I’m currently going through the gamut of emotions right now. My employer recently went through a round of layoffs. Hundreds of good people losing their job through no fault of their own, the unfortunate outcome of mergers & acquisitions. A tale as old as time at least since people started working for corporations since the early 20th century.

I found this image illustrating the 5 stages of Grief. Denial, Anger, Bargaining, Depression, and Acceptance.

Denial – I saw news stories about the event before it happened. I knew there would be some changes but nothing of this magnitude.

Anger – I tend to project others emotions on myself. How could they do this? Why couldn’t they have offered these people other jobs? Why weren’t more options given?

Bargaining – Could I have done anything to prevent this happening to the people on my team or the ones that I work with. Not really, I wasn’t consulted at all during this process.

Depression – Should I stay here? Should I jump ship? Should I start looking for other jobs, in *this* economy?!! Should I pause these plans to move out of my apartment? Am I going to be next?

Acceptance – The reality is I was *not* part of those who were laid off, though my role is changing in ways also not in my control. My salary is unchanged and I still get to work remotely. My leaders think highly enough of me to keep me on the team and it’s not my first time at the rodeo. The people impacted received severence pay and should also be eligible for unemployment. Some of them I’m sure were burned out in their previous roles but kept the fire burning hot. A few people who used to work for my employer seem a lot more relaxed after moving away from this particular industry.

5 Stages of Grief

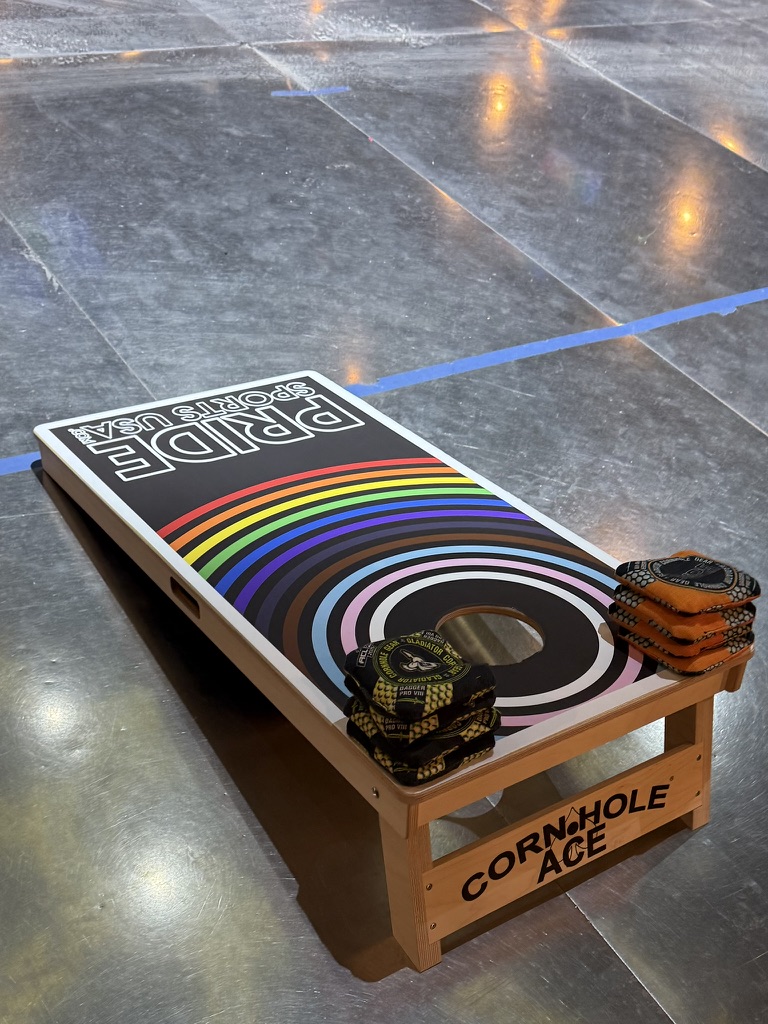

Recent Purchase Wise I spent on a few items.

- Gift for best friend from NY – His wife is about to deliver a baby and I could afford to spare the cash

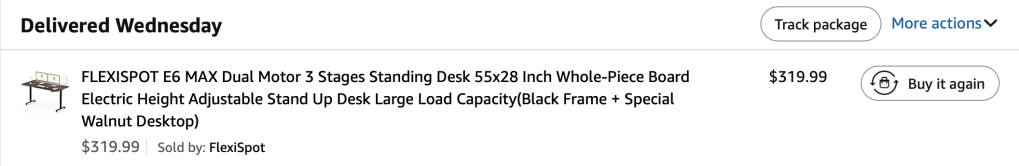

- Standing desk from Flexispot – The reality is I was sitting in front of a computer and sort of hunched over about 12 hours a day. That isn’t healthy and I need to definitely get out more. In the meantime though I’m focused on making small changes. It’s also quite sturdy and able to handle a 352lb of weight. The E6 Max standing desk was $346.39 after tax is included the top at least was made in Vietnam and I don’t think impacted by the tariffs. The first one I got unfortunately had a hairline crack right in the middle of it. I called the 1800 number after hours and a rep helped me immediately. All I had to do was send over pictures and just a few days later the new top was at my door. It was annoying to reassemble half of the desk but having a box nearly as tall as I am in my small living room also wasn’t an option.

- Walking Pad – Along with working from home there’s a strong need for me to keep my body moving. Staying stationary I think is one of the factors contributing to my recent weight gain along with other health challenges. After my most recent bloodwork I need all the help I can get. $248.96 after a $40 coupon was applied and tax. There was a price drop after the fact I couldn’t take advantage of thanks to Amazon’s rigid price match policies. Both of these I wouldn’t normally splurge on but I had a slight financial windfall in April that is working to my favor.

- Expensive dinners – Well expensive to me, close to $100-$112 with tips for 2 people. Try to limit to once a week. With current prices I suppose it’s not that bad once you include alcohol. My bf also cooks meals for us and will cover some of the cheaper meals when we go out so it’s even. I also earn a higher salary so it’s fair.

- Clothes – I got some on clearance from J Crew Factory and some from the Penguin Store. Happy with the result, but still think a could use a few more items. In denial about it still but XL polos don’t fit me anymore unless they’re slightly oversized. Sitting down and having my belly stick out is not a good look.

- Groceries – I did two food orders from Whole Foods. One was $177, the other was $111. Also made a few other runs. I don’t always have the energy to go food shopping after a long day or get up early enough to do it all before work. Plus asking people for custom cuts of meat can be a little bit exhausting especially with a line of people aside from trying comb through the aisles to find the best deals. Online I can see the prices and what’s on sale without any confusion. Is it lazy? Extremely. Is it cheaper than ordering doordash delivery or driving to get fast food? Certainly.

The crack not heard around the world

The latest news stories are talking about the impact of tariffs to the supply chain and potential empty shelves. I don’t know what the oucome of this will be. I don’t want to panic buy anything. My electronics are good for a while if prices suddenly go up. Clothes are good. If I have to button things down I can. I’ve been looking at cars again (either more powerful, more spacious interior, or electric) but the one I have is perfectly fine aside from it being kinda on the slow side.

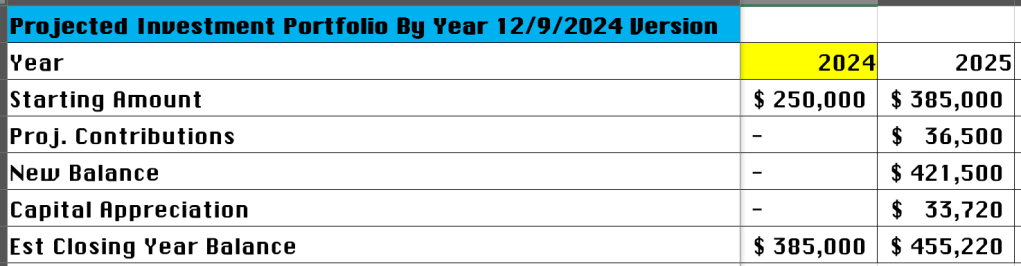

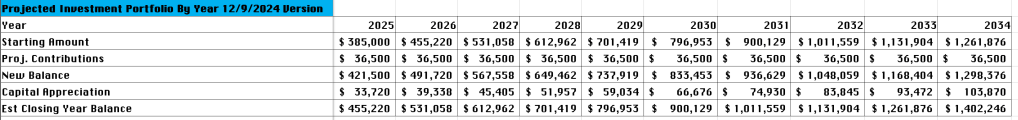

Ok onto the finance piece. My net worth is now the equvalent of an Intel microprocessor that popular during my youth. Good ole reliable 386, $386k that is. +$10k or +2.7% where I was last month. I lucked out in terms of money coming my way and for that I’m blessed. My cash levels are at record highs for me but still not enough for a down payment on a home. I also don’t qualify for any down payment programs. The home values haven’t gone down *that* much and trust me I have been looking daily. I may do a 10% down payment and move into a property that meets most of my needs that is $350k or less. The work news makes me a little worried though and all signs point to housing getting cheaper in the next 12 months. My lease is up in close to 3. If I ride it out one more year I can get to 20% down and have an emergency fund. Do I want to do that though, 10 years in this apartment and I’m not getting any younger. I’m also borderline depressed being in such a small, physically dark place 16+ hours a day.

You may recall in my start of year post my net worth estimate for the end of the year was $455k. I no longer think that is feasible and $426k seems more realistic, perhaps less if I buy.

Compared to a year ago my total investments are up 27%, cash is up 500%, and through aggressive contributions my retirement account balances are up 21-26%. I’m tired often but pushing through. At some point I might not have the option to invest all this money. Hopefully that’s not for a long time but try to plan for all possibilities. I do get paid again Friday, $1k of that will go to savings, $293 into the Roth IRA, $920-ish to the 401k plus matching. The avg American can’t afford an $500 expense, I was there almost 15 years ago.

Well off to bed now I’m tired.

| 4/29/2025 | 3/28/2025 | Difference | % Change | 5/4/2024 | YoY Diff | % Change | |

| 401K | $ 306,755 | $ 303,119 | $ 3,637 | 1.2% | $ 254,172 | $ 52,583 | 20.7% |

| Roth IRA | $ 50,234 | $ 49,814 | $ 420 | 0.8% | $ 39,986 | $ 10,248 | 25.6% |

| Brokerage Accts | $ 2,827 | $ 2,494 | $ 333 | 13.3% | $ 2,415 | $ 411 | 17.0% |

| Cash | $ 22,862 | $ 17,209 | $ 5,653 | 32.8% | $ 3,846 | $ 19,016 | 494.4% |

| HSA | $ 3,400 | $ 3,415 | $ (15) | -0.4% | $ 3,056 | $ 344 | 11.2% |

| Total | $ 386,078 | $ 376,050 | $ 10,028 | 2.7% | $ 303,476 | $ 82,602 | 27.2% |

| Credit Cards | $ – | $ 93 | $ (93) | -100.0% | $ – | $ – | #DIV/0! |

| Auto Loan | $ – | $ – | $ – | #DIV/0! | $ 11,555 | $ (11,555) | -100.0% |

| Net Total | $ 386,078 | $ 375,957 | $ 10,121 | 2.7% | $ 291,921 | $ 94,157 | 32.3% |