Mid-June 2017 update

Yesterday I returned from Puerto Vallarta where I got the joy to experience the unity of two friends in marriage (yes one of my ex and I initially wasn’t going to attend). The trip was a balance between having as much fun as possible I’ll also being practical. I had fun but didn’t go overboard.

Specific to credit card debt my balance as of today is $8,055. I will have an additional charge of approximately $90 which includes food and alcohol for 3 nights at the resort. I paid some friends $100 in cash to watch my dog, a cheaper rate than leaving her with a dog watcher (~$150). There were some other meals involved at the airport / miscellaneous purchases that were ~$100. I saved $200 by doing DFW -> AUS -> DFW on Wednesday then DVR ->PVR.

I started reading a book called Bachelor Pad Economics by Aaron Clarey (assholeconsulting.com fame). It’s one of those books that really makes you take a step back and assess whether the decisions being me today are having a positive impact on your future. A common theme is to focus on having fewer things and more experiences of people. The concept of not being the richest man in the graveyard is a common theme.

Between my company and insurance I’m being charged a $25 dollars fee per paycheck again because I have not completed proper coaching pertaining to being overweight. Have one session remaining and would gladly have began earlier, but I’m at the mercy of the coach’s schedule and my own with work. Not a huge sum of cash but the principle itself is what bothers me….

A little over halfway through 2017 a time I reflect on the things that worked, didn’t work and what I’m doing to help me get closer to my goals. What prolific thoughts do I have????

- Death by 1000 cuts – little shit adds up fast. Like that $10 membership, or $15 glass of alcohol. Or fancy entree that costs twice as much as everything else on the menu. I write a god damn blog on this and sometimes I don’t look at my expenses as closely as I should.

- You can’t be a penny pincher with everything. There is a time and place. You can’t take things with you when you’re dead. So live a little. If you’re like me get the v6 instead of the slow 4 cylinder. Or a moderately fast / light road bike over the heavy cheap one you will regret riding every time. Or for special events like weddings, family you haven’t seen in a year, it’s okay to splurge a little bit.

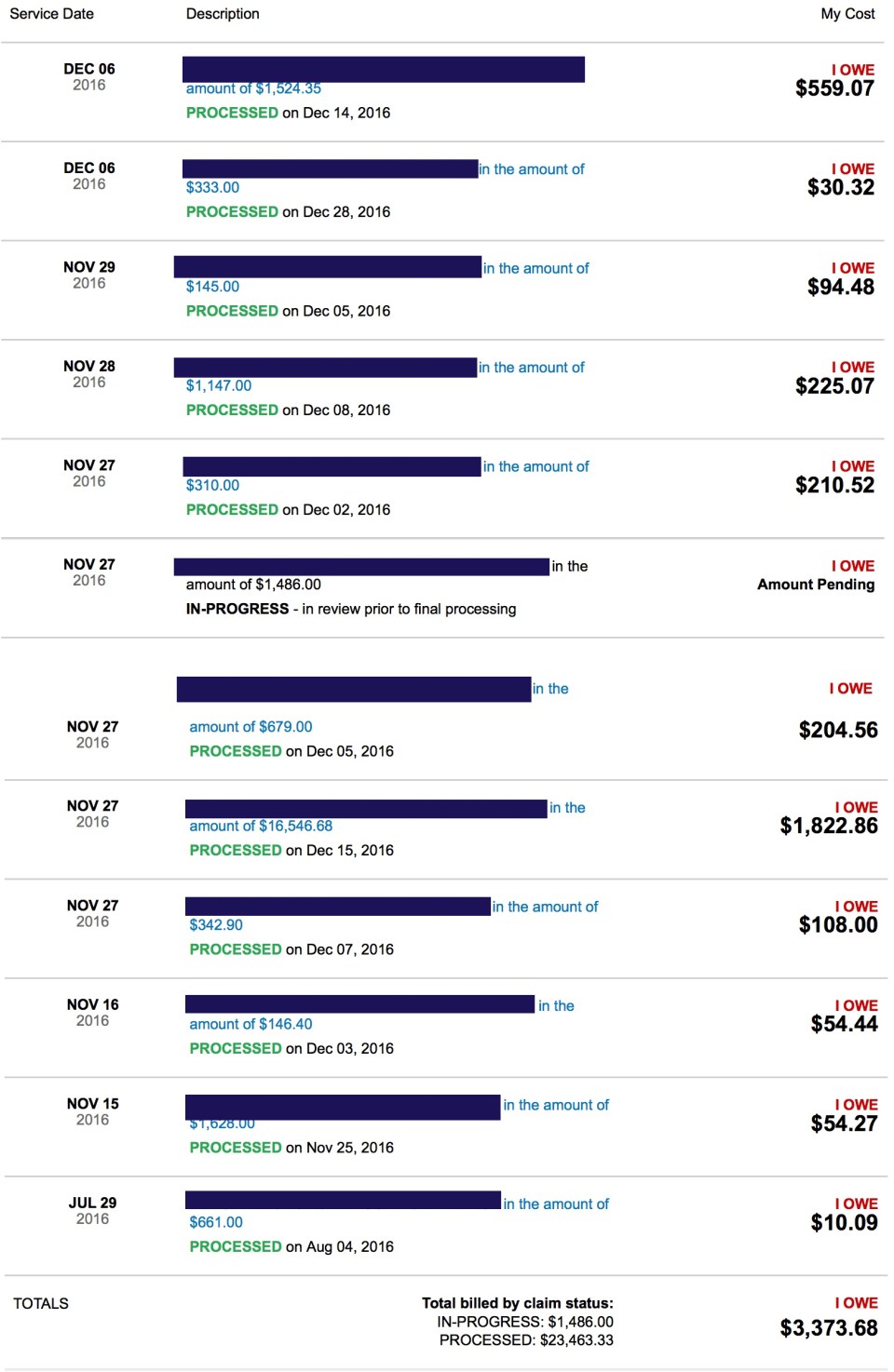

- Insurance – Get it. Self employed are at a disadvantage because it costs way more. Without it you’re looking at medical bills for years, or bankruptcy instead of a 6 month inconvenience.

- Work within reason. I got my Bing certification along with Google AdWords / Analytics. I work hard while at work but I really try not carry it with me. I may hit up a library or Starbucks after work, but it’s always things that will help drive me further long term. Closer to 6 figures/year. Today without any debt I’d be doing amazing, with I’m still doing really well compared to many other millennials.

- I love vacations. Hope to do more while I’m young enjoy to enjoy them and have no physical mobility issues. I also have 3 more weeks left of vacation for the year…. Why the heck not?? 😛

- Lighten the fuck up – Joan Rivers was right. Life is short, you should enjoy it. Some folks just want to be a victim, complain all the time and do nothing to change the situation. I used to be like them. Life isn’t perfect but focusing on the solution works tons better.

Here are some pics from my trip. I could write a lot more about the trip, but I know my audience… Be well. Live with passion. ❤

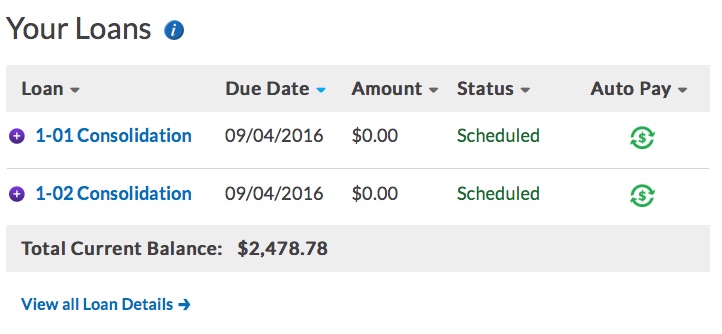

My retirement is steadily growing. 401k is finally vested after 3 years and up to $17,654. My Betterment account is up to $258.

My retirement is steadily growing. 401k is finally vested after 3 years and up to $17,654. My Betterment account is up to $258.