Wow, October and Halloween feels like such a long time ago now. Biden is now president-elect, we are going through another surge of Covid-19 in America and many other parts of the world. Many of us are still filled with hope over our major pharmaceutical companies releasing a vaccine. There are still looming questions with regard to effectiveness, side effects, distribution, and more.

Black Friday / Cyber Monday

Today I bought a new computer chair. The one I had was held together with zip ties and bungee cord. It was the highest dollar amount I’ve ever spend on my chair. It’s not the Herman Miller Mirra 2 or Aeron I strongly considered but were ultimately way outside of my price point for a new chair. We’re talking $633 on the low end. Surely I could have bought a refurbished one but those kind of creep me out a bit. I bought…

- WorkPro® Quantum 9000 Series Ergonomic Mesh Mid-Back Desk Chair, Black – Office Depot was asking $449.99 for it. I found it on Lenovo instead for 319.99 plus 10% cashback through Rakuten and 1.5% cashback on my credit card. So net is around $310. I’ve used it for a few days now, much of my back pain has subsided

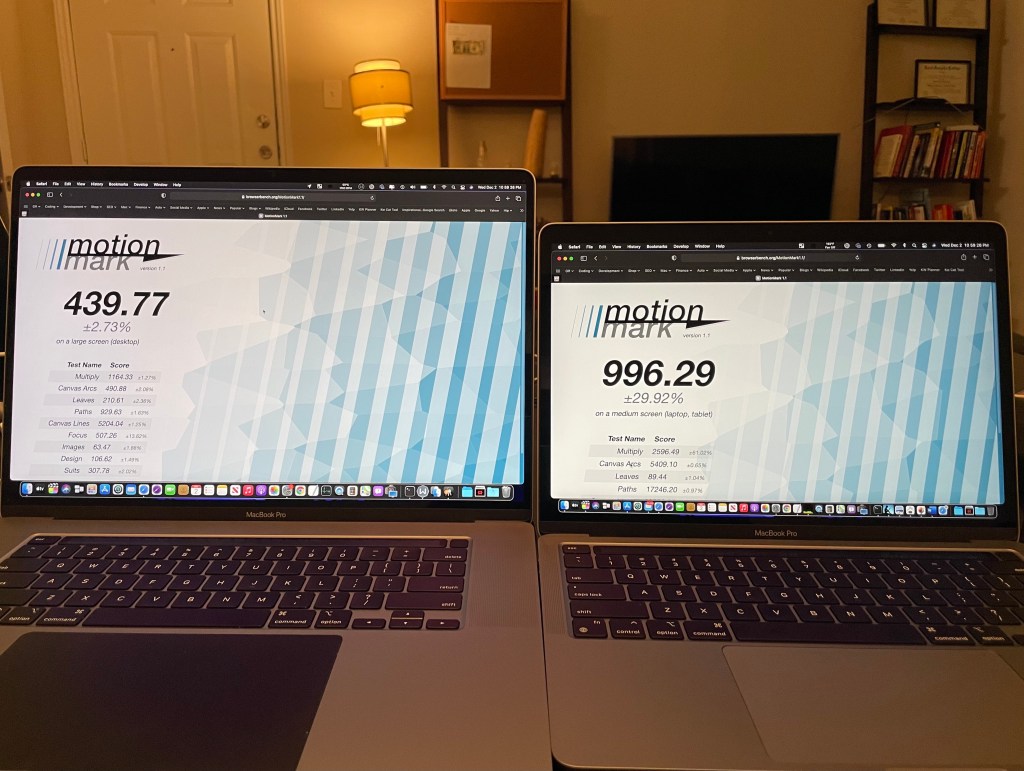

- MacBook Pro M1 – 16GB / 1TB – This is a purchase I honestly debated for few weeks. I had a fully functioning notebook, a 2019 16” MacBook Pro. However it’s heavy, the cpu often hits 200° F, super uncomfortable in my lap. In Geekbench 5 single core tests this machine is 51% than the computer I bought a year ago for ~$2800. Multicore is only a few percentage points higher but it does that without the fan running. To make it even more enticing, Apple increased the trade in value offer from $1400 -> $1530 and another site that I ended up using offered me $1784 for a one year old computer and that trade in value offsets the cost of the new machine. With my corporate discount my out of pocket cost is under $300.

- Logitech MX Master 3 Mouse for Mac -This is quite possible one of the best mice I have ever used on a computer. It works very well over Bluetooth and is a perfect addition to my wireless keyboard. Cost $82 after a $10 and $5 Gift Card.

- SanDisk Extreme Pro Portable SSD V2 : I will be the first to admit I have too many hard drives. The one I have been using for my backups is 20x slower than my internal SSD. The 500GB Samsung T5 SSD in 2017 is too small to store all my data. 2TB is a lot but I’m also planning for the future. I got $200 off on this for Black Friday, and 10% cashback through Rakuten. Then my credit card offers 1.5% cashback on top of that. $287.81.

- Henckles Knives Set & Shower Liner – I have had the same knife set since moving into this apartment in 2014. They were cheap when I bought them and now starting to rust. I feel like 6 years off a $20 set is time. $86.28

- Shag Donut Luxury Plush Cuddler – My dog flips up her bed all the time. I think it’s because it’s too small. It’s also over a year old. She deserves a comfortable place to sleep and relax so it’s time. $64.90

Aside from that I haven’t made any major purchases lately. My car and renters insurance are both coming due within 10 days. Car insurance is $669.64 and Renters is $115.61. I’m really thankful to be at a point where these expenses don’t devastate me like they used to.

In terms of personal life someone I really enjoyed the company of ghosted me after 3 dates and talking for several weeks. It’s crazy how someone could open up to you, talk about how they might want to adopt one day, sleep next to you… then all of a sudden be stressed out, not wanting to talk on the phone for even 5 minutes and not respond to text messages anymore. I bought two small birthday presents for him, returned one and gave away the other. It hurt but I watched some videos on how to get over ghosting and now it hurts less.

Looking back at the last couple years…Relying on other people really hasn’t worked out so well in adulthood. I have countless stories between friends and family. I know it’s a two-way street, but now I just focus on things that bring me joy. If other people want to join me I’m open to it but not just sitting around hoping just to be left alone.

Enough about that though… It’s time for an investments update:

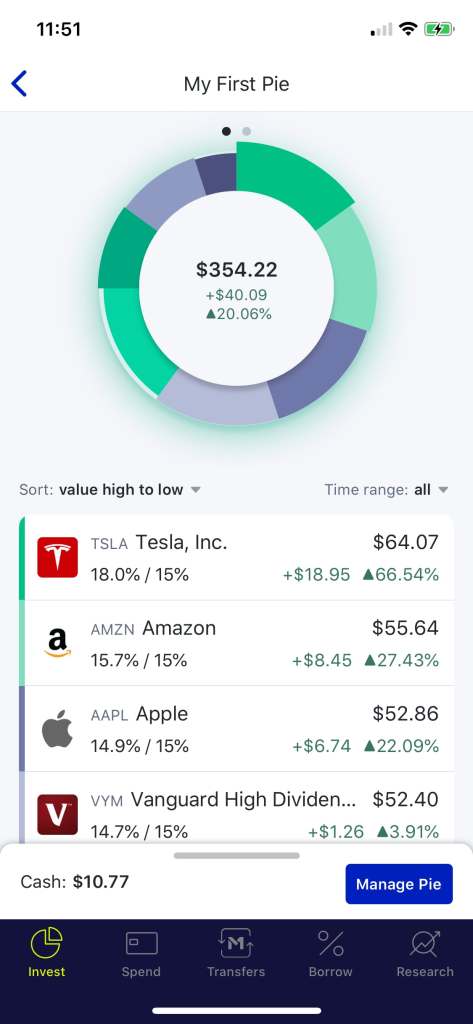

401K: $105,686.95

Roth IRA: $6,506.07

M1 Acct: $1,131.47

Total Investments: $113,324.49

Considering last month was $99k I’m doing pretty damn well. November 2019 my investments were $68,561 with over $10k in debt. My net worth is effectively double in a year!

Credit Card: $2,053.61

I’m getting $1,784 of this back through my old computer trade-in. Coming up I also have my renters insurance and car insurance coming out. Both payments will be around

I can pay this off fully out of savings if I wanted to, but keeping an emergency / moving / home fund is something I prefer not to touch. I will pay it all off in full when I get paid again in 2 weeks.

Last but not least I’m extremely thankful for all my blessings right now.

Stay healthy, be safe out there. Remember to do things that make you happy.