So I saved $1500 today…

That statement is subject to interpretation. Long story short, Nissan North America recently issued a recall on my soon to be 6 year old Altima.

Dear Nissan Altima Owner:

Nissan has discovered that your Altima may be equipped with an improperly calibrated Engine Control Module (ECM) that may incorrectly detect engine valve closure as engine knock. Due to this issue you may experience some minor drivability symptoms and a slight decrease in fuel economy under certain driving conditions.

What Nissan Will Do

To correct this condition, Nissan is conducting an Emission Recall Campaign to reprogram the Engine Control Module in your vehicle.

For vehicles with greater than 50,000 miles, the manifold catalyst will also be replaced due to possible prolonged exposure to higher than anticipated exhaust gas temperatures. Any cracked manifold catalyst or front exhaust tube with catalyst will be replaced regardless of vehicle mileage. This free ECM reprogramming service should take about one hour to complete, but your Nissan dealer may require your vehicle for a longer period of time if catalysts need to be replaced or based upon their work schedule.

I dropped the car off Tuesday evening and was originally told car would be ready by end-of-day. Next I get a call saying they need to order the part but could be provided a loaner. My loaner was a 2013 Nissan Sentra S, equipped with a 1.8L engine, uninspiring electric steering, cloth seats, no sunroof, hubcaps and a no-frills stereo system. Great MPG (32+) and a smooth current-generation CVT were its only redeeming qualities.

Some may remember July 2012 I had a hole in my exhaust system that two dealerships were both unwilling to fix. Midas would’ve done it if I ordered the parts, but combined would be in excess of $1200 out-the-door. So the fact a year and a half later the dealer would be fixing my car free of charge brings an entirely new meaning to the expression good things come to people who wait.

Below is a list of the item breakdown:

|

Qt

|

Part # |

Part Description |

Unit Price |

Total Cost |

|

4

|

14069-JD00A |

Bolt |

4.83

|

19.32

|

|

8

|

14069-ZN50A |

Bolt |

0.12

|

0.96

|

|

1

|

20692-65J00 |

Gasket-Catalyst |

4.46

|

4.46

|

|

1

|

20010-ZX10A |

Front Pipe / Tube-Exh FS W/C |

670.00

|

670

|

|

1

|

20691-19U00 |

Gasket – Exhaust / Front Pipe Seal |

10.77

|

10.77

|

|

3

|

01223-N0021 |

Nut |

0.92

|

2.76

|

|

1

|

140E2-JA92E |

Exhaust Manifold |

547.33

|

547.33

|

|

1

|

14036-3TA0B |

Gasket Exhaust |

32.70

|

32.7

|

|

5

|

14094-JG30A |

Nut |

0.87

|

4.35

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Parts |

1292.65

|

My interest in vehicles using alternative sources of energy runs deep. One in particular is the Nissan Leaf. As a reformed early adopter, I’m enamored by a vehicle that can propel itself without any polluting fumes, or the noise and complexity of an internal combustion engine.

The Leaf gets the equivalent of 129 city / 109 hwy, single speed transmission with instant torque.

Reasons against buying / leasing

- Won’t own at end of lease

- Heavy depreciation (especially if new model comes out in 2015), 35% after only 3 years, comparing around 50% after *6* years

- Smaller than current vehicle

- Limited range (100mi on the high end, but normally 80)

- Current car is paid off and relatively low mileage (72k)

- Battery life questionable in warmer climates / may deteriorate faster than expected

- Got a boomin system in the Altima, superbass boombadootdoot, doubt the 3k I spent on that during my dumb and broke days will be recouped

Reasons for buying / leasing

- Eliminate $150 in monthly gas bills (instead use 20-40/mo in electricity)

- Lower cost of ownership

- No pollution

- Much quieter driving experience

- Being able to boast to people about never having to ‘fill up’ when they complain about gas prices going up.

So unless I find some crazy good deal after the Leafs off lease I will stick with my tried and true Altima.

Onto another topic. On the subject of making home repairs, plumbing in particular…we decided to have some work done. The toilet in the upstairs bathroom would just run endlessly after flushing. Nothing like fighting with a toilet at 2am playing with the chain with your arm submerged in water while thinking about how exhausted you will be the following day. That and a fear of coming home to a flooded downstairs are what drove me over the edge. We also had some shower faucet issues. Turning on the cold water involved pushing your weight into the handle then turning, hoping the little gear mechanism inside would click and open the valve. We needed new stems, handles, and some other hardware. Whoever fixed it before used the wrong part which is why it never really operated right to begin with. $417 later (bf gave me $150), the bathroom is fine… except for an annoying problem where mold is turning some of the caulking around the tub black. That’s another job though. May do it myself to save money, or just call someone and hope they don’t try to rape me….

Know I’m bouncing around here, but during the last week I got to experience the beautiful place that we all know and love as Las Vegas. It really rivals NYC as being a city that doesn’t sleep. Great places to go shopping, sight seeing, shows, gambling and drinking. It was Halloween on the first night we landed, I dressed up in a Star Trek uniform and hit up a local gay bar. $20 cover to get in, though drinks were pretty reasonable. I took out $200 from the ATM and came back with 0. Mix some light shopping with that and really didn’t do so bad. My bf and one of our friends got two rooms, both covered the cost.

Two of our friends in DFW just got married and we had lunch with them as Vegas was their surprise Honeymoon destination. Enlightening to see how my friends who have debt spent a ton of money shopping and putting it on credit cards. I shopped very lightly, only buying two pieces of clothing and drinking lightly. My friends know I’m cheap though. O:) Had a great time, I need to go on trips more often.

Also funny as I write this I get notification my AT&T wireless bill was processed. I pay 102.39 a month for it, this month I got a tax credit so it’s only $99.52. I use my phone more than anyone else I know.

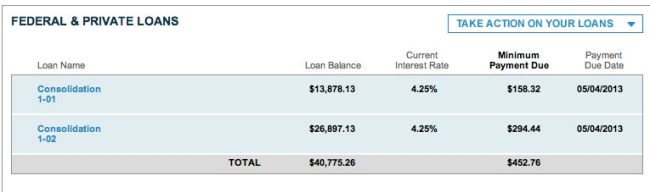

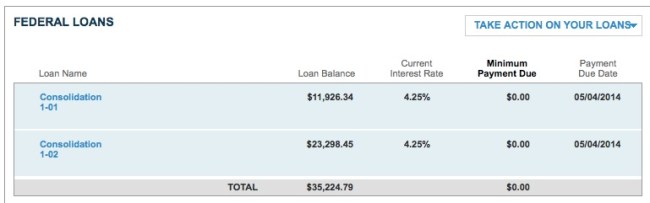

Still a lot of money for a *service* though. Between cell and home tv / cable 16% of one paycheck goes toward these entertainment expenses. 10% goes to fuel for my car. I was spending 40% of my check on food. 62% of a check goes to Sallie Mae.

I left my wallet at home yesterday accidentally. Had two containers of Mott’s apple sauce and some raw almonds to eat. I had a hearty breakfast and was only mildly hungry during the day. Bf went out with a friend to see an opera and have dinner. I felt liberated not paying anything for food. Typical Friday I’d spend $40-$60 depending on where I went.

TimeValue Software

TimeValue Software