Assuming I stop investing completely and market returns stay at current rates I’ll double my portfolio from the current $373k as of a few days ago to $735k in 8.5 years or 2032. Then double it again and hit ~$1.5M in 2040. I will be 57 years old then and presumably retired or very close to it.

In practice I’m putting about $1,986 of my own money aside monthly in 401k plus let’s say $745/mo of matching. Not including Roth, crypto, or brokerage account. So that’s $2,731. At that rate I will double my portfolio to $756k in 5 years. If I could hold that pace for 5 more years I hit $1.3M 5 years from now or 2035 at 52. That’s independent of money I’m putting into a Roth IRA, high yield savings account, bonuses / the rest of my income, or may go to a potential home.

Not stressing about any of this really. If it happens great, if not I will keep focusing on things and people who matter in my life. 2024 has been a year of uncertainty,. A friend got laid off a few weeks ago, a former coworker was looking for employment for close to a year and took a demotion, another who left voluntarily got laid off elsewhere not only once but twice.

I spend a ton of money this month but mostly for good things.

1. Tire – Got a new set of tires – $1,392.13 – TLDR on this is I drove to Arkansas and my tire started to make a bit of a noise. I had the car aligned several times, along with tires balanced before so this was odd. The Discount Tire rep said 3 of the tires balanced but the one I had issues with wouldn’t balance. He then showed me irregular wear on the tire and what looked like a liter of liquid sloshing around. The car is AWD so it’s recommended to replace all 4 tires at once. So the car I bought October 2023 at Grubbs Acura of Grapevine, TX had tire sealant the time I purchased it. I e-mailed a few people there and got a pretty generic response. I was fuming because it could have resulted in the tire sidewall exploding and I drove 10k miles with the tire in that state. I was able to pay if off that week with money I had saved up. I was pissed though. The car rides much quieter and I get road hazard coverage / free rotations for multiple years.

2. Europe flight and seat upgrades – American Airlines $1,737.23 – I knew the expense was coming. Did I want to make the payment this early? Not really but I’m going to have a blast

3. Dodgeball team membership – $90.50 – Since the kickball season stopped and we’re not doing cornhole I wanted some type of social outlet with people I knew. Missed the early brid pricing by a few days oops.

4. MacBook Pro $2,899 plus tax – Got $2,252 for the old one. Wasn’t going to replace but the big bulky 16″ barely fit on my desk. and discouraged my from going out anywhere with it. The specs are a slight downgrade in terms of amount of memory and GPU cores but the system is faster than my own one so real world it just uses more of its RAM and a tiny bit of swap space.

5. Wicked tickets… j/k on that one but great movie. The acting, special effects, and the music. This film had a huuuge $145M budget.

Inside of old tire wearing abnormally and new tire

The 2024 Edition laptop – M4 Max MacBook Pro

Sharing a couple pictures from my camera roll in November.. Lots of Christmas. experiences. 😀

On the health front I was sick for a few days but my blood pressure also was sky high 152/97. I was drinking lots of water, taking garlique and dandelion root, going for walks whenever possible. It was working for a while until it wasn’t. The other medication I was on just ruined my GI system. High blood pressure is the silent killer so I openly accepted going back on another medication with the hopes of getting back into normal range. Numbers are back to normal again. Since the election I’ve been down about 10 pounds so it’s helping. I also no longer am active on X / Twitter instead favoring Mastodon and Blusky. The X algo would constantly show me performative outrage, political content I never asked for, its owner’s comments non-stop, and videos that go viral for all the wrong reasons. The platform is polarizing, toxic, and quiet honestly a waste of time. Garbage in, garbage out.

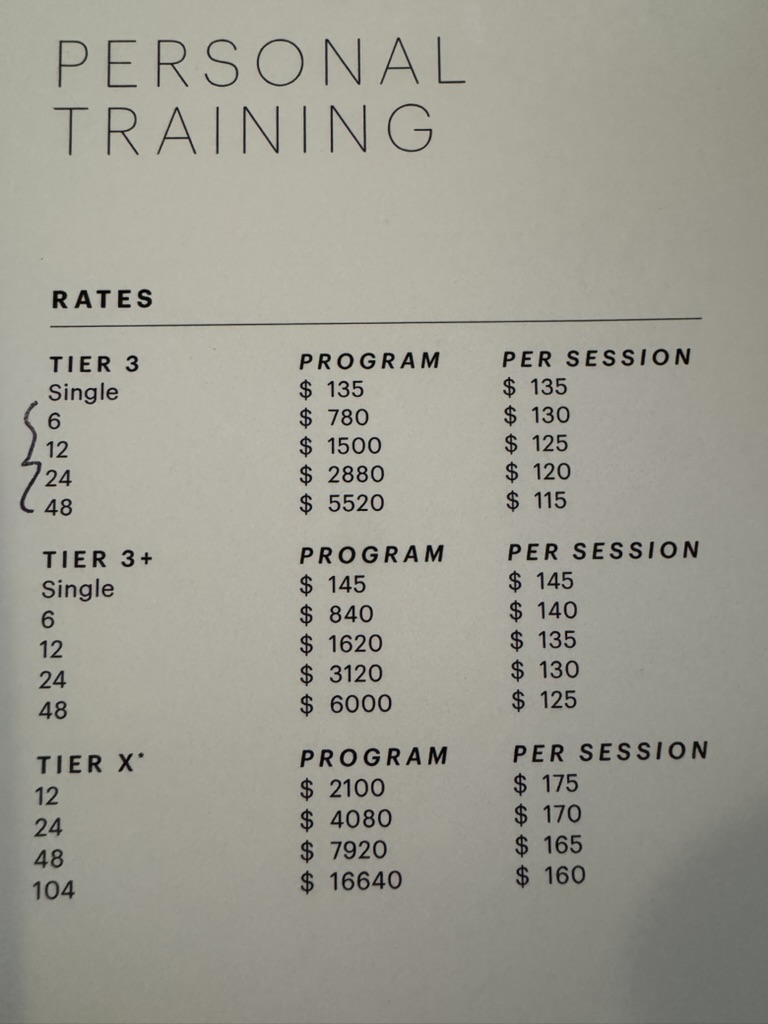

My net worth is at an all-time high. I am having doubts about being able to afford a home by August 2025. A common rule of thumb is to not exceed 28% of your take home on housing expenses. That with my aggressive retirement investing would be about $1708 (good luck finding a mortgage payment that cheap) and then a Ramit Sethi video said add 50% to that to account for all kinds of additional expenses. So $2,562…

Up $24k in a month due to a recent surge in the market. Doubtful this momentum will continue but I’m pushing as much as I can. $400k by March? Def a possibility. It doesn’t feel real though. 12/2/23 I was at $233,478 so a +64% or +$149k gain in a year. I’m extremely thankful and vividly remember the -$45k I came from when starting this blog. Still working on stacking cash but it takes time.. Alright it’s after 3am I should be in bed now.

| 12/1/2024 | 11/1/2024 | Difference | % Change | |

| 401k | 319,005 | 297,764 | 21,241 | +7.1% |

| Roth IRA | 51,308 | 47,977 | 3,332 | +6.9% |

| Brokerage Accts | 1,346 | 882 | 465 | +52.7% |

| Cash | 7,603 | 8,686 | -1,083 | -12.5% |

| HSA | 3,561 | 3,490 | 71 | +2% |

| Total | 382,824 | 358,799 | 24,025 | +6.7% |

| Credit Cards | 166 | – | 166 | |

| Auto Loan | – | – | – | |

| Net Total | 382,658 | 358,799 | 23,859 | +6.6% |