99°, it’s sweltering hot outside. I don’t feel guilty about not going outside for some exercise. 15 minutes of walking results in being drenched with sweat….

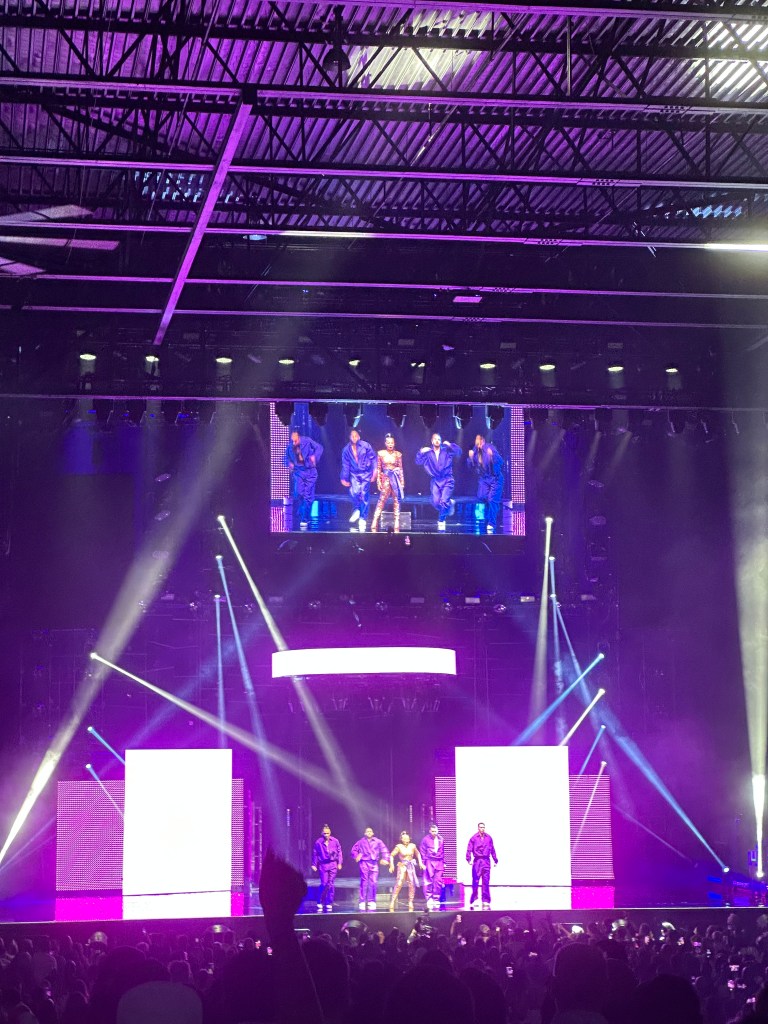

For June it felt like the expenses didn’t stop coming. I bought a computer game Diablo 4 but up until recently I could not play it on my Mac due to Blizzard abandoning the Mac platform. So I bought a $48 cloud computing service for a month, a better solution to me than buying a whole new mini PC for the occasional game. Then a week later I figured out how to run it on my expensive MacBook Pro M2 Max laptop. Then my car insurance was up for renewal at $565, concert tickets to see Gladys Knight and Patti LaBelle who put on an amazing show. I used a week’s worth of vacation time and have another week coming up this week.

I had a small bike mishap that cost me $35 to repair and a little over $200 for the podiatrist visit (put on my HSA) where I was convinced I sprained my toe. I got x-rays, a boot and everything. Then 2 days later my toe was perfectly fine, full range of motion, no pain at all. Cancelled my Friday followup appointment today. The worst part was trying to figure out how to get home. Biking 3 miles in the heat with a busted wheel was no fun at all.

Potential expenses – I’ve been wanting a bigger television for my living room for a while but up until now have talked myself out of it. The 5k computer screen is enough aside from when I have company over. which is pretty infrequent still. Same with the Acura Integra Type S. Lots of performance, sportier design than my A-Spec Tech Package but is it almost finance $20,000 more better? Really quite debatable when you consider that most roads in the area outside of the highway you can’t really enjoy it all, sort of like with a supercar. In terms of hours of work, another 600 hours of work for a depreciating accent? Naaaaah. I’ll just put my car in sport mode, work the paddle shifters and pretend I have the fast version.

For gym memberships I’ve been doing a lot of research on Equinox. The cost isn’t cheap at around $230/mo. That’s $2,760 annually. I lift and do cardio, no classes because I feel like a major doofus trying to keep up with the trainer. Maybe spin would be different from yoga, dance, Zumba or something but still…. If I did decide to hire a trainer it would be even more. So the alternatives are joining the other Anytime location that wouldn’t take me because I’m not a member of their location, sticking with the busy city gym I signed up for last month ($20 for the one month I signed up for or like $115/yr), or joining another gym in the area. The Lifetime near me is awful and the LA Fitness is not any better with some calling it the worst in the metroplex.

Speaking of the car I’m super happy that in about 8 months I’ve been able to pay 63% of what I originally borrowed. Had I stuck to the 60 month payment plan that would look much more like 14% and a wee bit more interest. Most people don’t do what I do and I’m perfectly fine with that.

I certainly do feel a bit of FOMO having vacation time I need to use before I lose it and not having any trips planned out. I want to go on a trip with a bf, partner, or even a friend. None of that seems in the cards right now until August for my upcoming 40th birthday.

Dating continues to be a disaster, I’ll be brief. One potential match had to go back to law school and never would answer me about what’s going on in his world, the other on the 2nd date told me he wasn’t looking for anything serious despite showing interest in December and suggesting otherwise on the first date. Another is vacationing in Mexico for a few weeks lol. A friend told me he and his husband got married after a month. That to me is crazy talk but then again I also don’t trust anyone.

It recently marked 24 years since my grandmother passed away, and my dad was 19 years. It’s hard when the family you are closest to is gone and all those memories that could’ve been just aren’t. Like high school, or any of my 3 college graduations, learning to drive, celebrating a new job, promotion, family trips, leaving home, coming out, etc. Then being physically distant from the rest, or sort of estranged by my grandfather whom I haven’t seen in 14 years and he only reached out to me once, by accident. The most important way to honor those who are gone is to live a rich fulfilling life and find happiness no matter what trials the tribulations arise.

Not living in the past is something I need to practice more often. I think a lot of people I’ve met over the years aren’t really my friends. Maybe they were for a season or multiple seasons. Then they move away without even saying bye, or thanks for our friendship, nothing. I guess I expected just a *little* bit more. Aside from my inner circle and I’m going to focus more on me going forward. Just deleted the Facebook app off my phone for good measure to break the addiction. Health, energy, and good vibes are the most important things right now. Healing from rejection and feeling of inadequacy is a process.

| | 7/1/2023 | 6/2/2023 | Difference | % Change |

| 401K | $195,156 | $185,475 | $9,681 | +5.2% |

| Roth IRA | $29,756 | $28,322 | $1,434 | +5.1% |

| M1 Acct | $1,123 | $1,000 | $123 | +12.4% |

| Cash | $2,596 | $2,018 | $575 | +28.5% |

| HSA | $2,567 | $2,591 | ($24) | -0.9% |

| Total | $231,195 | $219,406 | $11,789 | +5.4% |

| Credit Cards | $128 | $0 | $128 | — |

| Auto Loan | $9,548 | $10,517 | $(969) | -9.2% |

| Net Total | $221,519 | $208,889 | $12,630 | +6.0% |

Last year 7/1/22 I was at $171,997, and that’s before I even bought the new car. So up $49,522 or 29% is pretty good in my book. I might not own a home but I’m doing something right. Thank you stock market, steady job, and retirement accounts!

For anyone who still reads this, Happy 4th! Much love. Do you have a personal finance blog I should look at?