As I write this I’m in the middle of recovering from a cold that has lasted me the majority of the week. I’m working on healing my soul in addition to my body. I went on two dates last week with a gorgeous guy in his late 20s and he completely ghosted me the whole week. I’m going to say he probably had other things going on. Getting out of the marines, going to school for software engineering, moving back to the area, and getting a part-time job. I was a little hurt at first, but I’m getting better at not getting attached to people right away. Journaling has helped.

Some changes – Added contributions that will show next Tuesday for simplification purposes. I am also including my emergency fund as part of my investments going forward. I don’t plan on including my car which is worth about $17k today or any other possessions I may sell over the course of the year.

7/30/21 –

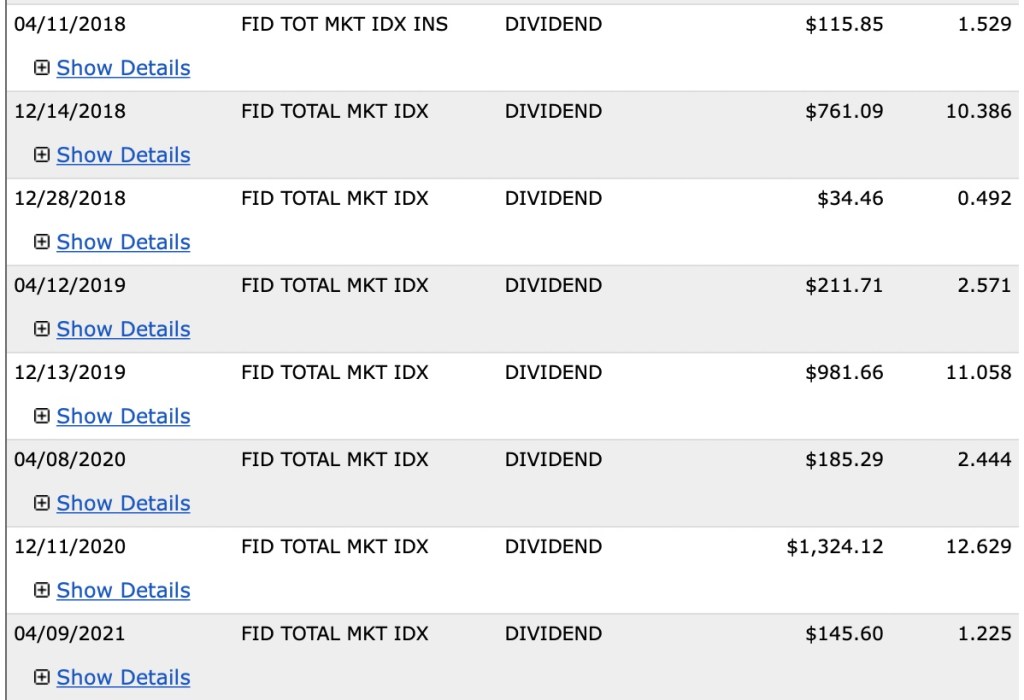

401K: $145,693

Roth IRA: $15,419

M1 Acct: $2,564

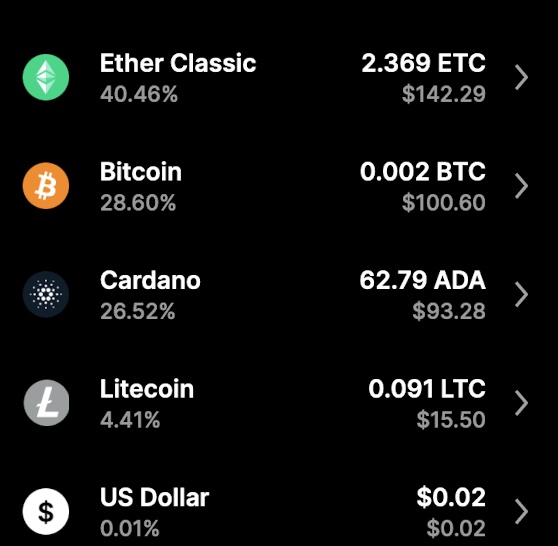

Crypto: $451

Buffer Fund: $5,013

HSA: $1,752

Total Investments: $170,893

6/28/21

401K: $139,579

Roth IRA: $14,842

M1 Acct: $2,283

Crypto: $400

HSA: $2,120

Total Investments: $159,225

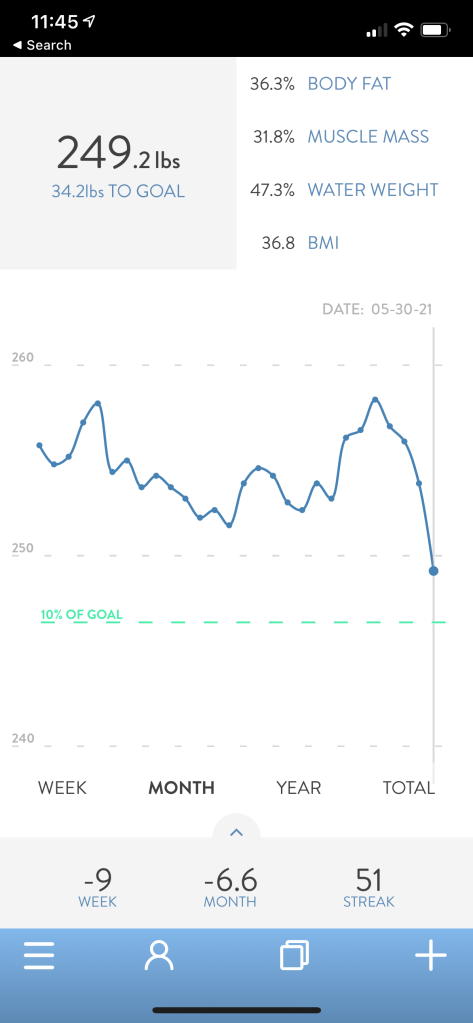

Net worth is up 7.3% or $11,668 from a month ago. Compared to a year ago I’m still up 95%!! Vs July 2019 my net worth is up 368%. I haven’t purchased any more crypto after getting burned on DOGE, still down $126 or 63% as of this posting. My holdings in ETC, BTC, ADA, LTC are also down in value. My M1 portfolio is still up 25%. 401k 1 yr RoR is 44.12% / 17.89% YtD. Roth IRA is 43.79% 1 Yr RoR. I don’t know how long this is sustainable with the market hitting all-time highs. Have to research Fidelity’s High Dividend options again, but I think the higher fees were a big turnoff. Balancing with growth stocks I can access in a non-retirement account without penalty before 59 1/2 might make more sense if the market starts to go lukewarm.

7/28/2020:

401k: $81,450.93

Roth IRA: $4954.67

HSA: $661.87

M1: $485.98

July 2020 Total Retirement: $87,553

This month has been a real doozy health-wise. I had a blister the size of two grapes on the back of my heel. Have some slight scarring but mostly back to normal. Got a minor laser procedure done on my nose that I’m happy with. Then the latest sinus / ear infection that has left me congested and bitchy. Got tested for Covid as a precaution, at least that came back negative. I also re-injured myself by not wearing proper bike gear. Tsk Tsk.

There are some things professionally that have me a bit irked. I can’t control it though, I think all jobs have some element of crap you have to deal with. The question is would you rather put up with the known vs the unknown. Without going into too many details, I do think growth is important.

I took a staycation earlier in the month and on the last day decided to take a little road trip to Denison Texas. Less than 75 minutes from Dallas it was just far enough to get away from the big city, but not far enough where I felt like I needed to book an overnight stay. The pictures are a bit deceiving how high up I actually was. I’m going to say at least 100 feet up, my fear of heights kicked in immediately. It was a breathtaking view though, a reminder of how life isn’t all about work, hitting goals, and worrying about things.

I had the best time at a friend’s apartment last weekend. Outdoor barbecue, burgers, hotdogs, drinks, cornhole and fun conversations. I really value the friendships I have lately, even if we aren’t necessarily “best friends”. It’s nice to feel appreciated.

Earlier this month I also saw some rad fireworks pretty close up and posted them to my other YoutTube channel. A different friend invited me to a 4th of July party, the first one I’d been to in 3 years.

Even if things aren’t perfect I still am thankful for everything I have. I know someone from high school who has lupus, is on dialysis and also having serious complicatons with her pregnancy. Someone else I know from my home state just split up with his ex after being together for years. Another has his arm in a cast due to a fractured wrist and thumb after a sports accident. Another couple I know is getting a divorce. I have relatives who are on unemployment. I’m sure there are lots of people who wish they earned what I make now and had rent under $1000/mo.

That’s mostly it. I’ve spent way too much on food this week as I haven’t been in the mood to do any cooking and food shopping while you’re hacking up phlegm isn’t fun. Postive vibes, we are all going through something. Some people are open about it others not so much. It’s almost 3am, time for bed…