH: 258.74

LTC: 185.28

Total: $670.93

This would be the equivalent of a 347% return on my initial paltry investment. This is play money. If I lose it all it isn’t the end of the world. Still SMH over that one.

For some added backstory, one of my friends in 2009 told my about Bitcoin. I didn’t think it was going to become anything big and honestly didn’t understand it. I think he bought about $100 at the time. Not sure if he sold it. I had difficulty finding prices back that far. However indexing against 2010 prices BTC was at $0.39 per coin. $100 USD would have had the purchasing power of 256 coins. Tying that into prices today… One bitcoin is valued at $38,404.40. That would be worth $9,831,526.40 assuming your investment didn’t get stolen.

Found this cute little chart on bitcoin.com – The Reported Number of Stolen BTC Drops by 92% as ‘Bitcoin Security Appears to Be Improving’

It’s also important to note that there are no real underlying assets behind these cryptocurrencies. No government backing it, not tied to any company earnings, not tied to a tangible commodity. It also dropped to $3,690.91 in January 2019 from previous $19,167 in December 2017. This sucker’s super volatile. There will be a selloff at some point again I predict. Will it be tomorrow, 6 or 12 months ago who really knows?

I’m still investing anyway. Open to donations if anyone wants to send me money. I haven’t earned $0.01 from this blog since launching in April 2012. Same with YouTube. 😛

BTC: 37oTXEZgvNsQADdB5WKfLaHntNsR6SLLrm

ETH: 0x7cC6c462B7225228f63379fC010c60A1B77D5f98

LTC: MU7is12jrh2ES2hA1EZRqSJmtPq3UVMEpF

Cheers to a new year, new investments, and us hitting more of our life goals!

End of Year Update – $124k for 2020!

I made a video on this…

How it Started:

Dec 8, 2019 Balances:

401K: $65,831

Roth IRA: $4,425

HSA: $633

Total: $70,889

Car Loan: $5,375

Car Warranty: $517

Credit Card: $1,557

Total Debt: $7,449

How It Ended:

Dec 31, 2020 Balances:

401K: $110,076

Roth IRA: $7,389

M1 Acct: $1,304

HSA: $507

Buffer Fund: $5,000

Total: $124,276

$0 Debt

My net worth is basically up $60k from last year. 2020 was a rocky year for me, for a while I wasn’t sure I was going to still have a job. I didn’t go into the year at full steam but didn’t backpedal when my investments took a huge dip in the Spring. I managed to put $19.500 in my 401k and on the path to hitting $6k for 2020 in my Roth IRA before the April 15th deadline. That’s exactly where I put every last dollar of my $600 stimulus check. Some might call it a dumb move but I like compounding and seeing my money grow.

I see others making poor financial decisions and the only thing I can do is step back and let them learn the lessons on their own. I could offer advice but it would fall on deaf ears. You can’t take it with you, but you can enjoy life while also planning for a future filled with abundance and joy.

What Are Financial My Goals for 2021?

- Max out my personal 401k contribution for 2021: $19,500

- Max out Roth IRA for 2021: $6,000

- Max out Roth IRA for 2020: $3,900 left

- Add to taxable investments: $5,000

- Double emergency fund / downpayment account: $5,000

- Max HSA Contribution: $3,600

Total: $43,000

I’ll admit these are some pretty aggressive goals for the year. If I can’t meet all of these goals I’m not going to beat myself up over them. Life happens, but paying attention to my investments and being super aggressive is more than what most people do.

I also want to find a new place to live after over 6 years in this apartment. Houses are way too expensive in this current market. Not to mention the competitive nature of the market. People with conventional loans getting preferential treatment over FHA, or making cash offers above asking price. Then you have taxes, maintenance, HOAs, utility costs 4x my apartment, pest control, PMI, closing costs, home security, etc. Not sure I want to sign up for that right now. I would be building equity up however. Lots to think about.

I have a couple non-money related goals but keeping them to myself for now. Talk is cheap until you’re actually out and doing the things you claim.

What are your goals for 2021?

December 2020 – Retirement Portfolio Update

December 2020 Net Worth Update – It’s been a long year, I hope you are all happy and safe. Sharing a quick net worth update. I feel very fortunate for having a job, being able to contribute to my investments and for the capital gains / dividends I keep earning over time. I haven’t gone on any trips this year, live alone, and have seen friends minimally for the last 9 months. In 2012 I had $0 in investments and a net worth of -$46,000. A bit fat negative balance. Just one year ago I had literally half the net worth as today. If you keep at it, you can make a lot of progress in a short period of time.

Hoping this video gets more than 5 views. That’s all the last one generated… 😀 I also noticed the exposure on the last one was messed up. Lesson learned..