This is not a money related post. It’s a way of getting my thoughts out regarding a situation that could have potentially been life threating to me and two friends of mine.

This afternoon at 1:30 two of my friends and I were supposed to go see a movie at the AMC movie theater in North Park Mall in Dallas. I have been to the mall several times before and think of it fondly. I saw people of all ethnicities there both workers and shoppers. The area is considered affluent and far from being a crime hotspot. I was planning to get there 15 minutes early but both due to weather, getting ready last minute and other factors I got there about 1:26. A woman in her 30s pulled up about the same time as me and we both proceeded to the entrance at the same time.

A friend sent me this at 1:22PM, indicating where I was supposed to meet him. Right next to the Nordstrom building.

Great, I have a landmark to reference. I crossed the parking lot and proceeded to head to the door. I literally was less than 20 feet away and I hear sirens. My first thought…. Is it a fire alarm? Perhaps some unruly teenagers were bored. Wait a couple minutes and it will all be over. The people in front of my ignored the alarm and proceeded to walk in anyway. The woman in the Porsche Cayenne paused and waited outside with me. We both were processing.

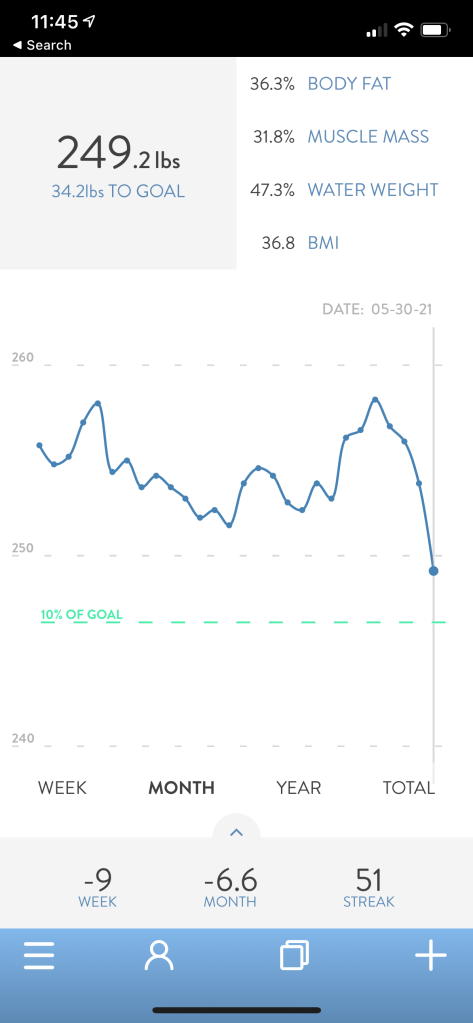

Not even 15 seconds later we see people exiting the doors. Except the pace was not leisurely, they were running. Mothers, fathers, children. Someone shouted there’s a shooter in there. I started running with them, adrenaline kicking in… I had my sneakers on. Genetically I’m a sprinter and not a long distance runner. Except I’m 5’9 and 250 pounds. It’s just across two parking lots. I got this.

For context-I hear stories in the news about mass shootings at least weekly in America. It’s seemingly unavoidable. I’m a minority. Going back 100 years to Tulsa and how a group didn’t want to see Black Wallstreet succeed. A former classmate from my high school was stabbed and killed in New York City. Downtown Dallas 2016 had a mass shooting where 5 officers were killed. On the same street as my apartment two people were shot and killed in separate incidents. In my 20s I feared going to the wrong neighborhood at night because of the gangs. Then the stories of Pulse night club. I tried to block all that from memory but was unsuccessful..

Was this yet another unfortunately footnote in the decline of American society? Would they target me because I’m black? What about my two friends who I’m supposed to meet at this very moment? One is stuck on the 2nd floor and live streaming to facebook to let everyone know he’s okay. The other one was literally parking and I text him don’t go in. I try to call but the call wouldn’t connect. Was he okay? He is new to the area and it’s his first time at the mall. My mind starts racing… I send pictures of where I am to my friends and they both respond. Okay they’re fine.

My other friend drives an early 2000s Acura with a shit ton of miles. It overheats for any trips over 30 minutes, almost blew up on the cross country trip. He’s trying to get out of the parking garage but it’s a standstill. On a good day it would take all of 2 minutes. This time it was over 30 minutes. Eventually we were able to rendezvous and sort out everything that was going on. I had a moment of PTSD but had to quickly take a breath to assess the situation and try to move on from there.

Later on we found out it was a mentally disturbed man banging a skateboard and pretending he had a gun. What if it wasn’t though? I’m only 37 with so many years ahead of me god willing. I don’t want to get shot. Some people were trampled by the crowd requiring hospitalization.

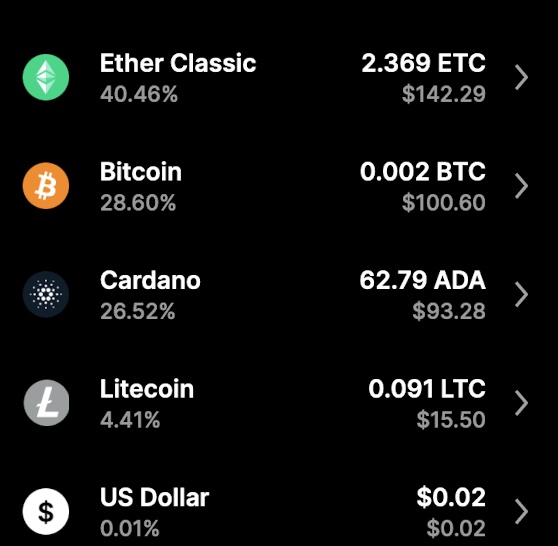

I hadn’t done any travelling over the Memorial Day weekend and we didn’t get to see the movie we planned. Rain check… We instead had some friendly banter at a nearby restaurant in Park Lane. I didn’t drink and got a salad. Trying to keep up with my weight loss. If that didn’t drive me over the edge I think I’m doing pretty well. Down about 9 pounds from my all-time high where I felt like literally nothing I did worked. My addiction to food was ultimately the culprit. I still find myself lacking control around certain sugary delights. It’s in a box and I have money. I can grab this box, eat 1000 more calories than I should and feel short term pleasure. Rinse repeat. Only up 9 pounds now since Covid started.

I went on a 26 mile bike ride yesterday and feeling pretty good about that considering I hadn’t pushed myself that long in 259 days! Also want more color variety in my bike gear. The GCN Jerseys look pretty rad. Those Brits take cycling seriously. I do need to upload a new video to my other YouTube channel, but the last 2 got 0 views so.. My biggest takeaway is to get to the point. I have about a 20 minute video of my going on and on about random stuff. Decided not to upload since it put me to sleep…

Nothing in life is guaranteed. Try to be smart but also enjoy life. You never know what day might be your last. Living in a bubble all the time is not really living. It’s a big country and a big world out there. This day will never come again. Looking back the times when I said yes to life more I ended up having a blast and making more meaningful connections with people. Game on!

Also http://www.nomoreharvarddebt.com is down possibly permanently. His blog inspired my back when I launched this one in 2012. Joe hasn’t updated in about 5 years, was hoping for a several years later update. Still maybe that’s for the better though. Thanks for reading. Hope you all are doing well.