Originally started writing this last night then fell asleep. So here’s to a Round 2. My partner is in the windy city right now for work and I’m sitting in cozy 87° Dallas. I’ve never experienced this in March and enjoy the warm weather. It makes me feel more active than I would be otherwise.

Have had a lot on my mind lately. What I’ve learned is change doesn’t happen overnight. It takes discipline and in many scenarios staying the course. Also knowing when to take a different course when the time is right. Still figuring out the 2nd part of that process.

Three people at my job put in their two weeks notice. One a manager, one at my level and a third in between. They’ve all been there longer than I. I’m really curious to see where they’re going off to. Is the grass really greener on the other side?

I check my credit annually and was very surprised to see my credit score is a 798. All the years of my mom’s worrisome mentality of being able to pay the bills on time and my grandmother’s use of the expression borrowing from Peter to pay Paul has rubbed off on time. It also helps that I’ve had people looking out for my best interests for quite a few years now. I’d love for it to be 800+ next year. I’m right on the cusp.

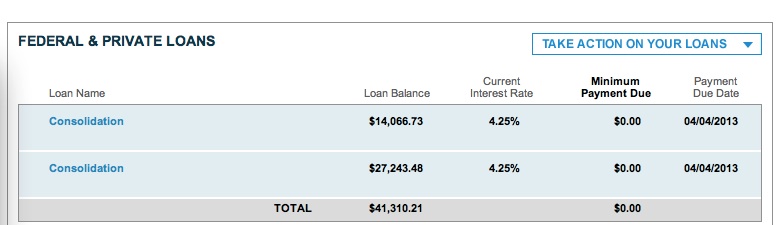

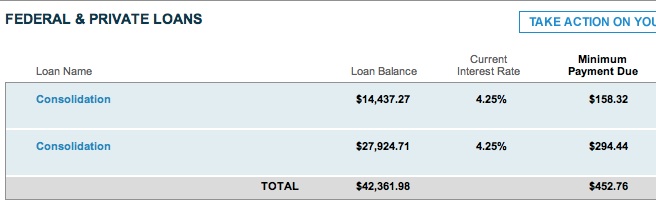

Student loan will be under 41k soon and that’s something to celebrate. I can’t believe I’ve almost been at this a year and will have only knocked down about 10% total of what I owed. When you’re young you don’t realize where all the money goes. Think you can live under your parents roof forever or they will help you out if you’re on your own. Then reality hopefully sets in. I earned about 30k for the last year but I honestly couldn’t tell you on what I bought. I earn 300/mo more now than I did in New York though household expenses and actually paying down my loan eat up a chunk of that.

Using my credit card again, earning my Thank You points. The 1% cash back through using my debit card really wasn’t earning me much over the course of a year. Still spending very little overall though. I ordered a set of airline tickets to New York next month. I paid half, bf paid the rest 390 round trip through American Airlines. It will be nice to see my family and friends a lot less rushed than last Fall.

Once I hit 5000 in savings, I still plan to use a majority of my income above to accelerate my debt payoff efforts. One of the biggest challenges thus far is getting to that point…