401k: $65,831.25

Roth IRA: $4,425.07

HSA: $633.38

Total Retirement: $70,889.70

Car Loan: $5,374.98

Car Warranty: $517.00

iPhone 11 Pro: $1,235.68

Credit Card: $1,557.14

Total Debt: $8,684.80

Some of my payments will be posted next week, but I do plan on posting a 2019 year in review post in a few weeks. Overall observations about his month:

1. I really considered going on a vacation either to Austin or San Antonio, but I don’t think I would have the level of experience I’d desire with my current budget. I refuse to fly Spirit after my last claustrophobic experience in the back of the plane stuck behind the restroom. Places I want to stay are close to $200/night, my budget would be $100/night. The hotel we were going to stay at has some really sketchy reviews, charges a daily parking fee. The weather isn’t that nice right now either. Maybe I’m just making excuses.

2. Apple gave me more for my trade-in than I thought considering I got a credit on the taxes. Ended up being $1,515 vs $1,400. That’s fairly close to what I would have netted out to between ebay fees. Let’s break it down.

eBay Listing Fees:

Insertion Fee: $2.00

Listing Fees: Bold + Subtitle + Scheduled listing: $2.60

Electronics Fees (8% of the initial $50.00, plus 5% of the next $50.01 to $1,000.00, plus 2% of the remaining final sale price balance). Assuming $1700 sale price that would be $4+$47.50+$14: $65.50

PayPal Fees: 2.9% + $0.30 of the total selling price: $49.60

Shipping: Estimated $50.00

Total Fees: $169.70

Fees – Sale Price: $1,530.30

Not much of a difference and a lot less aggrivation.

3. I bought a few things for Black Friday. Between new shoes, bedding, a pair of jeans, and a shiatsu foot massage machine I spent about $199.53.

4. I just switched insurance providers from State Farm back to Allstate. It costs a little more each month, but…

State Farm doubled my payment, I switched to a monthly plan through from a 6 month lump sum. then took a whole 2 weeks to give me a credit.

Around the same time, the rep in the office tried to cross sell me some insurance I wasn’t interested in but ultimately agreed to. Then after signing up I got a letter in the mail saying I don’t qualify due to my BMI.

Their office moved what is now 30 miles away from I work. I have never met the actual insurance agent. I tried to give them the benefit of the doubt by scheduling a Friday call after work since their Saturday schedules are always busy… She never called me back. Then she calls be back all happy go lucky about wanting to discuss my insurance renewal two weeks later…

Really thinking about the next few years of my life. Perhaps overly so…. I’m not 100% sure what direction things will go. From an earnings standpoint should I continue in Marketing, explore options in IT, or ramp up my side hustle game. I could have a Bachelors in Computer Science before the age of 40. If I start now I’m confident it would take me 2 years. Assuming it takes me 2 years to get the degree I’d have to start out taking a pretty big pay cut from where I am now. Would it be insane to start racking up certifications as a backup incase my industry starts to move toward automation or we have a crazy recession? I’ve gotten burned before being a one trick pony

Software Developer Salaries Compared – Courtesy of Salary.com

I don’t think this blog is able to be monetized and that’s not inherently a bad thing. The traffic isn’t there, it’s honestly all over the place, and really specific to my own experience. I write for my own pespective instead of someone just getting started in Personal Finance.

It’s also not a Brand in the typical sense. Too close to debtfee.com which is a licensed LLC. If I am to blog with the goal of generating ad, affiliate, etc. revenue I’d have to pivot to a different name.

My goal is to start modelling myself more after the top 11 people I follow in the space.

1. Alex Becker – Entreprenuer, Popular on YT – 387k subs

2. Clark Kegley – Refusing to Settle – Passive Income- Entpreneur – Mindset – 292k subs

3. Jaspreet Singh – Minority Mindset – 515k subs

4. Nate O’Brien – Millenial, saves a ton of his salary, minimalist – 343k subs

5. Mr. Money Mustache – He’s the standard 32k subs

6. Mike Rosehart – Young guy, into real estate, is completely crushing it, 14.7k subs

7. One Big Happy Life – Great to see things from a family perspective – 178k subs

8. Ryan Scribner – Personal Finance – Entrepreneurship – Stocks – 502k subs

9. Madfientist – He hit F.I.R.E. super young – 9k subs

10. Joseph Carlson – He dives into the world of investing weekly. Big on dividend investing (I’m also trying to increase my retirement stash quicker than he is lol) – 58k subs

11. Andrei Jikh – Magic of Finance – Big on dividend investing, has almost $195k invested at 30 years old, saves close to 50% of his income – 251k subs

Stay tuned….

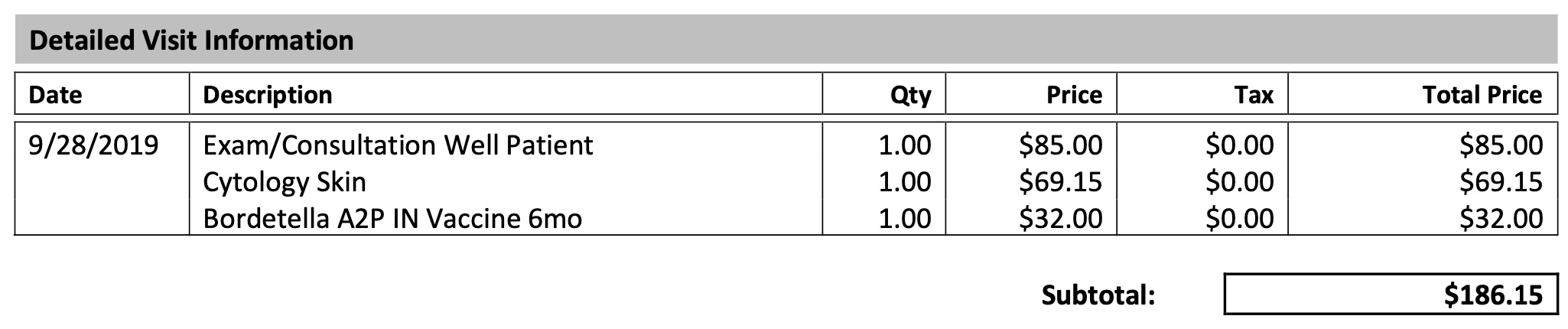

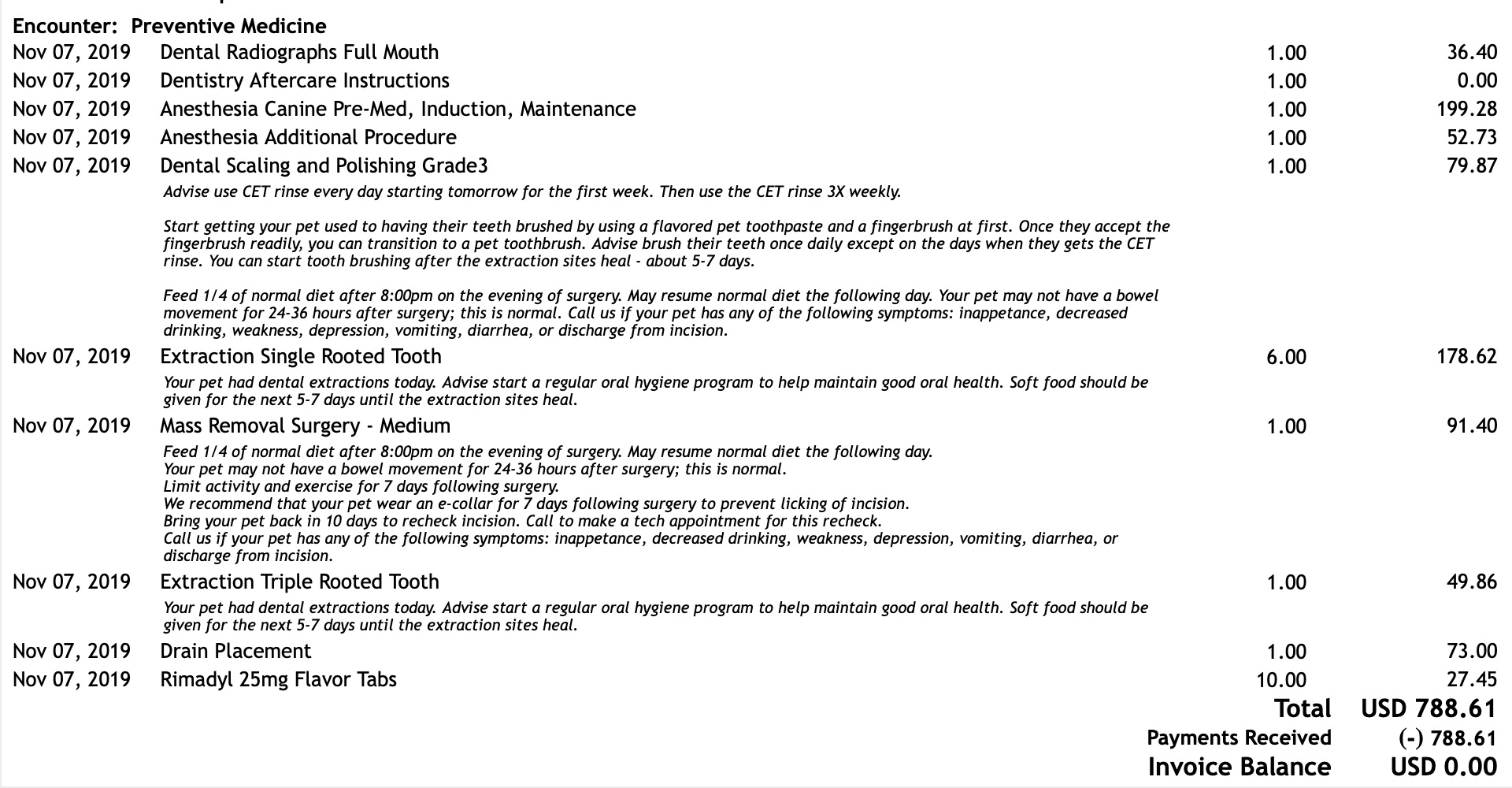

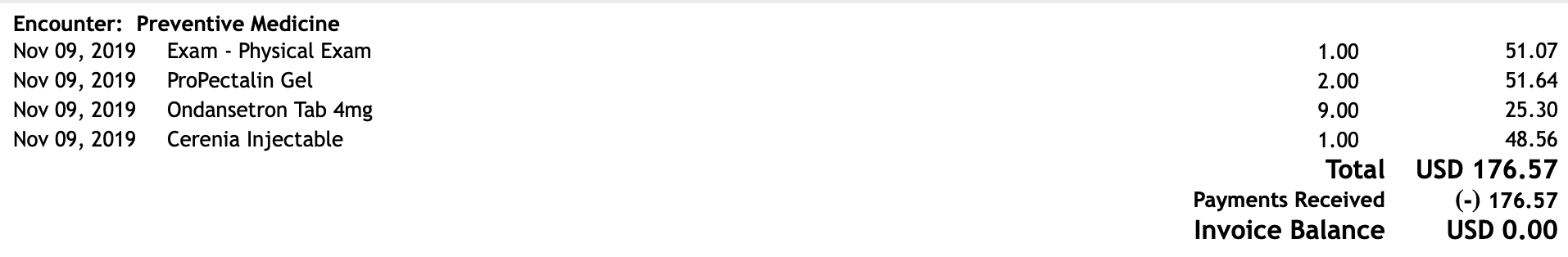

The place gave me a quote for a dental cleaning + surgery removal that was been $900 and $1300. I decided that was too much and wanted a second opinion.

The place gave me a quote for a dental cleaning + surgery removal that was been $900 and $1300. I decided that was too much and wanted a second opinion.

The brings me to a combined total of $1,151.33. I love my dog, despite the huge vet bill. At least my card is 0% until May and I can probably pay this off in full within 30 days.

The brings me to a combined total of $1,151.33. I love my dog, despite the huge vet bill. At least my card is 0% until May and I can probably pay this off in full within 30 days.