If you follow social media closely you’d think we’re in the middle of the great depression. The current administration is doing layoffs left and right. Across NOAA, USAID, IRS, SSA, Labor Dept, EPA, NHTSA, FEMA, TSA, HUD, Dept of Defense, NIH/CDC, Dept of Energy, Dept of Education, Department fo Veterans Affairs, U.S. Forest Service, Personnel Management, National Nuclear Safey Admin, GSA, FAA. About 30,000 people most of whom were contributing valuable services to the nation.

Let’s not forget the private sector, going off https://layoffs.fyi there have been a slew of them across many different sectors. Thousands more high paying mostly white color jobs wiped out in an economy where it’s harder to find a job than ever. With over 1.6 million unemployed looking for job and the process taking at least 6 months having you balance sheet right can mean the difference between being homeless or having cushion to lower stress.

For me, my employer last week went through a round of layoffs. I wasn’t directly impacted but there are people I’ve worked with over the years that were. It makes me sad and wonder will I be next. How do I make myself Indespensible to the team to show my value. Also what skills do I need to brush up on to add to my value in the marketplace. My job is far from perfect but I try to give it 100% daily and be an effective leader of people.

Mr. Money Mustache recently made a post Wow, have you seen the stock market lately? I encourage you to take a look at. TLDR is the S&P500 has had a crazy run up and we may be due for a correction. It’s still going to be profitable in the long run and the economy will continue to grow. Ignore the headlines, enjoy you life and keep on investing. I’m very much inclined to agree with him. I look back at the top news stories from 20 years ago. That was 7,300+ days ago. Most of the headlines elicit a wow that happened kind of response but aside from national disasters they don’t impact our day to day lives much. If your eyes are glued to the latest updates on X, Fox / MSNBC / CNN, etc. you’ll drive yourself insane. Give me the archive version and keep the party moving.

If I do end up getting laid off…

1. Company has a severence package in place – I’d rather not disclose the amt but it’s significant and would be close to 22 weeks worth of pay.

2. I currently have a stockpile of cash that I’ve been saving for a potential home purchase – Almost $12k

3. There are things I could sell for close to $1k if neded

4. I have a Roth IRA that I can pull from without penalties. My cost basis might not be exactly right but it’s close to $30k

5. 401k hardship distribution – Not ideal given the need to grow the investments, and 10% penalty

6. 401k loan

Per Fidelity: With a 401(k) loan, you borrow money from your retirement savings account. Depending on what your employer’s plan allows, you could take out as much as 50% of your vested account balance or $50,000, whichever is less. An exception to this limit is if 50% of the vested account balance is less than $10,000: in such a case, the participant may borrow up to $10,000.

7. If I really really had to I could break my lease and move back in with parents 1600 miles away but that literally would be the option of last resort.

8. Unemployment would cover some of my expenses – Maximum weekly unemployment benefit is $577 available for up to 26 weeks. That’s $15k.

9 Sell my car currently valued at $34,400 on Carvana and get something 10 years old and significantly cheaper. A 2015 version of my vehicle is about $18k. That’s $16k right there.

Hopefully things stay secure and I never have to leverage any of the above options. I do believe in being prepared just in case. I’ve been keeping my momentum going on this blog for 13 years I don’t want to start going back now.

Enough about that, what the heck have I been up to the past month?

1. Filed taxes for 2024. I paid sooo much in taxes and still owed a little under $200.

2. Sold the wheels from last month on eBay. Got a few lowball offers and ended up settling at $85 plus the cost of shipping. My payout was ~$107. I’m not sure how the math works on that. I’m sure they’ll bill me for it again later.

3. Was getting over a bit of a nagging cough that wouldn’t go away. It’s 90% better now but super annoying and was at my whit’s end.

4. Covid / Flu shot – It’s the season of people getting sick including 3 people on my dodgeball team

5. Finished dodgeball – Fun season and I managed to avoid getting injured so that’s a plus.

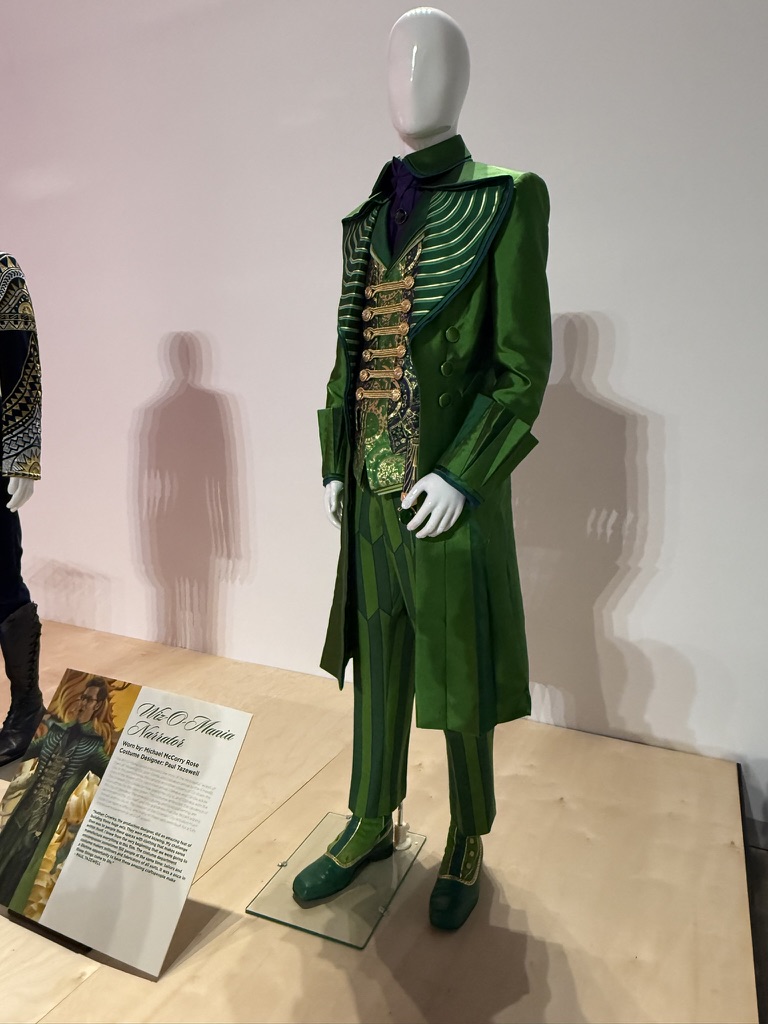

6. Saw this cute art exhbit in Grapevine TX dedicated to Wicked. I saw the movie “only” once but go a little crazy with the soundtrack hahaha.

7. Getting back into the fitness journey flow. It tires me out sometimes but it beats the alternative option. I also am learning I don’t drink nearly as much water as I should be. My energy levels are higher, my skin is clearer, along with other benefits.

8. Friends and I did an escape room for a friend’s birthday and watched the Superbowl together. Kendrick Lamar deserves all the accolates he’s been receiving lately. Not Like Us and Humble are my jams.

Ok ok let’s talk about a net worth update.

| 3/2/2025 | 2/2/2025 | Difference | % Change | 3/1/2024 | YoY Diff | % Change | |

| 401K | $ 320,732 | $ 324,256 | $ (3,524) | -1.1% | $ 247,070 | $ 73,662 | 29.8% |

| Roth IRA | $ 52,922 | $ 53,272 | $ (351) | -0.7% | $ 37,111 | $ 15,811 | 42.6% |

| Brokerage Accts | $ 2,321 | $ 2,016 | $ 304 | 15.1% | $ 2,189 | $ 132 | 6.0% |

| Cash | $ 14,303 | $ 11,975 | $ 2,328 | 19.4% | $ 3,589 | $ 10,714 | 298.5% |

| HSA | $ 3,537 | $ 3,562 | $ (25) | -0.7% | $ 3,067 | $ 470 | 15.3% |

| Total | $ 393,814 | $ 395,082 | $ (1,267) | -0.3% | $ 293,026 | $ 100,788 | 34.4% |

| Credit Cards | $ – | $ 166 | $ (166) | -100.0% | $ 440 | $ (440) | -100.0% |

| Auto Loan | $ – | $ – | $ – | #DIV/0! | $ 15,314 | $ (15,314) | -100.0% |

| Net Total | $ 393,814 | $ 394,915 | $ (1,101) | -0.3% | $ 277,272 | $ 116,542 | 42.0% |

My net worth in the middle of the month got as high as $404k then with some of the recent economic updates it went down. Am I at the mercy of the markets? Yes and I’ve been recently trying to diversify slightly away from that while also leveraging Dollar-Cost-Averaging.

I’m not quite a dividend investor. However I am chugging along slowly with my 4-4.5% in a high yield savings account. So far my little balance has yielded my $80 since December. My FEPI investment (cost basis ~$1008 current value $942) paid $20 in dividends in Feb, $20.86 in Jan, $21.16 in late December. Mid December I got a $536 dividend payment from FZROX in my Roth IRA. For My 401k I Got a $3,079 dividend from FSKAX. I got a few other dividends, $7 here, $2.50 there. It all adds up

Am I bummed about my net worth being down from the start of February? Not really. $1k decline is really nothing in the grand scheme of things. I’m still up over $116k from where I was last year. I also expect to see extra income come through this month and will likely end up with 50% more cash than I have today. A year ago I had about 3 months rent set aside in cash. The average person would struggle to handle a $500 unexpected expense without using a credit card. Meanwhile I’m living the debt free lifestyle with a healthy amount of cash reserves. So even if the $2k/mo I’m setting aside on top of other expenses / investments makes me feel “forced poverty” sometimes, it’s for a good purpose.

Throughout the week I look at homes for sale, the prices are coming down. Currently there are 3 homes in the development I once lived in. They aren’t selling. The homes I think are nice average out to be about $385k most of them are 3 bedroom, 2 bathroom. That’s a $77k downpayment. I have 18% of that right now and my lease ends mid-August 2025. That’s basically 5 months away…

3 bedroom homes in the area:

So the next question… Do I need a 3 bedroom home for 2 people? Well, I do work from home and dedicated “office” space would be nice instead of working from my bedroom or living room. Plus if my partner moves in with me he should have his own space. Same for if my parents come to visit though that hasn’t happened in over 6 years…

2 bedroom homes:

These two bedroom homes are priced a bit lower but not *that* much cheaper. I will say the some of these look a bit more modern. About $30k cheaper in some cases the savings are more. Those savings of $40k-$70k add up. I can look in other areas too, a change of pace could do me a bit of good.

I looked at condos in the area as an option, but one had an $812/mo. GTFO here with that nonsense. Another option had that fee at $609/mo. With the insurance included I guess it’s not soooo bad but stil let’s say that’s $200 of it. “All Facilities, Association Management, Insurance, Maintenance Grounds, Sewer, Trash, Water”. You don’t have a garage to park your car in, or a driveway and still have taxes on top of that. Another property it didn’t include insurance on for $451/mo. Then no guarantee they won’t jack up the HOA dues again the next month. These units also don’t move quickly. One property has been on the market for 190 days and they also historically don’t appreciate at the same rate as stand-alone homes.

I’m still looking and hoping the prices keep coming down more. There are so many units on the market right now. I also hope that I don’t lose my job since that could push things back a longggg time. In any case I’ll keep saving and to have the ability to do that I’m thankful. Going to focus on the things I can control and try to adapt to the ones I cannot to the best of my ability. Off to enjoy the rest of my Sunday now. Cheers!