Merry Christmas and Happy Holidays to all the people who have been looking at my blog this year. I am happy to be able to be able to share a few hours each week sharing my journey to become debt free with each and everyone of you.

My bf and I recently saw the Trans Siberian Orchestra at the American Airlines Center in Dallas. Bought the tickets from a guy on Craigslist. It’s not the first time I’ve bought / sold something on CL, but I always have my guard up since I know there are a bunch of scammers out there. The cost was 150 for both of us, plus $10 for parking and around the same for tolls.

I thought the show would be boring and uneventful but it really wasn’t. They played Christmas music infused with rock, blues and a pyrotechnics show. Not sleeper music by any stretch and that was a good thing.

This Christmas, I didn’t go into any credit card debt. I didn’t buy any gifts for my friends or parents. They know I’m in the midst of getting my financial house in order. I felt no guilt for not buying them any gifts. I’d much rather spend time with people who are important to me than buying expensive items they probably will quickly forget anyway.

Tonight we had some friends over for a Christmas feast. Good food, some alcohol and crazy kids running around. I honestly don’t think I was ever that wild running around. Today I’m very even tempered, no-nonsense. Definitely not the kind of person who would want to deal with children all day.

It’s interesting to see opposing viewpoints on the same issue. Take one in particular. Person I work with who doesn’t pull their own weight so to speak, always comes in late and leaves early, does probably 50% of the work I do, living on a social networking site. Complaining about coming into work for 4 hours and getting paid for 8 and his commute in general. I can identify with some of what he’s saying, but I also have been on the other side of the equation. On days when you don’t have work, you don’t get paid. Those doing contractual work or self-employed. I’m grossing around 175-200/week extra by giving a few hours over the weekend and an hr or so a day in the week. He does a side job that is much more time-intensive and probably earns about the same but off the books.

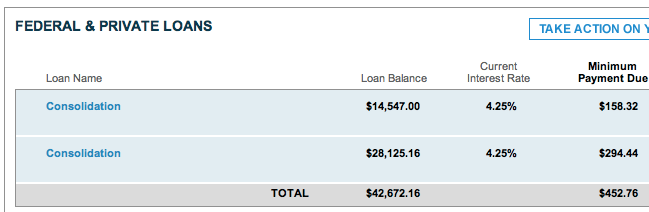

Raises are coming up soon. Should get one on the paycheck after my next one. I do work pretty darn hard at my job. I’m thirsty for success. Even a very slight 3% raise would be an extra $20/week or 1040 a year. That’s two months worth of loan payments. Also if I can sustain the 8 hours overtime a week (debatable), I basically will be grossing 33% more. We shall see…