Just over 6 weeks left until Summer 2018 will be over and done with. The temperatures have been pretty brutal in Texas, often rising above 100°F. As you may recall, I stopped contributing my 401k to the max in favor of other more liquid investments and paying off debt.

As of this past weekend I think I’m doing moderately well.

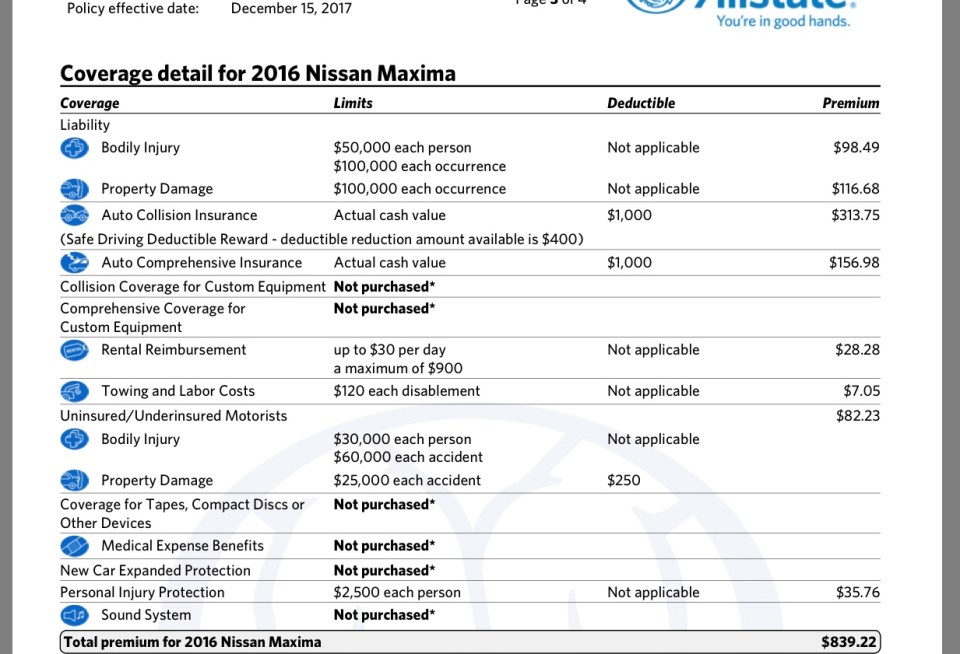

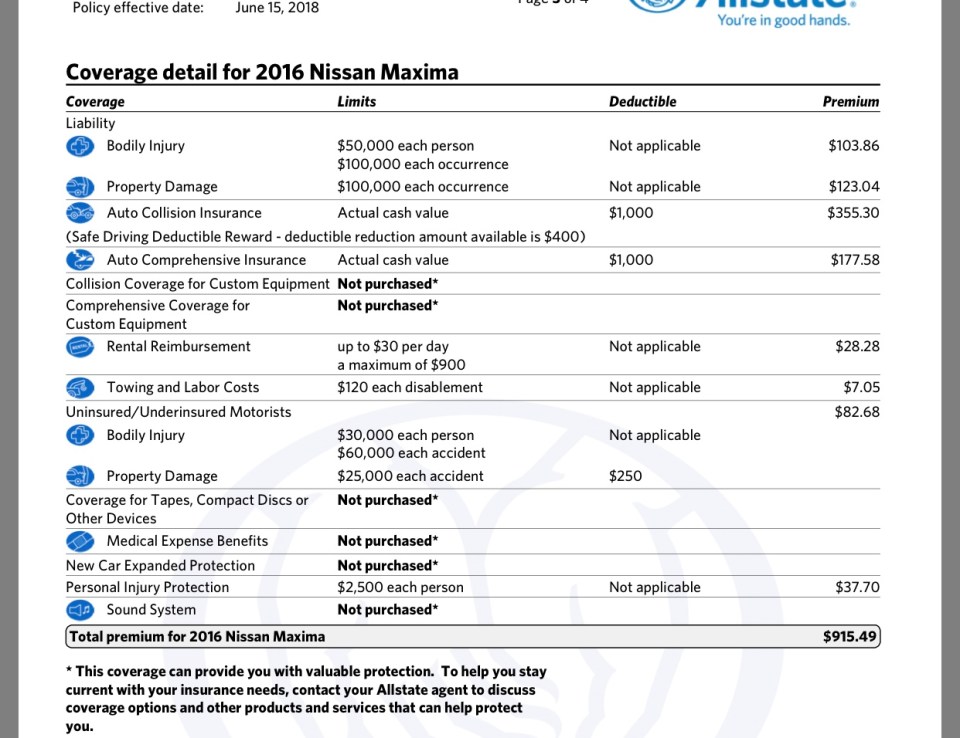

Nissan Motor Acceptance Loan: $15,125.90 (1.9%)

Credit Card Debt: $904.81 (16.74% APR)

iPhone X Loan: $1,235.68 (0%)

Total Debt: $17,264.03

Emergency Fund: $2,000

Roth IRA: $676.01

401k: $41,727.45

HSA: $265.38

Assets: $44,668.84

Why do I have the credit card debt? Had a relatively heavy road bike for 4 years. In 2016 I rode 238 miles, in the last 12 months I did 308 miles. So I decided to buy a new one from Performance Bike. It’s a Fuji Roubaix 1.3, weighs about 18.8 pounds, a 6lb weight reduction from my Windsor Wellington SL. I am still working on getting my cadence up. The more advanced rides want you to do an average of 19mph for the ride. I’m averaging 12mph right now, so I have a lofty goal to reach for.

Selling the old bike has been a bit of a challenge. No one seems to know what it is, or wants to low ball me. “That sure is a beautiful bike. I love to buy it today! I know there’s lotta wishy-washy people here. But, I’m a serious buyer and I can drive to you today and give you cash in hand. My offer is $50 today pickup.” My current asking price is around $320, I don’t plan to let it go for anything under $300. Worst case I keep it as a backup bike or for when someone else wants to ride with me. To-date, not a single friend has biked with me in 5 years, or worked out with me in 4. Pretty shitty.

Still not having very much luck in the area of social interation with others. I signed up for a beginner bike ride with a local group this weekend. Tomorrow I’m going to a concert with coworkers so that’s something. I guess it’s normal to have fluctuations in social activities. 7 whole days of no plans is a most frustrating feeling. I’ve broken it down into a couple of beliefs.

1. I’m a loser who lacks the basic skills to make new connections. I know for a fact that isn’t true, but usually there are more periods of awkward silence than anything else.

2. Despite my best efforts, even seeing a therapist at some point for associated anxiety, people just don’t really choose to make me part of their activities. This I don’t expect to change.

3. Everyone else is sort of busy doing their own thing, you have periods of the same. Especially if they already are in a relationship, have kids, organizations they area a part of.

4. I have almost no common interests with the social circle closest you’re closest to, so why be surprised when you don’t get invited out. Some of the activities they do like board games I am outwardly miserable being part of. Just not my thing but that’s okay.

5. The people you were closest to all moved away, lots of people from Texas are weird. Many of the ones who weren’t from Texas moved out of the state, often closer to their family. Or in an area for a new career opportunity / more closely aligned to their political beliefs. Altogether there were about 10 of them since I moved here in 2011. Now they’re all gone.

6. Attempts at going to the gay area of town and strike up a conversation by myself have been unsuccessful. Even with the usual series of apps at my disposal. The anxiety kicks in hardcore, I’m lacking a starting point to work off of. Commenting about the weather or what someone is wearing can be sort of lame. For the most part only the old, borderline creepy type guys show me any interest. Maybe one day this will no longer be the case.

7. I try to make plans with friends I do have and they’re usually busy. Some don’t even text me back. Took me about *5* months to meet a former close friend for lunch who works less than a mile away from me. One of my closer friends in the area admitted to me he has a drug addiction problem, and is in the middle of recovery. Generally he has not been the same person over the last 2 years. I would still hang out with him but it’s really not the same anymore. His personality is different and he’s been way too emotional with everything.

I’ve struggled meeting new people for literally the last 20 years. Trying to shift out of a defeatist attitude but weekends with literally no plans with people just make me feel deflated. Maybe focusing on actions, and the things I do have power over will help improve my situation. Keep on pushing…