A Good & Bad Days

Easiest way to explain this is probably to go in chronological order. I preface this story with the fact that I was flying to Philadelphia for a job interview.

Thursday / Friday

I work during the day and leave at about 4 to come home for purposes of getting last minute packing completed, walking the dog and briefly tidy up the house. Right before I leave, my friend asks me what’s on the floor and I tell him a hairball. I think little of it as I’ve seen it before.

Friend picks me up from the airport around 4:45, I have one carry-on bag, a messenger bag. We arrive at the airport before with time to spare. Initial scheduled departure time 7:25 PM. American Airlines has a series of delays and I don’t end up leaving until 10:45pm Central Time. During this time I have several conversations with a recruiter about what will happen should the flight get cancelled. Would the company be reimbursed and if I do need to reschedule for the next day should I even bother as my landing time would be significantly delayed. The key figures at the company would not be available and it would be just a waste for all parties involved.

Flight lands at PHL Airport 3:01am and my interview starts at 8:30. My limo driver was a super nice guy who talked about the meaning of service both in his current day job as well as for his daughter. He knows a lot of people who work at the company and speaks very highly of them. In all his time driving people around he says not one of them had anything bad to say about the owner. I appreciate the heads up information, but am also cranky as heck and would’ve preferred to sleep in the Lincoln Town Car instead. Even at over 315k miles, the car rode like a dream.

I get to the hotel, an older man at the front desks asks who I am, gives me a card and tells me about the complimentary breakfast. Come 4:45AM I get to my room, complete with a king-sized bed, free wi-fi and granite countertops. Brush my teeth, set my iPhone Clock Alarm and wake up at 7:00. Recruiter was hopeful I could sleep in a couple hours, but everything stayed on. I iron the extremely wrinkled suit, dress shirt and slacks.

Meet with several executive in the company, they are all very approachable and had several questions about my background. I also asked them questions to get a better understanding of what some of their short and longer term goals were. Two things I did notice right off the bat. Not one minority (as a black man I like to see at least one other person of ‘color’) other than the cleaning people and most of the people there were older. By older I mean what would be my parents age or older. It’s great that a company retains its talent for long periods of time, but it can be a bit intimidating when the gap is soooo huge. The slightly updated 1970s vintage headquarters did not impress me and felt more like a makeshift office than something completed. Our rented office in Dallas looks 10x better than it. I was treated to lunch, then met with a realtor.

The realtor was probably the youngest guy I met, I would put him at early 40s. He showed me a couple different properties in the suburbs as well as they numerous places to go shopping. The only place that really wowed me was on the higher end of our price range. A good 70k more than our current home, though it was complete with modern furnishings, energy efficient and brand-spanking new. The only problem is the place couldn’t be built until October. I would have to use their lender to top it off. Something about the area didn’t click with me. Maybe the lack of a night life, the key highlight of the area being some of the shopping spots like Wal-Mart, WaWa and Pep Boys. I get a thrill from variety and this place didn’t really do it for me. He was kind enough to take me to the Verizon store for a phone charger and allowed me to use his corporate discount.

Kind of awkward timing, but while meeting with the realtor, I get a call from a place I interviewed with weeks before and they made me an offer right back in the Dallas area. The offer was very competitive and more than I ever made before. A few hours later in the day I get another offer from the company I interviewed for. Not horrible but 24% less than my other offer. Two offers in one day, that has never happened to me before. I’m used to going through an entire interview process and not getting any offers.

That night It’s pouring down heavy rain, I walk to the nearby Mexican place to grab some enchiladas, head to bed finally and get a good night’s sleep for once.

Saturday:

I miss the cut-off for breakfast since my limo driver is 15 minutes early. I do fall asleep in the car and before I knew it I was at the airport early. Grab a big breakfast, plane takes off and lands on-time. No issues. Friend picks me up, stop at another friend’s house, grab dog and get to relax for a bit.

One of our two cats has gotten progressively worse. She won’t eat or drink water. At this point I’ve grown concerned. I’ve seen her sick before but never this bad. I thought about the vet, but get very emotional about these kinds of things. I record video of the cat drinking water and show what she looks like. I put food up to her face and she just turned around and wouldn’t eat it. Her regular vet was closed and I really wasn’t sure what to do.

Sunday Night / Monday:

Spend the day cleaning up the house. Cat still isn’t eating or drinking. I get even more nervous. I pick my bf up from the airport at 1am Monday morning. I’m tired at that point but am trying to be supportive so I did it without complaining. He sees the cat and says immediately we need to go to the Animal Hospital. We go to a local place, me riding with her in the back seat. She was meowing a lot, I could tell there was something wrong with her. Temperature is low (~96°F), blood work done and given some subcutaneous fluids to put some nutrients in her body. They give us some appetite boosting medication. We leave the vet around 5 and come home.

I’ll spare the details, but less than 5 hours later next day we lost her. Probably the most emotional day ever of our nearly 3 year relationship. I was powerless to do anything to make him feel better about what happened. I drove to the pet clinic place to pay out final respects. I wonder if I could’ve caught it sooner. I did try to feed her several times even putting her face right on top of the bowl and nothing. Try not to cry when I see pictures of her. Maybe she’s just a cat, but a cat that I’ve bonded with and looks the same as the one I grew up with from around birth to age 7. Below is a picture from almost 2 years ago when we first moved to Texas. I’m really going to miss Odie.

Monday Evening

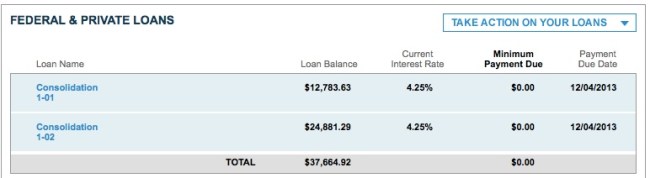

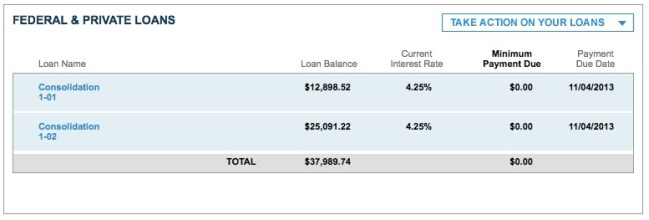

Asked a question about compensation and ended up getting a bump over my original offering. 5% in the door without working I’m down with that. The last 6% I got from my current employer was only after nearly a year on a much smaller base. I’m focused on doing good work and maintaining excellence in everything I do. This development may allow me to actually stay true to my goal of having no more student loan debt by the age of 32. I plan to put $1k a month toward it, max my Roth IRA and do 401k up to the match. Have about $200 in my Roth now and really not sure how to invest it properly. Getting a 50%+ bump in salary, can’t complain even though parts of the job will be new to me. I call it a work in progress once I can figure all this stuff out. ..

TimeValue Software

TimeValue Software