Joe inspired me to write this blog over a year ago. Great to see he’s back on the scene and helping people come up with a game plan to get out of debt. 🙂

Author Archives: Debt Free Alpha

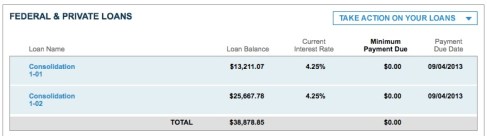

Month 15 Update – 38878.85

Paid nearly a $1000 down in a month. Percentage-wise only about 2.5%, but it’s better than the 452 I typically pay. It’s been a struggle not going to lie. I feel like the debt is the equivalent to modern-day slavery. Instead of a race of people oppressing us by denying what are now considered basic inalienable rights…as long as I have this debt I’m missing out on opportunities to invest and build up my overall net worth.

Still under $39k is progress. I keep the original amount in the name of this blog for the very reason of reminding me how far I’ve come. On the principal amount I had about $1800 of interest last year. It may not sound like a not, but if you’re looking at 5400 worth of payments in a year roughly, the interest at this stage is about a 33% of that. Then with Income-Based Repayment all that interest for the last year got rolled back into the principal amount. So it’s like a vicious never-ending cycle.

Still on track to pay the $600/mo I’ve been paying and more as my budget allows. That still puts me close to 6 years (age 36) before it’s paid off. I’m not going down without a fight on this goal of being out at 32 though. Fight, fight, fight! 😉

Expensive Weekend

Often the moment I have extra cash in the bank comes some unexpected expenses. This weekend was a perfect example of that.

- Took my car into a local dealership I’ve gone to for 2 years for a couple of different jobs. Inspection, oil change, tire rotation, rotor resurfacing (due to longer break times / slight grinding coming to a sudden stop) and emissions system recall. My serpentine belt / drive belt needed replacement. Hasn’t been done since 2010 so I didn’t make a huge deal about it.

Drive Belt: 25.34. Labor 115.00 = 140.34

Rotor resurfacing: 100 per axel x 2: 200.00

Basic Oil Change (Conventional Oil): 34.95

Tire Rotation: 0.00 (they charged me 19.95 for this).

Texas State Inspection for One Year: 40.45.

Total = 455.69

Less 19.95, as they agreed I shouldn’t be charged to rotate my tires since I bought them there.

435.74. At least the car got washed. The experience is even more proof that I need to do things a-la-carte from now on from reputable service shops. The service advisor also said nothing to me about recall work not being done on account of an problem with their CONSULT system after talking with me twice on the phone and in-person. Not very professional if you ask me. I will be trying another dealer closer to me from now on. They also seemed to have an attitude when I asked about charges on the receipt after signing it.

Today I went to Target and spent 155 on various items. An outfit, food for the week so I don’t eat out for breakfast, lunch or dinner, dry and wet cat food, personal hygiene products, etc. I could easily spend $30 a day on food that I feel guilty about eating so I think the money spent was well worth it.

I closed my car door, applied pressure to the brake pedal and pushed the push-button start. No ignition start. Dash lights just flickered a bit. Called a friend to give me a jump. A good samaritan with a CJ-styled Jeep offered to give me a jump but couldn’t figure out to pop the hood open… My friend showed up about 30 seconds later. After 10 minutes I was good to go.

My Duralast Gold battery was originally purchased at Autozone April 2010 after my car wouldn’t start at a friend’s house when I had the heated seats turned on, but the engine off for 30 minutes. So about 27 months on the OEM Nissan battery died on me. Drove 5 min to Autozone today, explained the issue with my battery. They asked me to remove it myself in the excruciating heat and provided me tools. Not a big deal though, as I had to do it before. The DLG is good for 5 years under warranty. The employee at the desk said they could charge it if I waited for an hour. As far as I’m concerned charging isn’t a reliable way to deal with the problem. Last thing I want is to be stranded miles away from home with no one around to assist me, or unable to get anywhere at the worst possible moment. Picturing first day of the job or a late night trip out with friends. This is the third time I’ve been stranded with battery problems and my aftermarket stereo system isn’t helping with the added drain of sub, two amps, higher wattage batteries, etc.

Long story short. about 120 for the battery, less $65 pro-rated credit for the battery, so out of pocket about $85.

Looking at forums, one guy with a 2008 Nissan Altima just like mine managed to rack up 300k without any major problems other than a CVT replacement early on its mileage. I will be tired of my car long before then but it’s nice this thing could last me another 5 years with routine maintenance.

All of these expenses were paid on my debit card, in part due to the life insurance policy I cancelled out and received a cash surrender of $1k for. I used half of it to make an additional $500 student loan payment and the rest stayed in my checking / was eaten up by my car expenses. My 20-year term policy is almost done being setup, had a physical on Friday and the money was pulled from my account.

Emergency fund isn’t where I want it to be but I am doing what I can to accelerate the debt snowball.

Cars cost money to run but hopefully I don’t have to chalk any more money up other than an oil change for the next 12 months. Lastly, happy 4th of July to all my viewers in the states! 🙂

Potential Breakthrough

So this month has been particularly interesting. Interviewed with a company in Pennsylvania that I and my partner both probably won’t be working at. Just because it’s sort of out in the middle of nowhere and some of the neighborhoods there are very poverty-stricken. Also my experience of people in Philadelphia is not particularly positive. Maybe it’s just a bad batch, but they have mostly been impatient, impulsive and almost never accept the answer given to them.

Went on some other interviews with a local company. I applied under different leadership and went through so much disorganized chaos with two now-terminated members of their HR team. At the time I was bitter about it, but a good chunk of time has passed. Basically in wait and see mode. I’m not driven by the money, I want to build up my career and ultimately become more of an expert in my field. I believe this opportunity will be a successful one, but the cards are ultimately out of my hands right now.

My current company is tolerable, though it’s been so repetitive. My manager is around I’d say 25% of the time. He has been receptive to answering questions when I have them and handling issue that require management intervention. One of the guys who started close to 6 months after me and is six years younger than me took a job that pays a good 10-15k more that I earn. I don’t want his job though (direct sales over a telephone primarily aren’t my thing) and think my days there are numbered honestly.

I’m seeing more and more salespeople leave the company. Getting calls from advertisers asking for people who have been gone for weeks. Along with that, talking to salespeople who say I’m the 3rd or 4th person in my position to be handling the account. Maybe I should take it as a sign? Most of the people I work with have little passion for what they do and are looking elsewhere. The floor is run similar to a call center where we work out of a ticketing system and answer a support line so I can’t really blame them.

If I do get this job, the insurance isn’t the best. So am trying to get a Dermatologist appointment lined up beforehand.

On the low end, looking around 50k with bonus potential. A 40% increase not including the overtime I do on occasion. Basically a big part of my job will be turning business around for the company since it is a huge source of revenue for them. If I get the job, it will be putting more of my MBA Managerial Abilities. Particularly my communication skills and ability to manage technology reports.

One of my friends was recently let go from his job. The boss said he didn’t look happy and it was beginning to affect his work. He has been dealing with some vision issues so luckily his insurance kicked in and he got those addressed before getting canned. Without it, he might be blind in one eye or have to undergo some hefty medical bills to preserve his vision. The moral of the story is to not take good health and a minimal debt type of situation for granted.

James Gandolfini passed away recently from a heart attack. I watched The Sopranos, a tv series he made famous almost religiously every week during the early 2000s. He was worth an estimated $70 mil and was arguably one of the top actors of our generation. However it’s likely he neglected his health to a point where it got the better of him at 51. At the end of the day, the money isn’t everything.

On a health front, I’ve been in maintenance mode with my weight. Watching calories along with weights / cardio. Did 10 miles on my bike today. I have some obese friends and I’ve observed that a lot of what they consume is not conducive to weight loss at all. Massive amounts of alcohol, high carbohydrate items such as pasta and desserts loaded with sugar and calories. I’m really putting on my moderation is key hat. Let them do what they want, but my body is my temple. I want to stay on the path of losing 2 pounds per week and their actions are completely out of sync with that mission.

30-Life Crisis

Think I’m having a bit of a mid-life crisis. Looking back on the accomplishments of my life. Where am I now and what have I done over the course of my life. It’s kind of disheartening.

One of the guys I went to undergrad with is meeting with the CEO of a pretty huge networking company in New York City tomorrow.

Update: It was at the #structure conference, I don’t feel so bad now. 😛

He has also been on trips to Europe and across the US. I by comparison don’t have a passport and wouldn’t really be able to comfortably afford a trip to Europe until well after 2 years from now. My bf is also planning to go to a gamer meetup in a few months with a friend in San Francisco. I’m not going because a) I lack the vacation time and b) I simply don’t have $900 in disposable income for airfare / hotel / food.

I’m still scraping to get by on my $35k salary and student loans that still exceeds my annual income.

I cancelled my $50k life insurance policy at the $34 paid every month was starting to weigh on me. It is a whole life policy where it will reach the full face value decades and decades into the future. I do have a policy though my job that I pay for each pay period. In my opinion the money is better spent elsewhere. A 20 year term which Suze Orman recommends is what I plan to go with. Still trying to shop around for the best value. Exploring doing it with the company I have my car and life insurance through.

I’ve dealing with a minor health issue right now as well with my eardrum twitching. I’m not sure if it’s brought about by anxiety, but I have never experienced this for two days in a row and it’s a bit unsettling. I left work early and used sick time to go to the doctor and rest in general. They flushed out my ear and didn’t see anything majorly wrong.

I don’t just want, but I need the next 10 years to be better than the last. I stayed with jobs that were getting me nowhere, wasn’t the best at establishing friendships and let life control me instead of the other way around. I’ve been diligently looking at jobs to apply for but time and time again I read the reviews or see what type of experience is needed and say that isn’t going to work.

These issues have been a barrier to my success for quite some time now. I think I almost need to hypnotize myself into thinking positively and not being a bitter person.

Month 14 Update: 39847.54

My next student loan payment is coming out in 3 days. I estimate my balance will be dropped down to 39825. This is monumental progress to me, since I graduated in 2008 my loan balance has been above the 40k marker.

Starting Tim Ferriss’s 4-Hour Body program. I’ve let myself go the past couple weeks, topping a whopping 222lb on the scales, at 5’9″ height. Frequent visits to McDonalds, Jimmy John’s deliveries to my desk and eating out. During the month of May I spent about $400 on food, most of it for me.

I’m getting impatient with some of of the progress I’ve been making. On both a professional level and a personal one. My company hired 7 recent college grads and I’m pretty sure they aren’t making much less than I am 8 years older, more work experience and the letters MBA. I need to accelerate the process of boosting earnings for my sanity’s sake. Have a preliminary interview with a company in 10 days. I really don’t want to move to Pennsylvania. If the offer is compelling enough though, we’ll see if my opinion is swayed at all. Meanwhile the job market in Dallas is better than most. Florida could be another destination location. Lots of speculation right now though.

Still keeping credit card balances under control, got it up to $252, but all that will be paid off Monday.

Something just a little bit different…

May – What a Month…

Just a forewarning, this post is much more candid than my others, so I hope no one takes offense.

Took time on May 23rd to remember the 9th anniversary of my father’s passing. 2004 -> 2013, a lot has changed and certain things shockingly remain the same. I remember the day vividly, for all the wrong reasons. It was supposed to be a day of celebration, in honor of my company’s 100th anniversary. The weather was finally getting warm, a real treat in New York where a good half the year has cold or rainy weather.

I knew my father had some issues related to his dialysis upon seeing him 2 days earlier, but neither he nor I knew the extent until it was too late. Even the people who lived less than 20ft away in the adjacent room had no idea what was going on. No phone and based on my research, you only have less than 15 seconds to react. So even if I was with him, by the time the paramedics would’ve arrived there’s no guarantee they would be able to revive him.

To this date it upsets me talking about my father. He was smart, yet also limited by his disability and stubbornness. As a kid, his mom died before he finished high school. He worked to help support his siblings and earned a GED. In 1985 he was diagnosed with Alports Disease, which impaired both his hearing and sense of vision. In some ways history has repeated itself.

In the news, there have been stories about antigay hate crimes. Up to 29 so far for the year in NYC. I don’t live in NYC but we’ve both spent nights or weekends there at various times and it’s scary. Mark Carson, a black male in his early 30s was shot and killed because a random crazy guy armed with a gun chose him to be his victim. This was in Greenwich Village of all places, not some random hillbilly town in the country.

Then the massive destruction that came with the tornados in Moore, Oklahoma. An entire city decimated by the worst tornado in 14 years. We had warnings in Dallas, but fortunately nothing too serious on my end.

Two of the three people left my job. One seems happy, the other hates her job and may possibly be coming back. That all assumes she’ll be able to put her pride aside. Dabbling with the idea of moving near Reading, PA. It’s one of the poorest places in the country, the weather isn’t great and it would be boring as hell. Financially worth it from bf’s perspective, but I’d likely not have a job for a while or take a massive pay cut. Also saw a video of a drive-by shooting victim seeking medical attention there on YouTube, never a good sign. Not worth it as far as I’m concerned.

On a more positive note, I bought my mom flowers for her birthday. They were close to $80 (online, including balloon and same day Memorial Day delivery) but delivered the same day and she absolutely loved them. I was debating whether to purchase them since Mother’s Day was just a few weeks ago. I wanted to do something special though, since going out to dinner, etc wasn’t an option.

I did splurge on a new keyboard. My handy-dandy Logitech unit has sticking keys which annoys me each and everytime I type. I’ve put up with it for over 2 years but enough is enough. I ordered a Matias Tactile Pro 4 for $125 plus tax and shipping. I come from a generation of people who type fast as heck on the older mechanical keyboards and this is the best on the market short of buying a $299 Kinesis Advantage.

I could lease a 2014 Mercedes E350 for what I pay monthly in student loans. Some months it feels like a heavier burden than others. This is one of them, with $200 less disposable income than previous months and having to wait till the end of the week for payday.

We had a friend visiting us from NY which meant lots of eating and drinking out. Went to Six Flags Dallas for the first time and my oh my it is one large park. Still not as big as the one in Jersey, but 213 acres ain’t tiny. Also went to a fancy movie theater / bar / dinner spot and ended up spending way than I wanted. Got to see The Hangover 3 and two days later Star Trek… Bought sandals and a hat too. So this month I dropped the ball financially. My credit cards are still under control at least though…

Dealing with Successful People

I’ve encountered or had communications with some highly successful people in the last 15 years.

- Worked for a high profile Internet broadcaster in the late 90s as part of a startup reviewing software which I got to keep but not actually keeping an income. Rights to the name / company were sold for an undisclosed amount off the record (though I believe it to be in excess of $1mil) during the dot.com bubble.

- Friends with an engineer at Google who has been there for 7 years. I’m sure he makes over 100k / year.

- Friends with another engineer at a well-known international company who is an engineer as well making over 100k/yr.

- Worked for a multi-million dollar CEO who presided on the BOD for one of the most well known mobile device companies in the world. Along with him, I worked briefly with the founders of a company that was later purchased by Oracle for an undisclosed amount.

- My bf does pretty well, though he has been in the same industry for over 12 years at this point.

- I’m friends with the CTO of a big nationally recognized company in Houston. He registered a domain name in the 90s and sold it to a pretty popular music company and got $30k for nothing basically. Also online friends with the CEO of that company.

As the saying goes ‘Your 5 Closest Friends Determine Your Income‘. I’m not sure how much truth there is to that statement. The five closest friends I have in NY:

1. Is in IT makes over 100k/yr.

2. Works at McDonalds as a manager making $9/hr.

3. Works at a cable company making high 30s/yr.

4. Runs his own business is making around 60k/yr pretax.

5. Moved far far away to China, then California to run his own business.

So the real question is what do I need to change in my life to get success closer to what they’ve been able to experience. What strategies would help me get there? I’m back to doing the IT training videos after a hiatus / spell of laziness. On module 1.7 – Connectors and have quite a bunch more to go. Reaching goals can be a bitch sometimes… Or is it? It’s 11:45PM my time. Better go to bed so I’m not a zombie in the morning.

Month 13 Update – 40,355.11 and Counting

Back from New York. Had a fun trip, got to see friends and family. Rented a zippy little Mazda 3 hatchback that was getting 50% better fuel economy than my Nissan. Started hypermiling and I went from 21.6mpg to 26.1. Let the bf drive along with me + our friends and it dropped to 24.6. Definitely notice how an extra 900 pounds of the car with A/C at full blast affects handing and acceleration. Makes me wish I got the V6…

Washed my car today. Nice and shiny. It’s kind of silly, when the car involved dirty and filthy I start thinking about selling it to get a new one… Over the weekend I spent some time enjoying the outdoors, both walking trails around a nearby Grapevine lake and doing tailgating for a Jimmy Buffet concert. I didn’t end up attending the concert but that’s another story.

Also did some major cleaning around the house as a friend came by to visit from out of town. Lots of last minute scrambling around, but the work needed to be done anyway.

So the Roth IRA contributions have been set aside. TD Ameritrade doesn’t seem to be processing my automatic withdrawal requests. Maybe something to do my account being dormant for so long. I’m already battling with what I pay now so that might not be a bad thing.

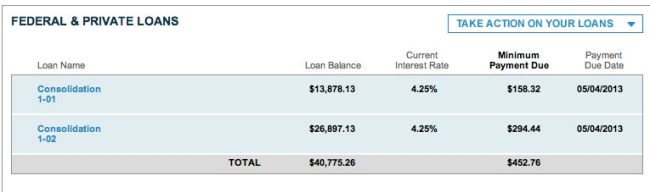

Each month I pay the 452.76 plus an additional 150. The 150 covers interest, the 452.76 goes straight to principal. As my principal goes down, more of that 150 will go toward the principal. Come next payment I will be under 40k, a huge milestone for me.

Indirectly had someone piss me off. Let’s just say someone I interviewed with last year who worked for a part of the company I was interested in working for. This person’s feedback weighted heavily on the hiring manager. Then at the tailgating party they made a rude side comment about me not getting hired. I hate workplace politics and I’m much better off not working there. I’m an INFP and we

I’m really enjoying the great outdoors – Texas style. Thinking about getting a roof rack for my car. I hate to put anything on the car, but it won’t fit inside. Also debating a gym membership at my local planet fitness. They are about 13 minutes away from my house but I wouldn’t have to pay a toll to get there. It’s the least expensive gym in our area, ranging between $10 and $20 per month and has the highest reviews. One big constant I see people saying is that it’s rarely super busy and always clean.

Here are some pictures from my excursions.

The road bike continues serving me well. $185 and so far about 30 miles on it. I get a thrill going downhill at 24mph.

My feelings are mixed on American Airlines. The MD-80 I took flying in was nice inside but I would’ve preferred a 737. I arrived at the airport early from LGA to DFA and they bumped up my flight 2 hours with no extra charge. With the sequester in place my flight would’ve been delayed a half hr or more. A friend went to Hawaii from Dallas non-stop and they wouldn’t even provide any type of snacks. Not to mention the horror stories of people sitting on runways for hours..

I constantly make reference to my personality type, INFP in this blog. The reason is simple, it defines such a huge part of me.

“INFPs do not want just any job or career. They want to do something they love, something they are passionate about. They want to use their creative gifts and abilities in ways that bring personal fulfillment and contribute to the greater good. The quest for a suitable career choice cannot be divorced from INFPs’ search for identity. Before settling on a career path, INFPs want to know who they are and where they fit into the fabric of the working world. They want a career that capitalizes on their unique abilities, coincides with their values, and ignites their drives and passions. Because most jobs fail to consistently inspire them, INFPs often end up feeling restless and dissatisfied. Even those with a college degree may struggle to find long-term career satisfaction.”

This is part of why I haven’t jumped at the first job posting that was going to offer me more money. I don’t want to work with a company that overworks its employees, lacks work/life balance, would involve a massive amount of travel or is just boring. Does that make me picky? Perhaps. I just have worked enough dead-end jobs over the years I never want to experience that for as long as I can help it.. I’m feeling chatty, so expect another post soon.

It’s Been a Freakin’ Year of Blogging

The Year In Review

April 7, 2012

I reached a breaking point in my life where I was no longer willing to live in a state of denial with my student loans. Looking back on it all, it doesn’t really feel like I’ve been hard at this for a year.

Back then, my debt load was a whopping 45159.35.

41,971.74 to Sallie Mae

3235.31 in Credit Card Debt.

Today April 8, 2013 I have $332 of credit card debt and that’s by choice. Looking at the abysmal return of using my debit card for every transaction (1% interest after 10 transactions in my checking account), I can have enough small transactions to continue earning that but on my larger purchases I can earn money through Citibank’s Thank You rewards program. Still the idea is to use credit sparingly and I’ve done a pretty good job of that.

As for student loans, I recently broke a significant financial hurdle. Down to 40,775.26. So at a quick glance I knocked $4384 off my debt on an adjusted gross income of just under $30k. So roughly 15% of what I earned for the year went to paying down the debt. On top of the $1500 down payment toward our home purchase (most of it got reimbursed as part of ourrelocation package).

The older I get, the faster time seems to fly. 8 years ago I bought my first new-ish car, a 2003 Nissan Maxima. It was powerful, way classier than my Oldsmobile and also a bit of a money pit. I spent a big chunk of cash on 60k maintenance, tune-ups, getting brakes redone and the like. If I didn’t think the transmission would be going soon on it I might have kept it longer. The car I replaced it with also a Nissan has been fairly problem free in the next 5 years I’ve owned it.

Wouldn’t have thought in 2009 that I’d be living with a guy, much less all the way out in Texas. Definitely not my old stomping grounds on Long Island, but that isn’t entirely a bad thing. The people here are nice, overall it is a safer place to live, cost of living is half of what it was up north.

Today after much deliberation I decided to purchase a road bike. A 42cm frame, steel Takara Kabuto. The price was $199 plus taxes so about $215 total cost. I had looked at Craigslist and several retailers that weren’t Amazon and didn’t like what I found. Either too old, required too much maintenance or too expensive. The last thing I want is to purchase someone else’s headache. I’m typically a mountain bike guy but road bikes are better for distance and I’d like to do a little bit of sight seeing in Dallas. 🙂

The real reason for the bike purchase is related to health though. Back in 2005 I would ride my bike several times a week and was about 35 pounds lighter than I am today. If I can get closer to that 185lb ideal vs 220, the cost is worth it.