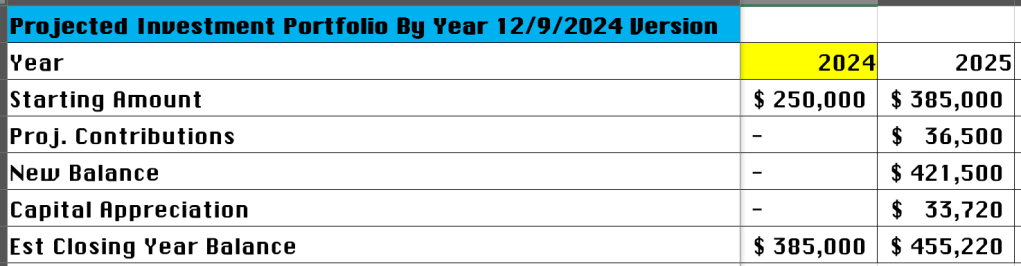

I did a bit of napkin math recently and discovered that outside of my house savings, retirement, rent, HSA, insurance and taxes I’m only living on about 25% of my gross income. That to me is a big sacrifice. On top of everything I’ve been doing the last couple years to get that retirement balance up.

Someone I have been watching videos from on YouTube for years recently lost her government job as a software tester and is now exploring options at temporarily leaving the United States. Matt D’Avella on YouTube also posted a video about why he was leaving the US due to healthcare costs and not really feeling a sense of community. I get that but also think there is a certain level of priviledge associated with it. When the average person can’t afford a $500 emergency, having resources to leave and be able to sustain one’s self is sort of a luxury. Also specific to Europe I’ve read that a lot of England residents are on public assistance. ~23% of pop vs 12.6 in the US.

Home – I see some of the prices beginning to drop. One home I liked went under contract with a contingent offer right after the price dropped around $25k. I felt like a missed out on a huge opportunity but to me even almost $300k is more than I want to spend. If it comes down another $25k that would seriously get me thinking about speeding up my timeline. $2,000/mo is what I’ve been setting aside the last few months and it’s rough doing that while also paying $1300/mo for rent. $3,300 and around $2500/mo going to retirement accounts. Some days I feel like I’m going to break from this short timeline. I easily could blow the money on something but that would be reckless for my future self.

One home in particular I adore the kitchen, but the driveway needs work as it has about 13 different cracks in it. It’s also a townhome with shared walls / roof and an HOA.

Another home is about $30k more or $330k but has so much natural lighting unlike my dark dingy 700 sq ft apartment. It’s a 4 bedroom 2 bathroom home and about 1300 sq ft. The kitchen is huge and the yard is nice too.

For a mere $20k more you can get a 4br/2ba that’s ~2000/sq ft but the interior needs a bit of work and things like the bathroom / kitchen cabnets need work. Some of the flooring looks a bit dated too. My bf and I drove to a few of the units I had looked at online. One was on the same block I lived just over a decade ago. The roads were halfway dug up and the city is putting in a new sewer system which was quite the eyesore. As happy as I was to be moving into a house back then as I’m older I think of how close some of the homes were to one another.

There was another home in the same community but a few blocks over without the road tore up that I liked. It has been on the market over 4 months though and was modernized quite a bit. I liked that it was 1900 sq feet, didn’t share a roof or wall with another building. Didn’t like that the wood covering the floor of the patio area was certainly in need of replacement due to how it it was designed. Or the slightly muddy backyard area but it did recently rain so that’s completely understandable. There is also no fence, instead just some bushes between the yard and the sidewalk which is right on a main road.

Why am I not taking action right now? I have about $17k in cash not $70k for a down payment which is considered ideal. That’s a huge gap. There was just a price cut of $6k roughly 2 weeks ago. It’s one of the more expensive units in the complex so I expect it to drop more. Based on my current forecast I’ll be at $41k in cash by the end of July. That’s enough for 20% on a $205k home which doesn’t exist at the moment. I still find myself thinking they want how much? For that? And at that interest rate? I know it makes me sound like a Boomer but if the math ain’t mathing I’m not going to just settle or be house poor.

There are a total of 3 people I know who live locally and are out of work. One was laid off around the holidays, another was laid off about a month ago, and a 3rd quit his job out of frustration. A once friend now acquaintance who owed my money posted recently a GoFundMe to get work done on his car. It’s been 20 years and the equvalent of about $730 in today’s dollars, don’t think I’ll ever see that money back.

| April 2025 | 3/28/2025 | 3/2/2025 | Difference | % Change | 3/31/2024 | YoY Diff | % Change |

| 401K | $ 303,119 | $ 320,732 | $ (17,613) | -5.5% | $ 257,260 | $ 45,859 | 17.8% |

| Roth IRA | $ 49,814 | $ 52,922 | $ (3,108) | -5.9% | $ 39,020 | $ 10,794 | 27.7% |

| Brokerage Accts | $ 2,494 | $ 2,321 | $ 173 | 7.5% | $ 2,367 | $ 127 | 5.4% |

| Cash | $ 17,209 | $ 14,303 | $ 2,906 | 20.3% | $ 3,392 | $ 13,817 | 407.4% |

| HSA | $ 3,415 | $ 3,537 | $ (122) | -3.4% | $ 2,693 | $ 722 | 26.8% |

| Total | $ 376,050 | $ 393,814 | $ (17,764) | -4.5% | $ 304,731 | $ 71,319 | 23.4% |

| Credit Cards | $ 93 | $ – | $ 93 | #DIV/0! | $ 65 | $ 28 | 42.9% |

| Auto Loan | $ – | $ – | $ – | #DIV/0! | $ 13,587 | $ (13,587) | -100.0% |

| Net Total | $ 375,957 | $ 393,814 | $ (17,857) | -4.5% | $ 291,079 | $ 84,878 | 29.2% |

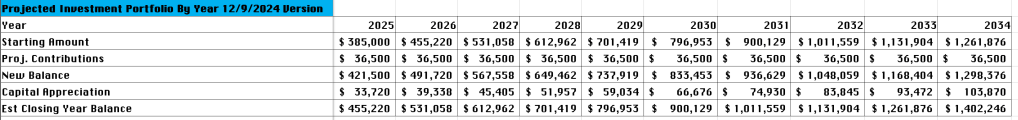

With all the volatility happening in the American economy it should come as no surprise that my net worth is down for the month. $17k to be exact. My cash is up close to 20% from last month though. I have thoughts on what’s happening but you’ve probably seen it a lot already before. I’m still up $85k to a year ago or +29% and am continuing to dollar cost average. My cash stockpile continues to grow to the highest levels they’ve ever been which I’m extremely thankful for. Most of my investing is on autopilot these days, trying to be an active investor in this market is risky and speculative.

March was a fun month, saw a Titanic exhibit, camping in Llano/Brownwood/Fredricksberg TX, saw Enchanted Rock, LBJ museum, some cool little shops. Replaced a dirty air filter in my car in 2 minutes flat. Finished up a season or cornhole and made it to the playoffs.

Here’s to April, hoping it doesn’t rain too much and I can enjoy the outdoors. It’s past my bedtime. Hope you are all healthy, employed, and not stressing about money. Having zero in student loans, credit card debt, no personal or business loans, and low overhead is a blessing.