December 2013 I purchased a Canon Pixma MX922 printer from Amazon.com for $70. It served me well for the basic scanning and printing functions I threw at it. Never any issues with Drivers or the hardware not working properly. Wireless printing, easy configurability. I’ve owned several Canon products over the years with very few problemns. Last week was a different story…

My Canon All-In-One would not power on suddenly after printing something just minutes earlier. I missed a gym session due to all the time / angst involved in getting the device to work. A few of the items I tried.

1. Tried unplugging and plugging it into multiple outlets. No dice. Power cables almost never go bad so I crossed that off the list pretty quickly.

2. Attempted to do the “hard reset” which involved holding down the on button and pushing the stop button multiple times.

3. Power supply – I did a little research on the cost for one, it was $30 and pretty much a gamble. In an ideal scenario that’s all it is, a task involving unscrewing the defective one and replacing with the working module. However many folks have done this step and the device still wouldn’t work. Then I’d have to deal with the hassle of returning a PSU back to a vendor, potentially incurring a restocking fee and paying shipping on my own.

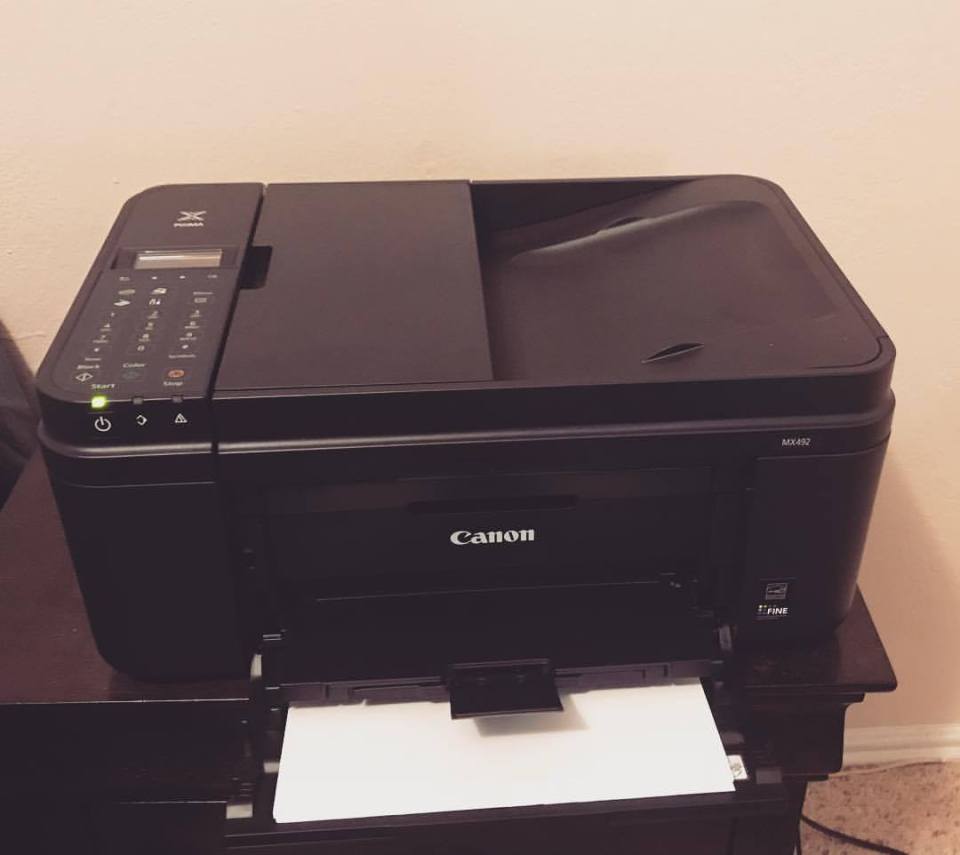

4. Looked in Amazon at prices for a newer printer. Canon still makes the MX922 new, available for more than I payed as part of the Black Friday special. However it was $70-90, money I was not interested in spending. The MX 492 runs between $50 and $100 with average reviews. Average is fine, it’s not like I will be using this a bunch.

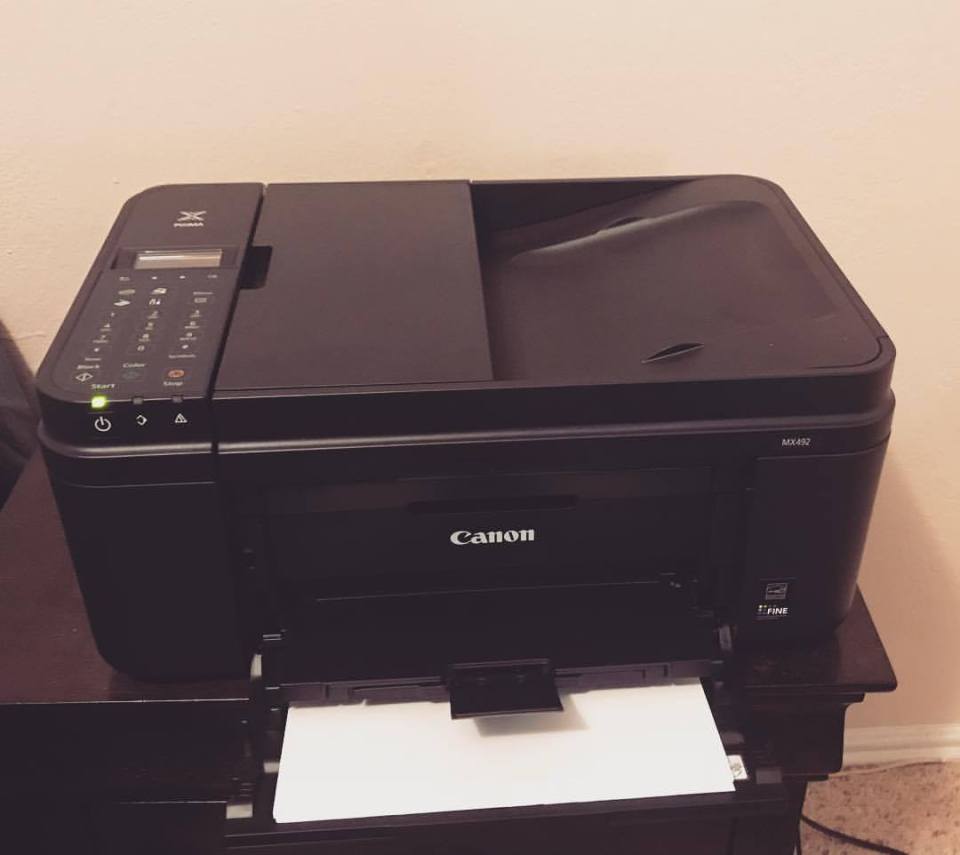

After weighing my options I decided to check out Facebook Marketplace. There was a lady selling the printer in Grapevine (about a 45 minute drive from where I am) for only $20. She said it was two months old and lightly used. Perfect! I make arrangements, grab money from the ATM on my lunchbreak, and head over there. Dealt with horrible traffic jams but I made it. She was nice, we exchanged money and I went on my way.

The printer works like a charm and you’d never know it was $20. I know No More Harvard Debt and Aaron Clarey both like to shop at Goodwill. I wonder if their experience is pretty similar. Maybe I wouldn’t find top name designer stuff, but something that looks nice for a fraction of what it’d cost new in a store and would look the same after the first wash? Not bad?

My $20 used wireless printer. How Mustachian…

My next purchase may be a Digital SLR again. Back in the 2008-2011, I owned a Canon Digital Rebel XT with the kit lens. It literally took the best quality pictures I’ve ever seen in my life. Even 6 years later the best iPhone simply can’t compare. My father was also into photography growing up. He had some expensive high-end 35mm cameras on borrowed money, but it was fun to just go places and take some shots.

One topic I’ve been thinking a ton about is the relationship between money & happiness. There is a funny video about contentment (https://www.youtube.com/watch?v=lpVqXrvyBYM) and it’s totally true. Many of the things we buy don’t create true happiness. You just end up getting a spike of satisfaction getting something you have been craving. Sure there mey be exceptions to the rule, for folks who know the nuisances of the items they buy and have a genuine need for associated features.

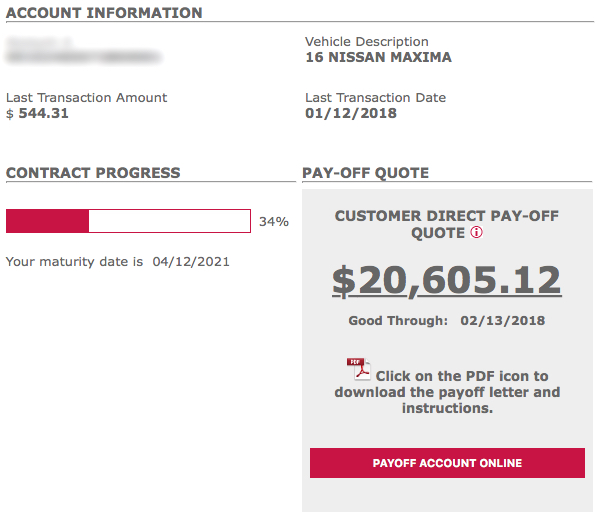

The auto industry is notorious for these practices. They market these $40k+ cars with videos showing no other traffic, on freshly paved mountain roads, as the perfect accessory to your expensive $750k house, or high paying job… You on the other hand have a reliable car that gets you from point A to point B, with little or no fanfare. Then you see a shiny new RWD Chevy Camaro or Ford Mustang on the TV, or for me an Infiniti Q50 Red Sport or Audi S5. These cars have either power, massive luxuty, a fabulous 10+ speaker studio on wheels, 400+ HP. Your materialistic friends will be in amazement when they see you go down the road in that shiny new machine and view you as highly successful.

The reality of the situation however is a bit different. With that high powered or luxury new car, come a few challenges.

1. Spending a lot mof on gas. Most of these cars aren’t great on gas. The Infiniti gets 20city/26hwy, the 2017 Camaro SS 17/27, Audi S5 18/28. Numbers have gotten a lot better, but if you drive 15000 miles a way you’re looking at $1800+ in gas. Close to $10k in 5 years.

2. More expensive maintenance. I love electronics but things tend to break more frequently than the tried and true mechanical systems that have been perfected over several decades. Plus all these sensors and computers are more likely to go bad.

3. Depreciation. The more you pay for a car the quicker it will depreciate. If a car is worth 50% of its value in 3 years your $50k car becomes worth $25k. The $30k car is worth 15k. A used car cheaper for $15k will lose a lot less value. Even if it’s $7500, that’s still a bunch of money in savings that can be used for debt, or investing.

4. Stress – I’m guilty of this too, you constantly are looking around for where to park to avoid door dings and spend extra trying to keep the car in tip top shape. Then if the car payment, living expenses and other payments are a high proportion to income, a situation emerges where one single repair becames a huge event. Can’t pay for it cash and have to put in on credit cards.

5. Less investment income. Most younger folks who buy these are not maxing out their retirement savings or doing and type of passive investing and some live paycheck to paycheck. They’re missing out on the power of compounding.

6.Sitting in traffic. MMM has written a few times about that how people sit around in these expensive sofas on wheels are just polluting the environment and the bank owns the car not them. What good is 400+ hp if Mon-Friday you are sitting in stop and go traffic most of the time. The luxury part I can kind of understand, if you are spending an hour or more each day.

At the end of the day though if you love a sporty or expensive car and can truly afford it, who cares… I’m paying mine off by 2019, possibly sooner. I really have learned a lot from my millenial peers who are kicking butt and taking names. Also a lot from the ones who can’t stop buying fancy items that they don’t really need. Higher salaries, high expenses and extreme credit cards don’t equal winning. Savings rates dictate more if you’re going to win in the long term.

Last but not least, I am constantly reminded of the need to go out and have fun. Recent events of late really affirmed that. Feeling alone is a horrible feeling, luckily I get to see my friends later today. I have to constantly work at making new friends and cutting ties with the ones who are always down or make less than a half-hearted attempt to socialize.

One final thought is you can’t take the money with you after this life is over. Push hard for financial independence / early retirement but also don’t have major regrets along the way. The paradox of life is you don’t really know what you regret until life has already gone by. For that I’d say learn from old people. There is wisdom that comes with age.