January was a weird month for me. I started out at a friend’s gathering then I got sick and developed a nagging cough that wouldn’t completely go away. I took a really strong antibiotic which the nurse practitioner said to take it if I needed to. It just made me feel worse. I’m about 90% good now but the cough still comes and goes.

- After getting a scrape on one of my wheels I bought a new one… For almost $550 brand new at a discount from a company that supplies parts for Acuras. I unsuccessfully tried to get a guy to come out and repair them who ghosted me, then the place I got repair done from previously wants to charge $200 and keep them 2 days plus they’re about 32 miles away which is not very convenient. I have the old one on eBay right now but no bites. Slowly lowering the price down to see what happens.

2. We had snow, likely for the only time this year. Everything basically came to a grinding halt. I enjoyed pictures of it from afar online.

3. Bf and I went to this really wondeful light snow on the outskirts of Dallas called Astra Lumina. We both really enjoyed it and it was pretty empty. 100% worth it.

4. Getting back in the flow of playing sports. I wore these leggings out for the first time and it was an adjustment. My body is a little stiff from yesterday but at least myt face is good after getting hit right in the face with a dodgeball.

5. Checked out fun restaurants and bars including Boxcar and Copper and Vine. I’m giving myself more grace with drinking, light drinking 1-2 drinks a week is my limit. I’m all about the vibe. These places aren’t cheap but it’s good for us to go out and occasionally indulge after long week.

6. I made a few clothing purchases and cologne. Trying to do samples to figure out what I like and use those sparingly for when I go out. Altogether it was about $280 and one item I gave away to my bf since it didn’t fit, another I bought twice since I thought I threw it out by accident so now I have 3 packs of samples.

7. For Retirement – The Roth IRA is maxed out for 2024. This Friday I’ll make my first 2025 contribution. I hate making the contributions honestly but it’s for my future. I was “only” able to contribute 96% or $22,125.05 to my 401k last year out of a $23k limit. YTD I’m at $1,840 plus matching. Each month this year I project to see a NW increase of ~$2500/mo or $30k/yr from the estimated return rate of my investments.

8. Housing – I’m still saving for a home but at the rate housing prices and interest rates aren’t coming down this may take longer than expected. Almost $10k a month in to the near year is a good start though. One of my IG friends who is a realtor essentially said come be my neighbor, the place looked amazing but $500k though. Most people under 40 aren’t going to be able afford that. Maybe couples, situations with 3 people on the mortgage, families with generational wealth, or the top 10%, but still. That’s a $100k down payment and $3k a month not including utilities, maintenance, HOA, etc. $300k is about the sweet spot in terms of what a home looks like and what I think I’d be able to afford. I believe in math. Do I have a little FOMO when I see someone in Forney that has a whole house and probably has half my salary? Yes a little bit, however that would be 40 miles from my bf’s job or up to 2 hour drive after work on a weekday. That and no one I know lives out there. Fuck that haha.

9. For time preservation, algorithm, and mental health reasons. I’ve decided to try and be 80-90% apolitical online but it’s hard. Even with the exclusion of certain mutes words and , me not personally posting political content it’s E-V-E-R-Y-W-H-E-R-E. That and the number of things to get outraged over seems to be rising exponentially. A cousin in Kentucky came across a flyer related to a divisive group’s meetings and was hoping it’s fake but it ‘s real. It’s always been there but now the people are coming out of the woodwork. The best revenge is living a good life so that’s what I’ll keep going. Also not going to any of those areas that want to take us back to the dark ages of segregation.

10. Stepdad’s home is finally sold, he’s been handling the finances of it since 1997 and the proceeds are significant. He worked 2 jobs for years to keep it all afloat and I’m glad he doesn’t have to worry about it anymore, though now he wants to build a home on a parcel of land he owns to avoid cap gains taxes. It sounds crazy to me, but then again I don’t want to deal with tenants especially in NY.

Ok here are the actual numbers…

| February 2025 Net Worth Update | |||||

| 2/2/2025 | 12/27/2024 | Difference | % Change | 1/31/2024 | |

| 401K | $ 324,256 | $ 315,581 | $ 8,675 | 2.7% | $ 232,746 |

| Roth IRA | $ 53,272 | $ 51,574 | $ 1,698 | 3.3% | $ 34,506 |

| Brokerage Accts | $ 2,016 | $ 1,644 | $ 372 | 22.6% | $ 2,031 |

| Cash | $ 11,975 | $ 11,896 | $ 79 | 0.7% | $ 4,448 |

| HSA | $ 3,562 | $ 3,559 | $ 3 | 0.1% | $ 2,725 |

| Total | $ 395,082 | $ 384,254 | $ 10,828 | 2.8% | $ 276,456 |

| Credit Cards | $ 166 | $ – | $ 166 | #DIV/0! | $ 87 |

| Auto Loan | $ – | $ – | $ – | #DIV/0! | $ 16,536 |

| Net Total | $ 394,915 | $ 384,254 | $ 10,661 | 2.8% | $ 259,833 |

I’m up about $11k over last month and $135k to last year. I get paid on Friday and trying to keep my spending in check. The credit card payments are scheduled to bring it down to 0 but haven’t posted yet. I might hit $400k net worth this month but it’s a little iffy since right now at least it looks like I may owe $1200 in taxes. Am I excited about this milestone? Eh a little bit. Most of my money I’m not touching until hopefully until I’m 59.5. It’s all relative though, I consider myself one of the fortunate ones… Especially with all the ruckus happening with the federal government and tech sectors. Not to mention all the wildfires in Los Angeles. My problems are important to me but also small by comparison.

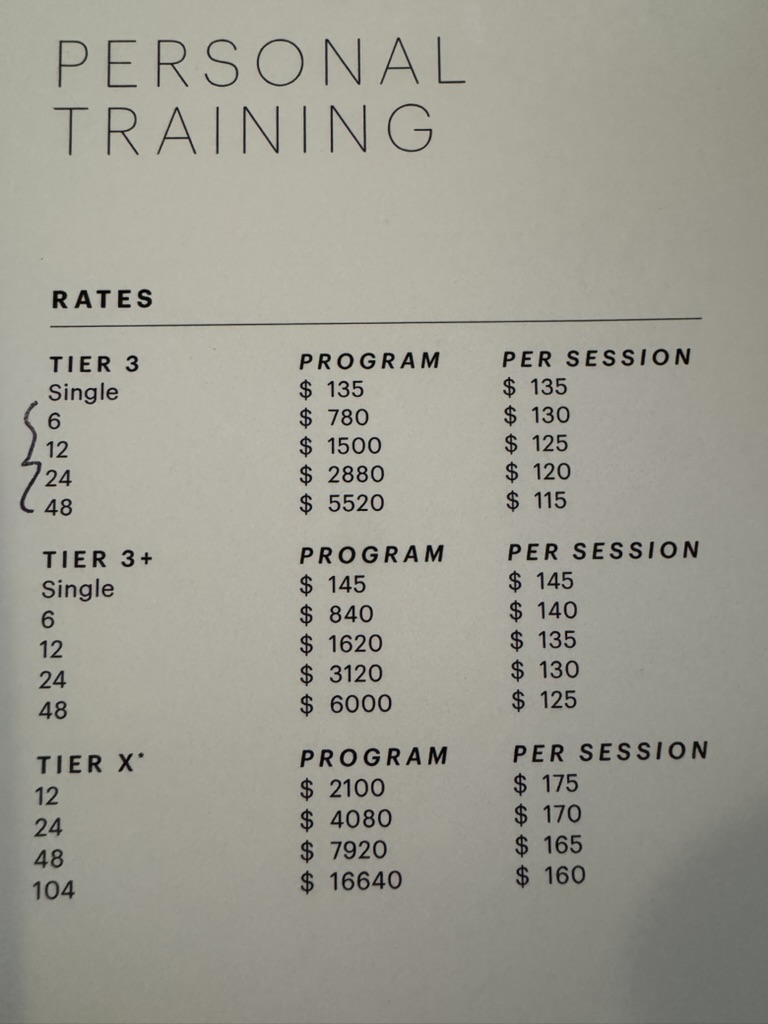

I have a really bad case of cabin fever right now but it’s supposed to be warmer this week. Doing things with friends in your 40s on a whim is near impossible. I think they assume I’m busy when I’m not or when I do ask them they are busy. What can you do though… Basically plan stuff on my own and maybe I’ll run into people I know. A big chunk of my 20s / 30s was spent hoping people would like me, to a fault. Now I’m like yeah it would be nice but not losing sleep over it. I can do fun stuff too and being fancy if I choose to be isn’t breaking my finances.

Last but not least one of our family friends going back to the 1980s passed away recently at the age of 84. She was one of the nicest people I’ve met and never complained about anything. She came to NY from the south almost 50 years ago with nothing. She made many friends, became like family in many ways, worked at a nursing home and volunteered at a church. I haven’t seen her since I left NY but my mom would stay in touch. The years go by quickly, make the most of them. I watched an hour long service from the church on YouTube. It was very touching.

Stay strong even if your finances are down right now. Long term history suggests things will continue to go up so that’s that I’m going to focus on. Much love to you all.