As I type this up I’m enjoying the tail end of a trip to West Palm Beach and Fort Lauderdale. The weather has been impeccable, warmth that I wouldn’t expect to see at the tail end of December. Yesterday hit a high of 82. People were jugging up and down the streets and boardwalk like we were in the thick of summer.

December was a good month for me financially. Hit my max 2025 contribution for the Roth IRA and 401K. Ended the month still able to have a $0 balance on my credit cards. The trip I’m currently on we did on a budget through discounts, credits. Food and some other things went on the credit card but it was only a few hundred split across the two of us.

Two of the paychecks this month didn’t have my 401k contributions taken out at all so that gave me a lot more disposable income.

I just started reading a book called Zero World Problems: New Standards of Living For the Post-Materialistic economy by Aaron Clarey who also wrote the book Black Man’s Guide Out of Poverty. For context I read that book in March 2017 when my net worth was closer to *$25k*. A lot of the material in the first section I was already familiar with but it is nice to revisit some of the core principals that will help me navigate my 40s/50s and beyond. Keeping up with the Joneses really does not make us happy.

So what happened in December 2025:

1. I got a car repair close to $260 including an oil change and replacing old hydroscopic brake fluid with new fluid to improve longevity of the entire system. A little more money than I wanted to spend honestly. I can always do oil changes at the Honda dealership for $59.95 after a coupon. I think I paid closer to $100 for that and that was after a coupon. Not sure about the brakes. Sometimes you just want to get in and out though, in this case I worked while they wrenched on the car.

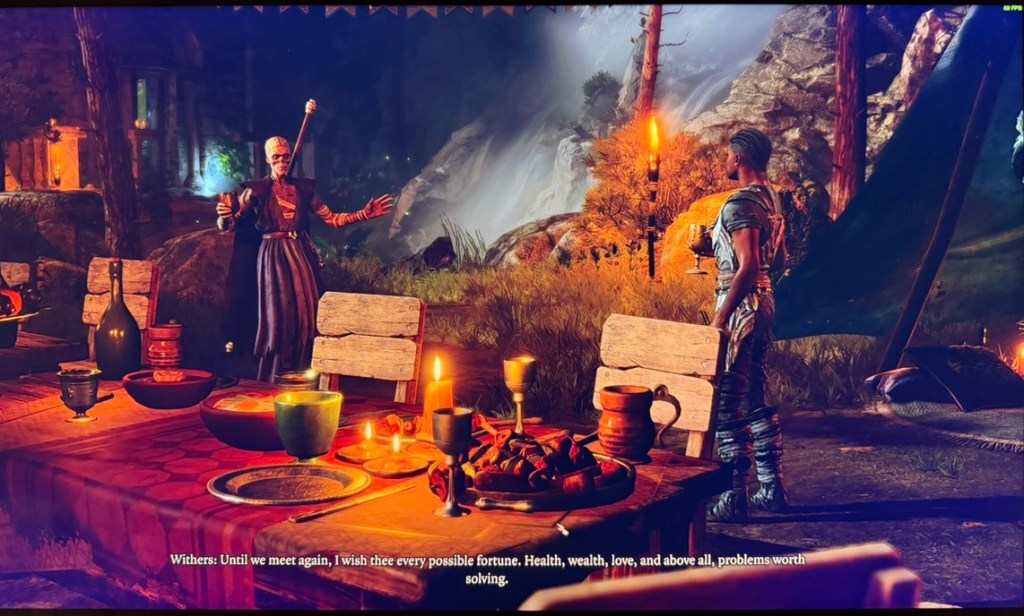

2. I finally beat Baldur’s Gate 3 – This came I bought about a year ago and it wasn’t super expensive. Got over 480 hours out of it which is a bit embarassing to admit. I promptly deleted the game from my SSD likely to never touch it again.

3. Got these Thai needles in bulk. My bf’s first reaction was to send it back but hey if we have 6 months worth of noodles in the cabinet that saves both time and money as long as we use them. Plus I’d argue they’re a touch more healthy than the kind you buy from the restaurant covered in sauces and oils.

4. Unsuccessfully tried to assemble a wooden cabinet for the office that had super cheap pressed wood and disintegrated on me.

5. Bought these supermarket flowers that I just love. They made it about a week and half before tossing them but it adds a nice pop of color to the space.

6. Christmas / Holiday festivities – Wicked For Good didn’t disappoint though I made the mistake of seeing it while sleep deprived in a dark movie theater.

7. West Palm Beach / Fort Lauderdale trip – Took so many pictures. I’ll post a few of them here. Lots of fun new memories and a well needed break from Dallas.

In my last post I set a net worth estimate for the end of 2025 at $480k

8. My mortgage is now paid up until March 1, 2026 (2 payments of about ~$2900 Jan and February) so it looks like my cash balance has come down a lot. I noticed these prepayments aren’t reflected on my oustanding balance yet. I like having a little buffer. Starting next month I’m going to start with the triple principal payments (2 more than normal month) scenario I mentioned in my last post.

People often overerestimate what they can accomplish in a year and underestimate what they can in a decade. Since last month my net worth is up about $5,500 and in the last year I’m up $104k or +27%. A decade ago I was in the negative $14k net worth range. Past me never would’ve thought my numbers would go up by $500k. I hope the new year brings you good health, financial abundance, and happiness. I’m going into 2026 ready to rock and roll.

| 12/30/25 | 12/1/2025 | Difference | % Change | 12/27/24 | YoY Diff | % Change | |

| 401K | $402,229 | $397,992 | $4,237 | 1.1% | $315,581 | $ 86,648 | 27.5% |

| Roth IRA | $57,765 | $56,073 | $1,692 | 3.0% | $51,574 | $ 6,191 | 12.0% |

| Brokerage Accts | $3,423 | $3,074 | $349 | 11.3% | $1,644 | $ 1,779 | 108.2% |

| Cash | $12,592 | $15,621 | -$3,029 | -19.4% | $11,896 | $ 696 | 5.8% |

| HSA | $6,343 | $5,869 | $474 | 8.1% | $3,559 | $ 2,784 | 78.2% |

| Total | $482,352 | $478,629 | $3,723 | 0.8% | $ 384,254 | $ 98,098 | 25.5% |

| Credit Cards | $0 | $0 | $0 | #DIV/0! | 0 | $ – | #DIV/0! |

| Auto Loan | $0 | $0 | $0 | #DIV/0! | 0 | $ – | #DIV/0! |

| Subtotal | $482,352 | $478,629 | $3,723 | 0.8% | $ 384,254 | $ 98,098 | 25.5% |

| Mortgage | $338,951 | $339,258 | -$307 | -0.1% | |||

| Zillow Estimate | $345,200 | $343,700 | $1,500 | 0.4% | |||

| Equity Estimate | $6,249 | $4,442 | $1,807 | 40.7% | |||

| Net Total | $488,601 | $483,070 | $5,530 | 1.1% |

Is this blog boring and repetitive? Maybe but slow and steady wins the race. 😀