January 2023 has some to an end. I’ve been full on investing again, aiming to max out my 401k and Roth IRA contributions for the new tax year. What have I been up to?

Currently getting over both a double ear infection and a sinus infection. Took a half day at work last week but aside from that I’ve been trekking along as much as possible. Just started taking antibiotics yesterday after a week of suffering with various symptoms. My aim was to schedule everything before the big storms started to hit. Starting to feel a little bit better day by day…

I had my heart set on a job at a local company. I’m not particularly happy with how the process turned out. I thought the interview went well. It might’ve been a reach but the response was a bit cold. I told a friend about the experience and he knows the history… He agreed it wasn’t very personal / professional how it was handled. Having to e-mail a week after the first interview to schedule a follow-up one. Then not hearing anything for days and days. I even had a list of follow-up questions. I stayed up till 2:30AM one night trying to do extra research on the company and work on an online course for certification / continued learning purposes. Weeks of wondering what the outcome would be and high stress levels.

Deep in my soul I genuinely believe what made me sick was the stress of the experience and massive sleep deprivation. So I’m giving myself a curfew to crawl into bed and turn all the electronics off. That and dating… Coming up on 3 years single. I haven’t travelled with a partner since 2014. One guy I thought had potential to go out on a date… Posted a pic of a him and his bf one week, then not long later showed pictures of the two wearing their wedding rings while on vacation. We were just chatting in December and he gave the impression of being very much single. So I unfollowed and am trying to burn it from my memory. 3rd time something like this has happened to me. I am working through my trust issues.

Purchase 1 – AirPods Max – $541.24 inc. tax – This replaces a pair of noise cancelling headphones I’ve owned since 2018 that were okay but starting to show their age. No Bluetooth 5.x, no Dolby Atmos / Spatial Audio, lackluser noise cancellation, a bit prone to interference. So I sold them on eBay for $47.58 after fees. Net $493.66. Paid in full.

Purchase 2 – MacBook Pro 16″ M2 Max – $3,462.92 inc. tax – 32GB memory / 1TB storage / 38 core GPU – My Late 2021 MacBook Pro 16″ functionally was working fine. However I made the mistake of not getting enough RAM on the system. Literally everyday I used the computer it had to use storage as memory (swap) and things would slow down. I could not run Windows 11 or Linux on this system in a Virtual Machine due to the limitations. Apple offered $1025 trade-in, itsworthmore offered $1400 or 36% more. I also paid $20 at FedEx for a laptop box. I hopefully will get payment in the next 4 business days. Net $2,082.92. I currently owe the amount of the trade-in still on my Apple Card, then it’s paid in full. It sounds like a lot and it is but I use this everyday.

Purchase 3 – Replacement PowerBeats Pro earbud – $70 – I bought these to workout in December 2019. However the right earbud started to fail. Rather than completely toss them out I just bought a replacement.

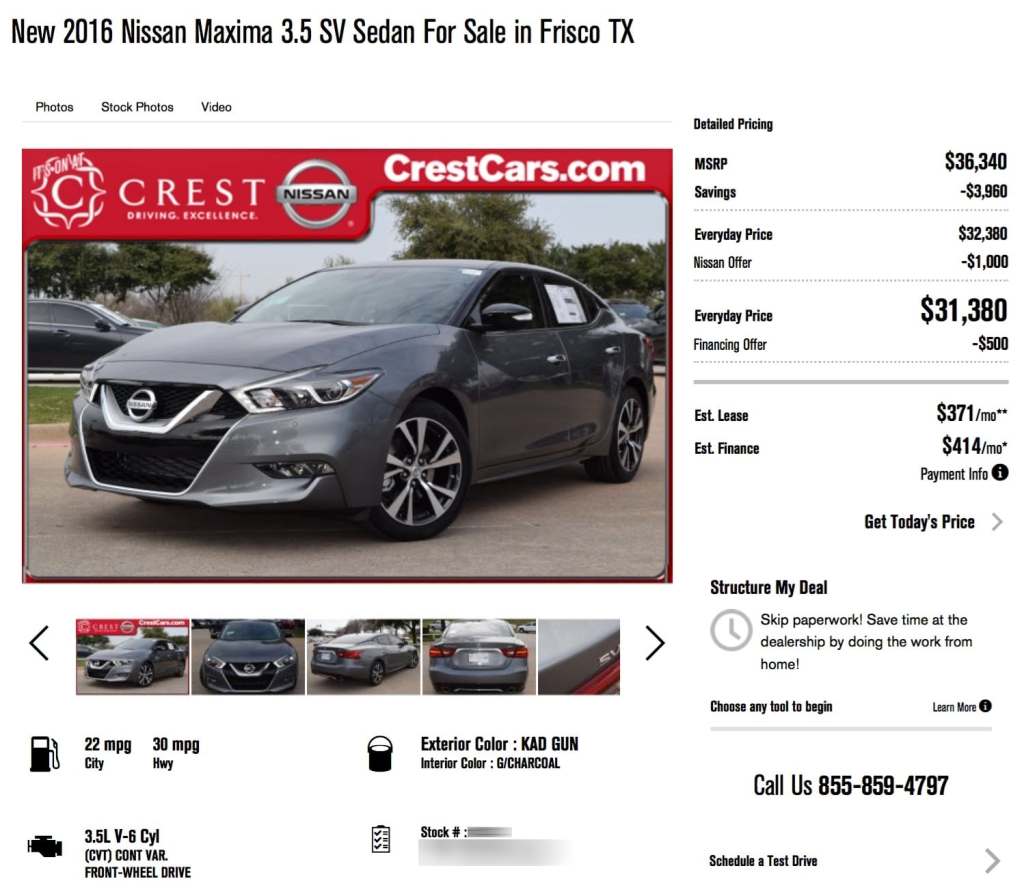

Still owed – $647.10. I bought my car in October and cancelled my old warranty the day after I bought it. I e-mailed the dealer about it, then Nissan. Nissan told me to contant the company that issued the warranty. The warranty company mailed out the check and told me to wait nearly a month later before they could reissue the check. Then the day of they said the check came back to them. The left the last # off of my apartment #. Kind of infuriating but I tried to stay nice and professional during the whole process.

It’s a new month and I’m thankful to still have a job when several people I know have encountered layoffs. My rent is half what it would be near my hometown on Long Island. My hair is also starting to slowly grow back with my treatment plan. I did kickboxing last night with Apple Fitness and it crushed me in a good way.

| 1/31/2023 | 1/2/2023 | Difference | % Change | |

| 401k | $169,051 | $155,964 | $13,087 | +8.4% |

| Roth IRA | $25,539 | $23,403 | $2,136 | +9.1% |

| M1 Acct | $580 | $446 | $134 | +30% |

| Cash | $3,377 | $7,002 | -$3,625 | -51.8% |

| HSA | $3,104 | $3,100 | 4 | +.1% |

| Total | $201,650 | $189,915 | +$11,736 | +6.2% |

| Credit Cards | $1,799 | $0 | $1,799 | |

| Auto Loan | $15,973 | $16,909 | -$936 | -5.5% |

| Net Total | $183,878 | $173,006 | $10,873 | +6.3% |

Between my 401k contribution, matching, and Roth IRA over $2,705/mo is going to retirement. $100/mo in my non-retirement account. That and double or triple car payments. About $2k of my HSA is invested but I could contribute more. Just not sure if I need to outside of the tax benefit. I also paid a ton in taxes last year, kind of makes me sick to my stomach. I don’t know how people who live in California or NYC deal… What’s also worth mentioning it that my rent is not only paid up for the month of February but also March as well. I also am not including the $2,047 I expect to receive back in the coming weeks in my total.

I also received a nice fat $2,218.86 in dividend payments on my 401k in December that gets reinvested. I was watching a video from Jarrad Morrow – This Is How Wealthy You Are Based On Your Age . Using the example as a 39 year old I’m ahead of the mean for Gen X which includes people upwards of 19 years older than me. Since I don’t have a home and there is no home equity I’m doing twice as well as the boomer generation. That’s fucking insane. I started with retirement contributions in June 2013 and sure as hell didn’t max it out before 2020. The $200k net worth is still elusive to me. Maybe if I would stop buying shit that would be different but it provides me with enjoyment.

Last but not least a big shoutout to Caleb Hammer on YouTube. Dude is in his 20s and his channel has gone gangbusters at 133k subs. Peace out, I need my beauty sleep.