Quick little video to see where I think I’ll end up for 2022.

Author Archives: Debt Free Alpha

January 2022 Net Worth Update – ¡$196k!

Keeping the renewed sense of optimism people have with a new year starting on this post. If you want to look Month-Over-Month I’m up $10,234 or 5.5%. Year-Over-Year I’m up $72k or 58%. I legitimately don’t think I could save much more and still have what I’d consider to be a comfortable lifestyle. Still it beats having a ton of debt and wondering how it’s all going to get paid. $200k by March I think is totally reasonable.

12/31/2021

401K $166,509

Roth IRA $21,328

M1 Acct $4,533

Crypto $2,070

Buffer Fund: $250.16

HSA: $1,500

Total: $196.187

11/30/2021

401K $157,149.28

Roth IRA $20,169.99

M1 Acct $4,019.33

Crypto $2,516.34

Buffer Fund: $625.00

HSA: $1,472.80

Total: $185,953

12/31/2020

401K $110,076

Roth IRA $7,389

M1 Acct $1,304

Crypto $0

Buffer Fund: $5,000

HSA: $507

Total: $124,276

I was thankful to receive a monetary gift from my parents. It helped me be a little less stressed while waiting for my next paycheck to be direct deposited into my account. I ended up splurging on a Ridge wallet to replace my bulky wallet that has like 13 different cards in it. Really digging the minimalist look.

If I could earn an extra $20k a year I think that would be the sweet spot for me. I’d feel much more abundance, being able to upgrade my lifestyle a bit. Right now I’m still on track but the process feels slower than it should be. Maybe with the new year I should change up some things in my life. Everyday is an opportunity to learn something new, or try something and fail. No reason to overanalyze and never give anything a try. I might fight tooth and nail but also mindful I’m not that far from my 40s and I’m never going to be this young again.

Sharing a few pics from my recent “adventures”.

I like to focus on my energy, cutting back more on Facebook and Instagram which have proven to be fairly easy. The dating apps are a little more challenging. Swiping, chatting, trading pictures. I got my first catfish of 2022. Red flags – Sounding too eager to find the love of his life. Wanting to chat on Google chat vs the platform he messaged me on. Having a story about the family being in the army and the UN. I asked him for a pic with a thumbs up. He responded ok one minute, then blocked me on the app we chatted on originally. Aside from that I’m trying to be a supportive son since my mom has Covid with moderate symptoms and we think my stepdad has it too. Glad they agreed to get vaccinated after many heated discussions. Oh and my dad would’ve turned 65 today, been 18 birthdays with him gone. You never fully forget the past, you take a deep breath and just keep on going despite it. Take care.

YouTube – 2021 Year End Recap

Going in a little bit of reverse order here, but posted the YouTube video first. Happy New Year 2022! Much Love!

December 2021 Net Worth Update – Still $185k

Knock knock knock… Who’s there? December? December who

So I splurged a little bit this month and ran up some credit card debt. I needed some new shoes, new jeans, dog food, a $36 Christmas tree, and some miscellaneous items. Two new pairs of higher quality shoes that work with my foot pronation were close to $170. A lot of DoorDash deliveries, a sushi date, cell phone payment & plan, electricity, sports team membership, gas, Netflix, iCloud, it all adds up… I have close to $1k in credit card debt racked up that will covered when I get paid tomorrow. The computer I paid off in *full* mid November.

A big chunk of my portfolio is in the stock market and lately that has been taking a beating. Yesterday the market was down about 1.18%. So as much as it pains me to say this my net worth is actually down a few hundred dollars since last month.

11/30/2021

401K $157,149.28

Roth IRA $20,169.99

M1 Acct $4,019.33

Crypto $2,516.34

Buffer Fund: $625.00

HSA: $1,472.80

Total: $185,953

10/24/21

401K $157,626.00

Roth IRA $20,720.83

M1 Acct $3,692.75

Crypto $2,372.39

Buffer Fund $379.18

HSA $1,426.62

Total $186,217.77

I started going down the rabbit hole of what all my options are. The best option I decided is to do nothing for now. Even today 12/2 as I type this the market was up around 1.5%. That elusive $200k number is still attainable… in 2022. I find myself getting impatient with this process, having started working 22 years ago and potentially working a total of 40+. Not saying that to ask for pity but damn this process takes a long time!

I was doing a little bit of research at the prices of what I consider starter townhomes. One that is essentially the equivalent of where I used to live is going for about $315,000. In 2013 it listed for $113k…Pardon my language but that’s fucking insane. Definitely a big deterrent for single income potential first time homebuyers like myself. At this rate by the time I have enough saved for a downpayment without PMI prices will be up another 30% or pushing $400k. That would be $82k down for a place built almost 50 years ago. Then monthly payments of let’s say $1300+ for the next 30 years.

I did hear something called the 5% rule today. Basically take what you’re paying in rent per year, I’ll round it up to $1000, divide that by 5% and then the number ($240k) is the most a home can be valued at before renting is more worth it financially. I looked at what’s available for $240k or less and I might have nightmares.

Really thinking about what will make me the happiest over the coming years as 40s are just around the corner. Losing weight is the first one. I want to do a pound a week. Going on walks again, doing intermittent fasting, taking exogenous ketones, lifting weights when the gym isn’t crowded. Avoiding certain foods altogether. The second is picking up some new skills. The 3rd is upgrading my overall quality of life. That could include where I live but also what I wear, what I drive, where I live, what I eat. Crunching the numbers on every decision I make is both a blessing and a curse.

Well I’m not going to therapy, I am finding things that benefit me from a day-to-day standpoint. Environment is such a big part of mental health either up or down. That also means switching things up every once in a while. It’s good to have a grasp of who you are and what brings you joy. It doesn’t happen overnight. What is considered “normal” tends to make us unfulfilled. The grass isn’t always greener either. I was chatting with a guy recently in general conversation. He’s white, >6′, nice build, beard. I’m not a 4 ft tall morbidly obese troll but the dude definitely has natural traits that you’d think would make him more attractive in the market. He was telling me he still hasn’t had luck in the dating scene.

I put up a Christmas tree in my apartment for the first time. I could come up with every excuse in the book on why I shouldn’t put one up. I just decided to roll with it and was happy with the outcome. Sometimes it’s just the simple things that make life better.

Well I do not see my family New York on Thanksgiving, I did enjoy a friends giving instead. I made a rather simple recipe for roasted brussel sprouts And everyone loved it. Definitely made me feel good about my cooking abilities. Not to mention who wants to be completely alone on a holiday? I sure as hell don’t. 🙂

So despite questioning some of my most recent investment choices, things have been going well on the whole. I’m running on 4 hours and 50 minutes of sleep, so I do feel like a bit of a zombie right now.I want to think bigger and start planting seeds that will lead to a very bright and prosperous future. I don’t know what will make me happy though. Will having the energy to do all the things I want to do help? Probably. Would more activity partners help? Sure. Part of why I joined two sports teams again starting next month. Gotta keep putting myself out there no matter what.

I just did all the math. Between taxes, insurance, 401k, Roth IRA, HSA, taxable investment account… That’s about $45k has out of my pocket for the year. Not even including rent, cell phone, cell phone plan, utilities, vet bills / dog food, car insurance, fuel, car maintenance, travelling, groceries. Combined thinking all those would roll up to another $15k. So $60k for the year and I’m not living in the lap luxury. I’m tired and think I need to celebrate or take a break soon. At least tomorrow is a half day at work. Thanks for reading my lengthy whinefest. Calling the whambulance now.

Two new YouTube Videos posted!

My last video got 1 view so click through the link to go to youtube.com. Still not sure if anyone is watching my content after 56 videos but that’s okay. Happy Halloween!

November 2021 Net Worth Update – $186k

These are the roaring 20s, 2020s. I’m not even sure where to even begin.

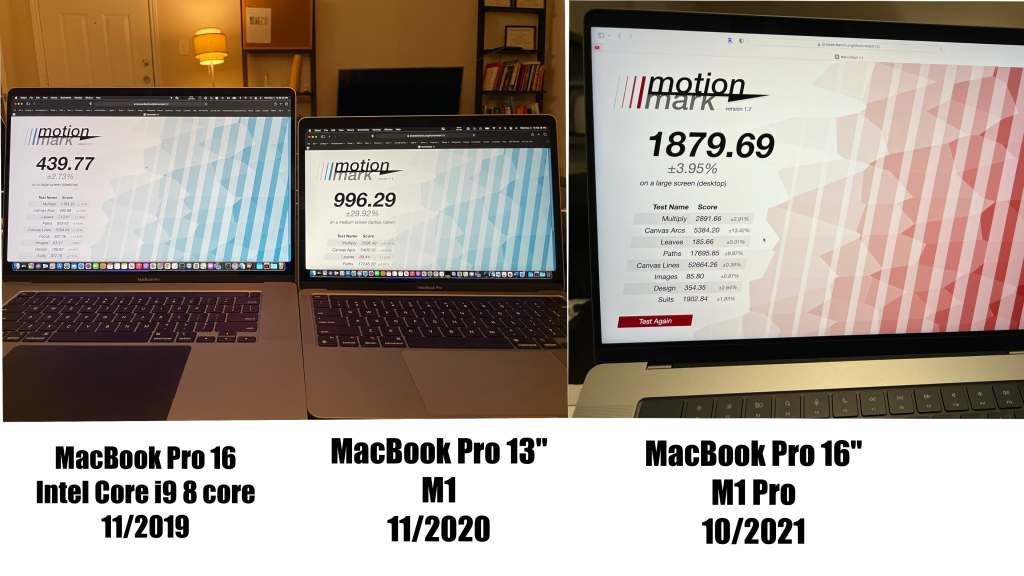

- After owning a 13 inch MacBook Pro M1 the past year, I decided to buy one of the 16″ 2021 models because of features that I would definitely use over the course of the next year. Originally I had ordered the higher price model which is $3,199 not including taxes, but in full transparency that was a bit of sticker shock for me. For the most part I don’t spend anything above $2500 for my computers which typically last me 1 to 2 years and then get traded in for roughly half the value. The way tech is advancing these days, that high end model from 1-2 years ago is now surpassed by a system half the price. My older system commanded me a trade in value of $900, so the splurge and spending additional $700 on the higher end model kind of seem like a bit of reckless spending. I also don’t use this system to make a living. Why did I buy one?

- The processor is significantly faster, it has over double the memory bandwidth, double the performance cores, and literally twice the number of graphic cores at 16 vs 8. Certain legacy games I had would choke on the older system.

- The screen is 16.2 inches versus 13.3 inches and it’s a mini LED display versus a more standard LCD. In the real world with that means is I can keep more windows open on one screen at a time, everything is a bit more legible to me since it’s brighter, and overall my eyes are less fatigued after looking at the screen for hours on end. When I bought the previous system I had a 16 inch model that I had traded in due to a number of issues including the system having a loud fan and overheating.

- The SSD on the system is also significantly faster meaning everything is snappier from opening to copying, or if the system has to read/write to swap memory.

- Ports. The previous system only had two USB4 Ports, one of which was used to supply power.A s a result, I often was unplugging one device and plugging in another device, I wasn’t able to plug in my tablet as a secondary screen and do a time machine back up, or connect to a device like my SD card reader or my USB microphone, or even just plug my phone into my computer to do a back up or to supply power.

- Built in SD card reader. This one is definitely more of a want versus a need but it’s nice to be able to just slide the card into the computer versus looking for the USB reader and plugging that in.

Cost = $2499 + $9 expedicted shipping + $206.91 tax = $2,714.91. Less $900 + Tax = $974.25. I also signed up for the Apple Card which offers me 3% cashback on all Apple purchases at a 0% interest rate. So that’s an additional $84.15 to take off. So $1,058.40 off the initial price leaves me with a cool or not so cool $1,656.51 out of pocket to pay. First payment is due November 30 and I can cashflow that in the next 45 days so not considering it part of my debt.

- Roth IRA – I made a large contribution into the Roth IRA to max it out for 2021. It was $3,636 which to me was a significant amount of money, but I’m thinking in terms of the long-term growth of those dollars and how me at age 50 will appreciate the diligence turn my younger years. Pulled from my emergency fund account which with the high levels of inflation recently has been losing value in terms of purchasing power.

- Crypto – In September I bought $1070 worth of Solana, October I purchased some Shiba Inu – $35, as well as Ethereum – $125, and Bitcoin for $371. I pulled most of the dollars out of my emergency fund to cover these purchases as well. The signals and my gut instinct were telling me to buy and stop sitting on the sidelines. So that’s exactly what I did. I do plan on building that account back up again soon. However these gains are freaking rediculous. No more than 5% of my portfolio will I invest in these speculative investments.

- 401k – Basically I’m staying the course with the 401(k), with my recent raise it looks like I may end up reaching my contribution limit for 2021 a little bit earlier than planned. Between my contributions the the market being up, I’m up about $10k since my last net worth update.

- Guilt – I have a little bit of guilt with where I’m at right now versus where I see others in my circles or my distant family.The stories range the gamut, I know one person who is currently on disability and literally at or below the poverty line. I partially blame his ex partner who because of his reckless behavior lead my friend to health issues that eventually contributed to his depression. With family I know a few people who are either long-term unemployed or recently unemployed. One of my old neighbors developed kidney failure and is also on disability and unable to work. Then I know a few others still in the service industry. The pandemic has turned everything upside down for them, and in some cases they are still expected to help their parents make ends meet. Then just older people in general who don’t have enough saved in retirement and have to deal with a toxic workplace.

At my current contribution levels and an 8% rate of return by the time I’m 50 my net worth will be $1,056,000. By the time I’m 60 assuming the other same inputs it will be $2.78MM. If I were to literally 100% stop investing today I’d have $479k. The older I get the more I just see money as a tool and a way to be free. Shiny new things are nice but they also can trap you if you’re not smart about it. I’m literally tired a lot these days wondering how in the hell people work until their 60s. Then again I work from home and live alone.

I was watching a video from Matt D’Avela about Why your life feels like it’s flying by. Basically he hit the nail on the head, almost every single thing I do week in week out is part of a routine. Wanting to change that for the sake of having more variety in life feels foolish in a way. Yet I am human and keeping things status quo for a decade seems sort of like a prison sentence. Between dating, career, health,

10/29/2021: 401K: $157,340 Roth IRA: $20,721 M1 Acct: $3,693 Crypto: $2,372 Buffer Fund: $379 HSA: $1,427 Total: $185,932

10/1/21: 401K: 147,601 Roth IRA: $15,921 M1 Accoun: $3,133 Crypto: $1,433 Buffer Fund: $4,314 HSA: $1,758 Total: $174,160

+$11,772 Month-Over-Month or +6.76%. The HSA total is down because I had to get an annual physical and do some lab work. Also had some other health issues I’ve been working through but still have been a major inconvenience. Two years ago I had a net worth of $54,681 so more than 3x improvment since then

Don’t let me outlook come across as me being all doom and gloom, there have been some good things happening in October too. I got dressed up as Maverick for a Halloween party last week.

Ferris Wheel – Texas Fair Park

Close to bedtime. I may post a video this weekend if I feel up to it. Take care! ❤

Youtube Video – Now vs 2021 Projections – How Am I Doing?

YouTube – Navient Exiting The Student Loan Business

October 2021 Net Worth Update – $174k

I’m about a day late on this one so apologies! Working to get better at getting things off my chest more….

Recently a young guy in Oaklawn was shot and killed while just a 2 minute walk from one of the bars I frequent regularly. Whenever incidents like this happen I think about how it could’ve been me. As a general rule between being old and concerned for my safety I try not to stay out too late. I feel sorry for the young man and his loved ones. No one deserves that. Apparently the person who did it was asking for money. I still refuse to live in a bubble and feel like a prisoner.

Dude I went on two dates with since August has essentially ghosted me. I had a romantic date and dropped about $100 for the both of us. He literally never initiates conversation with me via text. I tried to give him space and ask him how the process of moving was going… Still crickets afer 10 days. He also showed up to our first date almost 15 minutes late.

Then someone else I was interested in and met a few times took 5 weeks and 4 days to respond to one of my texts. Never answering me about his relationship status. Then taking 5 days to respond to one of my texts back. I’m taking that as a sign he is dating someone and just talking to me on the DL.

There are some other stories I left out intentionally. That said I think I’m giving up on dating for a while. Even when I don’t get too emotionally invested I end up wasting my energy. Ironically when I’m interested the least that’s when the most prospects start communicating with me.. hahaha

I may possibly be getting some type of merit increase in the next few weeks. I’m stoked about that but think I will be left underwhelmed since I’m on the lower quartile for my position and # of years experience. It’s unlikely my salary will be reset based on market rates…. Oh and this little thing called inflation…. Still some money is better than none.

I bought crypto literally right before the crash. Dropped $1,050 and slowly building up the emergency fund again back to where I was. I was tempted to invest more but figured I’d err on the side of caution. The S&P 500 is down 3.6% from where it was a month ago. The market is volatile but for now I will keep dollar cost averaging into low cost funds. Still a 1.4% dip Month-Over-Month isn’t the end of the world.

10/1/21:

401K: 147,601

Roth IRA: $15,921

M1 Accoun: $3,133

Crypto: $1,433

Buffer Fund: $4,314

HSA: $1,758

Total Investments: $174,160

8/28/21

401K: $150,508

Roth IRA: $15,937

M1 Acct: $2,810

Crypto: $659

Buffer Fund: $5,015

HSA $1,768

Total Investments: $176,696

Age 65 retirement looks less and less appealing by the day. Who wants to slave away for another 27 years and hope you’re in good enough shape to enjoy it. Not me! I’m more and more aware of that as my parents approach retirement age. Yesterday my grandmother would’ve turned 82, it’s hard to believe it’s been over 22 years since she’s been gone. I still miss her.

Took a few pictures over the last month to kind of capture some of the highlights. Pumpkins, my car after a wash, and Oktoberfest. The food was amazing!

Also got a physical recently. Overall my numbers aren’t horrible but not ideal either. Vitamin D deficiency and cholesterol are the main things. I honestly am looking to drop about 50 pounds, then possibly looking at a bit of a life makeover. Intermittent fasting and keto have really been helping me in that regard. I hit a peak of 259 pounds mid August right before travelling. I’m about 250 now, was steadily a pound a day for a few days then gained 5 pounds back in 2 days and now back to dropping again. Not eating or drinking away my feelings can be challenging at times but I’m worth it.

Also on a positive note after 6 months of having to breathe in smoke from my neighbors I decided to speak up and wrote a friendly letter to the apartment management. The issue is now 90% better and I rejoice in being able to not inhale their second hand smoke.

Hope you guys / gals are well. I feel like I type to myself sometimes on this blog but it holds me accountable at least.