Did three dumb things recently.

1. Scraped the rims on my car. The two front ones. Ordered a replacement on eBay for 209 (delivered) and on my way to pick it up I scraped one on the opposite side. Local place estimated $90-130 per rim to replace. So $418 on rims, then need to pay probably 50 or so each to install them. I hope to get around $300 total to recoup my expenditure. It bothers me that I have a car just about 6 months old and the rims all look janky. Maybe women feel like this about shoes and a new dress.

2. Double paid credit card balance. Somehow I made an extra $443 payment instead of the actual $99 balance I had. So in order to get my refund they have to mail me a check. Even though my payments are processed electronically. My fault but the site shouldn’t calculate a different balance when you have a pending payment.

3. Doctor visit. About $170 between the visit itself that I did at a local walk-in clinic and my prescription. Something I could’ve prevented had I known but doing much better now. Health matters can be super scary sometimes. You live and learn.

Did two not so dumb things recently.

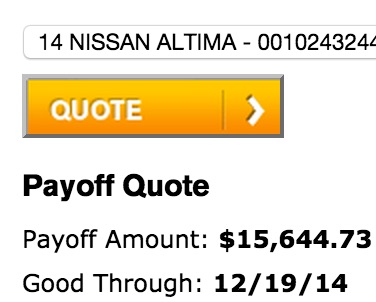

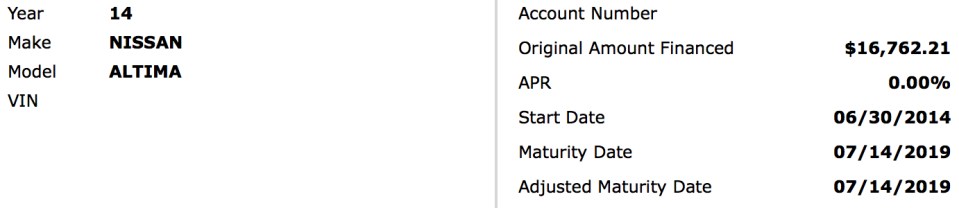

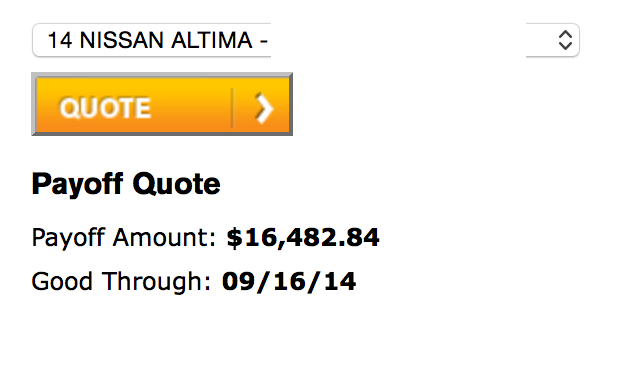

1. Bought a warranty on my car. 96 months / 120k miles Nissan Gold Preferred Warranty. $1750, 10% is up front and the remainder split into 18 payments. Just need to get an inspection done and send the paperwork over. My parents have cars a few years old and didn’t have a warranty. Ended up having to cough up a good chunk of cash to get them fixed. I plan to avoid that and the warranty also encourages me to keep the car until it’s up. In this case about 7 1/2 years from now.

2. Paid my credit card down to 0. Dipped temporarily into emergency fund to do this. I was not happy carrying that much consumer debt into the new year. I didn’t buy anyone gifts, just focused on paying my bills off. The balance was $1156.

3. Eating in more. I like this one aspect of apartment living on my own. I spend 60-80 in groceries each week and the food basically lasts me most of a week. I get breakfast, lunch and dinner on that budget. When I go out for dates I tend to spend more.

Met a guy who I thought was pretty cool right before Christmas, then New Years Day he said he just wanted to be friends. He was kind enough to pay for both of us. Was kind of heart broken but talking to new people now. Better to find out early than let it linger for months and months. Life is a game of trial and error really though. Have a couple of good candidates and may meet new friends in the process too so I’m happy about that.

For work at least I started writing my daily goals down as soon as I get in. Each day even if half of them are carried over from the day before I start with a clean slate. I feel better about how things go as a result. Need to start doing this with my personal life too. As soon as I sit down and start letting technology take over my productivity goes from incredible to zilch. It’s about balance though like anything else.

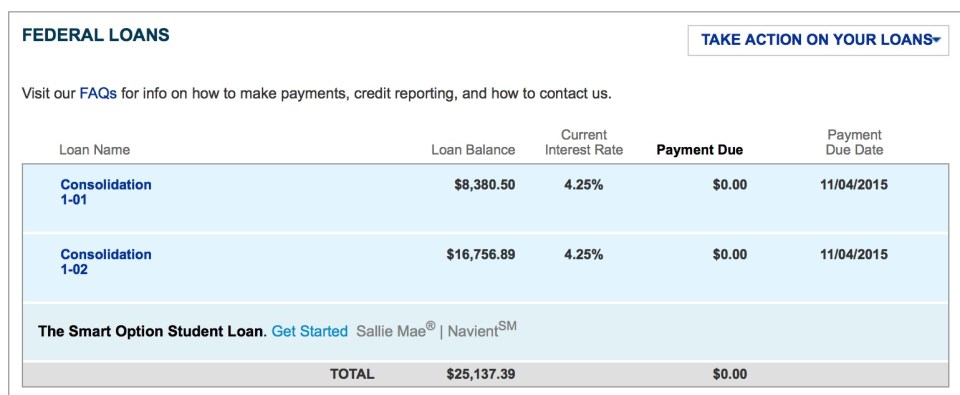

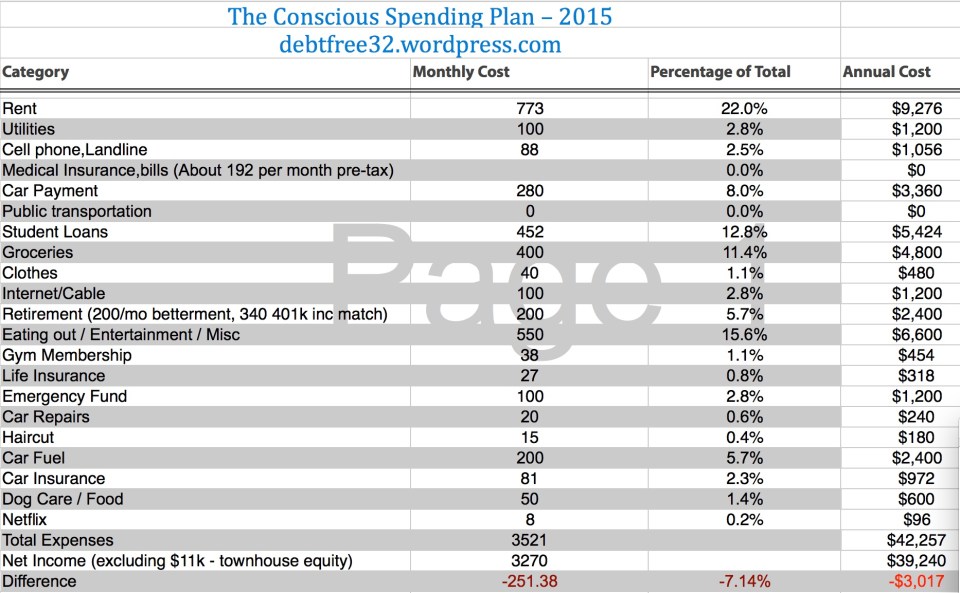

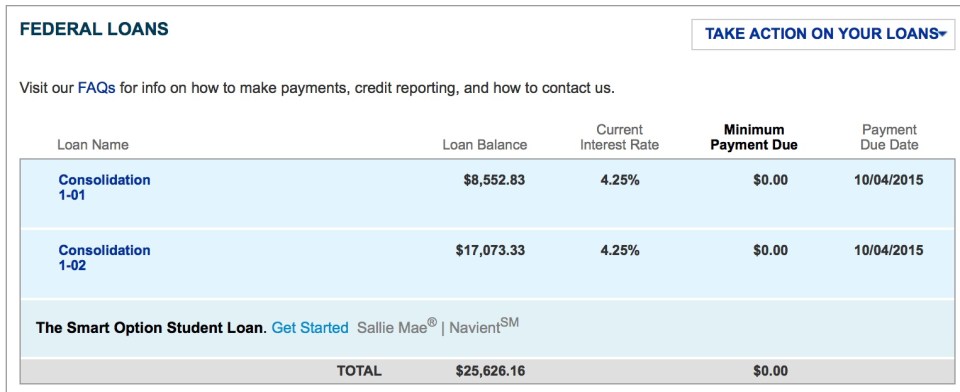

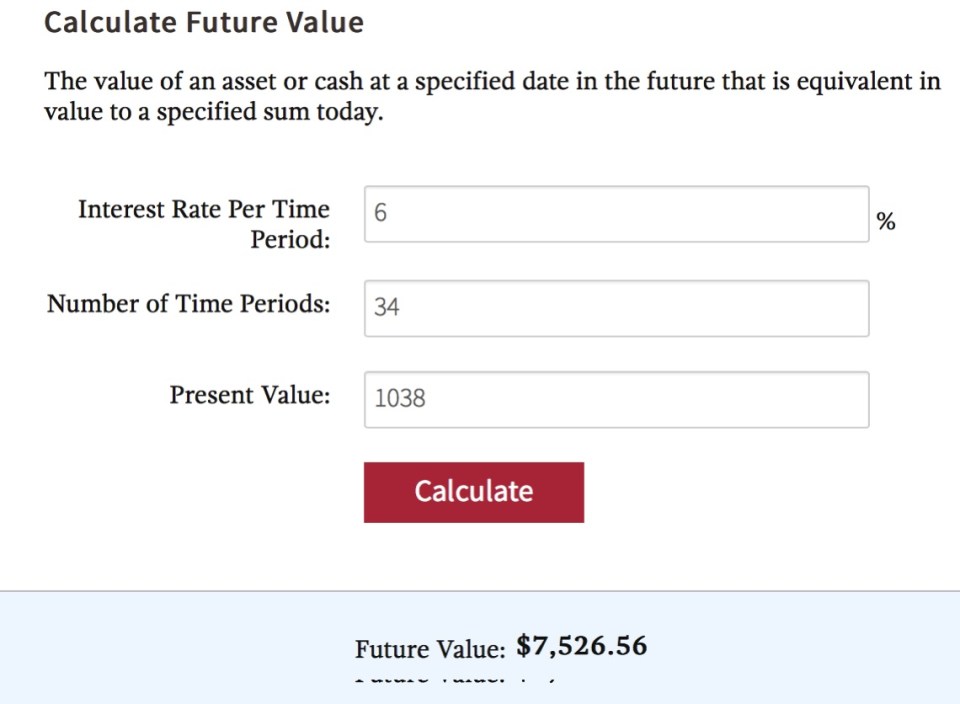

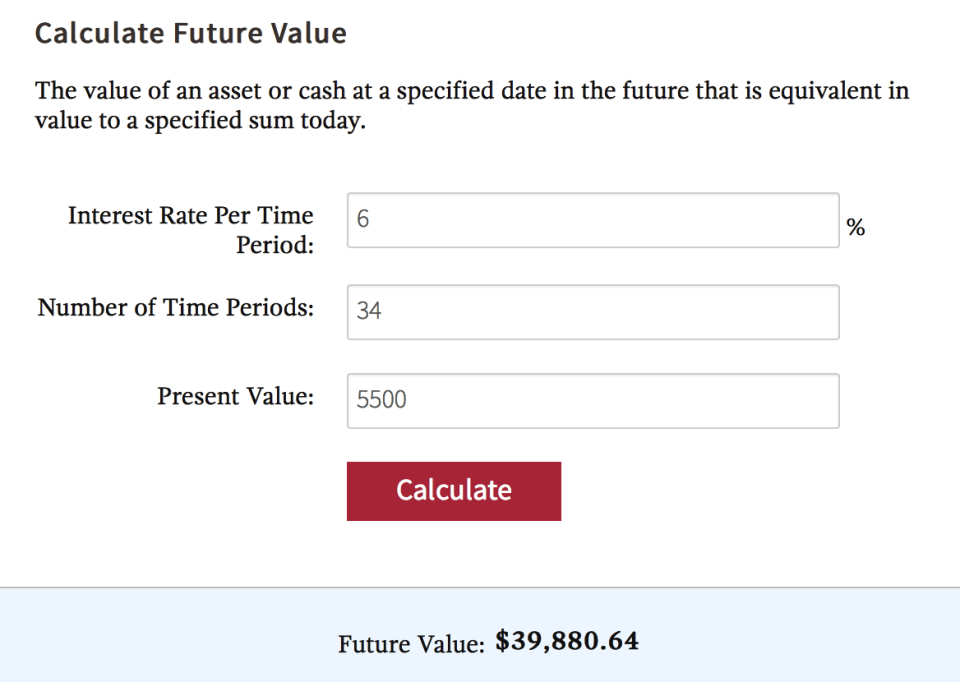

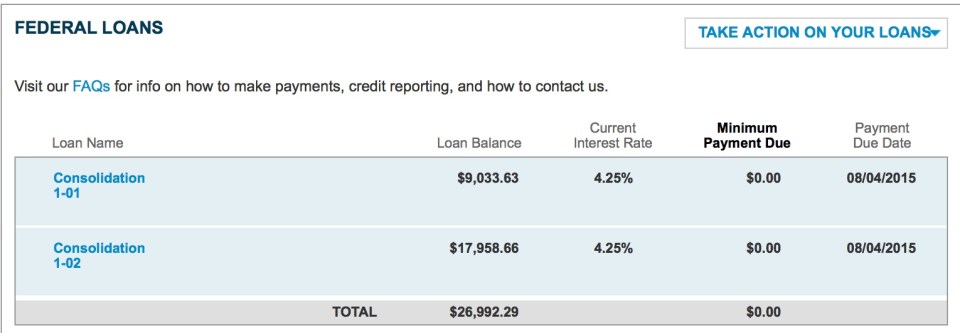

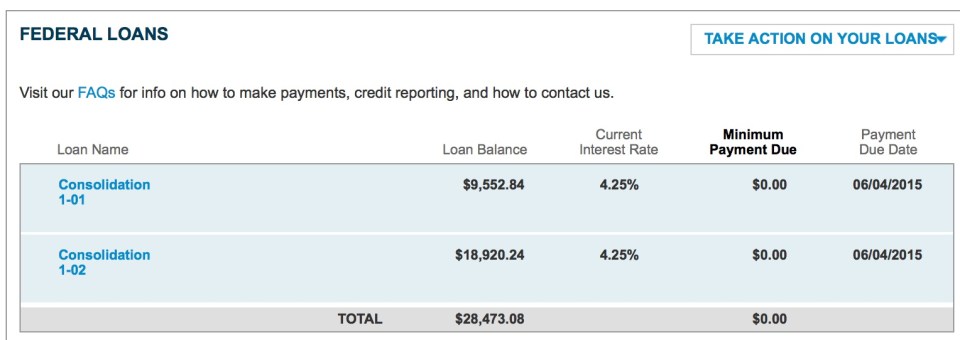

February is going to be the month that I get back to the original plan. By then all my furniture will be paid for and hopefully no other major bills coming in other than my dog’s annual vet bill. I feel like so many things just kept coming up that were not typical. Big $183 electricity bill from townhouse, final $144 Verizon payment, $804 initial payment for moving in and then the $773 payment for the first full month, around $650 for Home Depot, paying the Allstate bill I put on my credit card in November. Between my loan interest, clothing donations and a new car purchase I should be getting a decent-sized tax refund toward the end of the month. It will go all toward Navient. I really want the loan down in the low 20s by Spring.

Despite weather in the 20°s I still have been going to the gym. Kicking and screaming but going. Want to maintain at least even if I’m not losing any weight.