More layoffs at my company. There were at least 15 people I have worked with personally in the last 3 months who were let go. Makes me think loyalty to a company is dead. While you’re there you try to be a linchpin and indispensable. However if your work doesn’t result in a promotion or even a decent raise it may be time to look elsewhere.

The idea of having a safe secure job is dead. Skills are everything. We are moving toward a society when a full time employer with great benefits is going the way of the dinosaur. People running their own businesses can allocate more money toward their retirement, in some cases are free to make their own schedules and will often work more hours than a typical 9 to 5 er. There are of course risks, some crash and burn miserably.

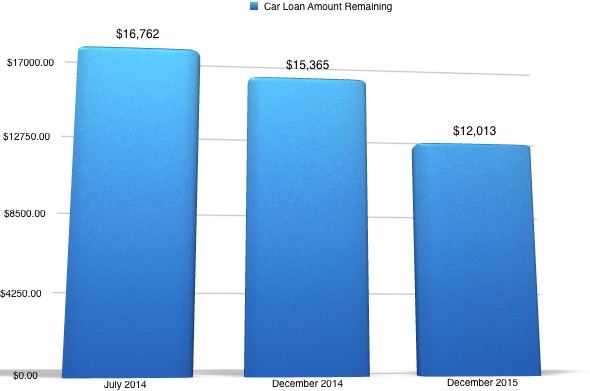

As I get closer to being debt free I think about more and more about the concept of f’you money. I see people driving brand new Porsche, Mercedes-Benz and Lexus cars. They buy fancy homes and put expensive items inside those homes. Then they work 60-80 hours a week to pay for these things.

Jacob Lund Fisker author of Early Retirement Extreme sums up this situation fairly well.

In real life, the prisoners of Plato’s Cave are those who are prisoners or slaves to their wages and their culture. A wage slave is a wage earner who is entirely dependent on their wages. While the wage slave is free to leave the current job, he is not free to leave the job market altogether and he can likely not imagine the possibility of doing so. He is still entirely focused on the wall.

The wall shows other people not as who they are, but as what they own. There goes a man in his new sports car, what is not seen is that the car is bought on credit and the man is stressed because he is having trouble making the payments.

Wage slaves have jobs where they can go and spend their most productive hours writing high powered memos so they can be more productive, while other people spend their time ignoring memos so they can be more productive too… … This endless working and playing is called “making a living”, yet people are so busy “making a living” that they have no time for living. A wage slave is a person who is not only economically bound by mortgages, loans, and other obligations, but is also mentally bound by an inability to perceive that there are other options available. Like the prisoners in Plato’s cave. Their chains are not physicals; the chains are mental, which in some sense makes them worse because it turns the prisoners into their own prison wardens.

Is spending the most productive years of your life chained to the job market to collect a lot of rarely used stuff that gathers dust in the closet or takes up space in junkyards a wise choice? Were you really born just to die, leaving a large pile of discarded consumer goods? I realize that not wanting a house full of things makes me look weird and even “unpatriotic”. After all, more is better and who does not want to be better? But perhaps conformity is not the only way to live. In fact, by taking the other end of the bargain, saving as much as other people are spending on wants, it is possible to retire and live on invested savings after just 5 years of full time work. Rather than increasing the amount of work to acquire more stuff, reducing this superficial need reduces the amount of necessary work. It is possible to reduce the amount of work all the way down to zero: financial independence. Indeed, playing the shadow game for five years provides a permanent way out of the cave! Alternatively it is also possible to return to the cave for a few months every year to earn money for the next adventure out of the cave.

I see people with fancy titles big homes and hair turning white in their 30s. That and looking stressed out all the time. Is it really worth it?

Is all this stuff we buy to impress people we don’t really like worth it?

Have we not learned from the overconsumption of the Baby Boomers & Generation X? Is lifestyle inflation something we’re just come to accept as the baseline?

I don’t want to be a slave to money or things that will just lose value over time. Not every one gets it, but a few do. It’s a movement, and it’s growing. 🙂

Put my mountain bike up for sale on Craigslist, asking 320 negotiable. I haven’t used it in a year. Was also wishing I’d find a boyfriend or even a friend that appreciated biking as much as me and would want to ride together. Got the bike in August 2013, none of those things happened and I use my road bike pretty much exclusively.

Put my mountain bike up for sale on Craigslist, asking 320 negotiable. I haven’t used it in a year. Was also wishing I’d find a boyfriend or even a friend that appreciated biking as much as me and would want to ride together. Got the bike in August 2013, none of those things happened and I use my road bike pretty much exclusively.