As we finish off January 2026 I’m just trying to mentally keep track of what has happened. Not that long ago we were celebrating the ball dropping and the new year. Now it seems like more and more of the same stuff, different day.

- My employer filed for Chapter 11, and there were several changes from a senior leadership perspective. Operationally there were a few major changes too that I don’t really want to comment on. Hopefully that means my employment will be on stable footing over the long term. I was very anxious in the days / weeks leading up to it. Now it feels more like an ok that happened now what kind of experience.

- A pipe in the house burst several days ago when we had a deep freeze. I thought we were in the clear but apparently I grossly underestimated things. It started with the hot water side of the kitchen faucet not working. Then one day it started working again all of a sudden. However not long thereafter we started seeing water on the kitchen and garage floor. We also heard water running from somewhere which prompted to me to look outside of the house. To my dismay there was hot water flowing down the side of the house into the snow / dirt. At this point it was around 6:30 PM and I wanted to at least call a plumber to get their feedback. They told me to collect water in buckets, etc to be able to flush the toilet and have some for drinking purposes until the matter could be resolved. However after we hung up the steet-level water shutoff did not work. So the water continued to run outside until I found a handle on the hot water heater that turned it off. Roughly 2-3 hours between the time we saw the flooding and the time it was turned off. The hot water inside stopped working completely before that so no time to shower.

Also…. one plumber came earlier in the day to give me an estimate and I showed her a water meter that was spraying water, she had zero interest in even touching that and told me to call the city… After the plumber came and I paid $900, I noticed very low water pressure. I called the city to have them look at the leaking water meter that day and no one showed up. The next day I called again and said I had low water pressure on top of the call from the previous day. They showed up in 15 minutes and were outside for roughly 4 hours. Hopefully I don’t get a bill later on but now my water pressure has been great since.

3. Earlier in the month I decided to splurge and get some roof repair work done. One piece of roofing adjacent to the tree growing 3″ from the house and another further on the roof identified over the summer with visible hail damage. $775

4. Despite my additional expenses, I still enjoyed having fun driving in the snow and doing doughnuts. At least as much as an AWD almost 4,000lb vehicle would allow me to do in a parking lot without calling too much attention to myself.

5. To kick off things shortly after the year began my bf and I had brunch at Reunion Tower in Dallas. It was a lovely experience and I would go back again. Cheap no but within budget. It’s fun to live the high on the town lifestyle for a meal and then go back to the more affordable lifestyle in the suburbs.

6. When temperatures were much nicer in early January I took my trusty 2020 Cannondale CAAD 13 bike out for a ride on the trails. Really the only things I’ve replaced on it are tires / inner tubes, the seat, and water cages. The borderline crusty water bottles might be next, those plastics have a shelf-life.

7. I splurged on two shoes, one for workouts. The workout ones were $125 and biking ones were $86.34. I don’t feel guilty about these since the bike shoes were starting to split at the seams and are roughly 3 years old.

8. I am benefitting from having a DINK (Double Income No Kids) household though it doesn’t feel like it after the doozey of a month January has been. Having $1,675 come 100% out of my pocket with all the other expenses would be a real stretch once you add the $2890 mortgage, $150 electricity bill, $100 water bill, $80 internet bill, and the $625 per month extra going to principal.

9. Almost done with my tax preparation paperwork. It looks like I may get a small refund of a little under $1k. Thank you mortgage interest and itemized deduction. Hope to have most of it wrapped up in the next week.

| 1/31/26 | 12/30/25 | Difference | % Change | 2/2/25 | YoY Diff | % Change | |

| 401K | $404,137 | $402,229 | $1,908 | 0.5% | $ 324,256 | $ 79,881 | 24.6% |

| Roth IRA | $58,801 | $57,765 | $1,036 | 1.8% | $ 53,272 | $ 5,529 | 10.4% |

| Brokerage Accts | $4,614 | $3,423 | $1,192 | 34.8% | $ 2,016 | $ 2,598 | 128.9% |

| Cash | $11,723 | $12,592 | -$869 | -6.9% | $ 11,975 | $ (252) | -2.1% |

| HSA | $6,380 | $6,343 | $37 | 0.6% | $ 3,562 | $ 2,818 | 79.1% |

| Total | $485,656 | $482,352 | $3,304 | 0.7% | $ 395,082 | $ 90,574 | 22.9% |

| Credit Cards | $0 | $0 | $0 | #DIV/0! | $ 166 | $ (166) | -100.0% |

| Auto Loan | $0 | $0 | $0 | #DIV/0! | $ – | $ – | #DIV/0! |

| Subtotal | $485,656 | $482,352 | $3,304 | 0.7% | $ 394,915 | $ 90,741 | 23.0% |

| Mortgage | $338,020 | $338,951 | -$932 | -0.3% | |||

| Zillow Estimate | $343,200 | $345,200 | -$2,000 | -0.6% | |||

| Equity Estimate | $5,180 | $6,249 | -$1,068 | -17.1% | |||

| Net Total | $490,836 | $488,601 | $2,236 | 0.5% |

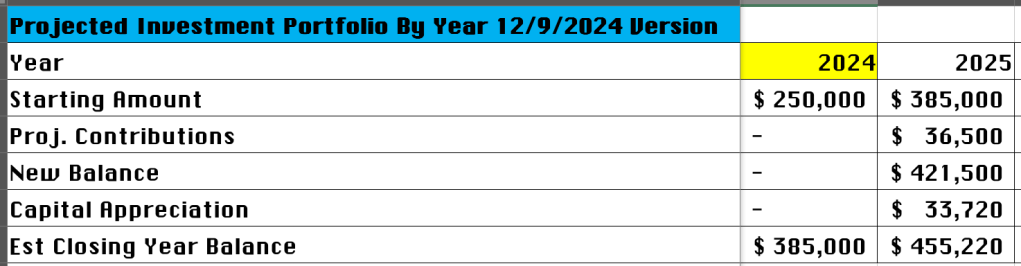

I started ramping up my investments into Brokerage accounts outside of my 401K / Roth IRA. I want my money to give me recurring income and capital growth…. Also not have to wait until 2043 to be able to access it. Especially with the way things are going with AI and my industry. You just never know.

Brokerage #1 : $200/mo ($50 per week) goes in split 3 ways between a Bond ETF, Berkshire Hathaway BRK.B, Vanguard High Dividnet Yield ETD VYM.

Brokerage #2 : $740/mo ($185 per week) goes into a mix of the following: BRKB ($99.56), GLD ($18.52 Gold), SCHY ($82.12 Schwab Strategic International), SLVR ($19.96 Silver), and the rest into FZROX ($611 Fidelity ZERO Total Market Index Fund). Silver just took a massive dump yesterday but I’m not discouraged. Dollar Cost Average or stop buying for a while.

Are these going to make me a millionaire? Hardly but it’s something to get excited about. Could cover gas money, a utility bill, be another income stream if I fall on hard times, etc.

Retirement #1: $576.92/mo ($144.23/wk ) goes into my Roth IRA. What I invest in is based on my mood that particular week but the majority of it is FZROX (94%), GLD (1.5%), SLV (1.2%), FEPI ETF (2.87%). I want to buy things here once and hold them over the long term. FEPI is generating me $36 of divideds monthly that gets reinvested.

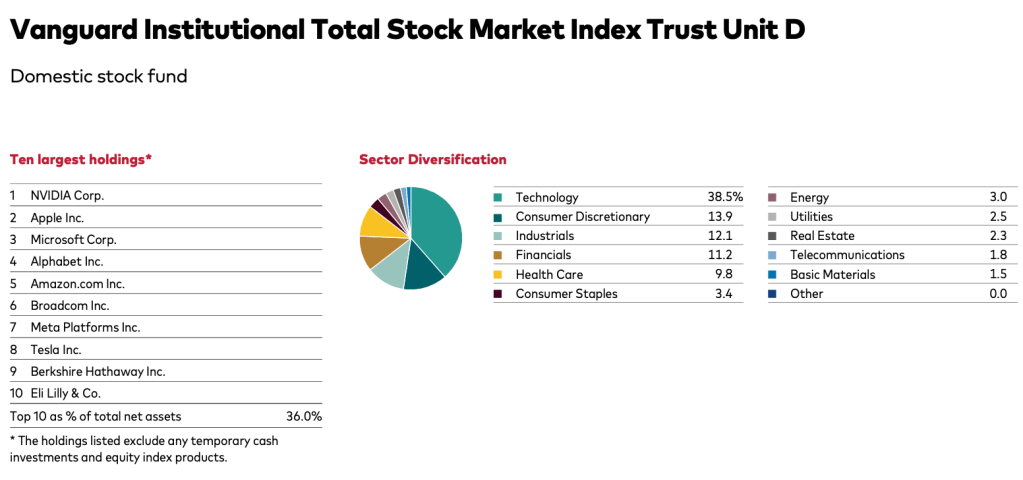

Retirement #2: $2,325 a month in 401k between my contribution and employer match. Most of this is in A Vanguard Institutional Total International Stock Market Index Trust, and about 5% in bonds.

Total Monthly: $3,842 | Total Annual: $46,103

Mortgage Monthly: $2,879 | Total Annual: $23,548

Extra Principal Monthly: $625 | Total Annual: $7,500

With those numbers above I think I’m doing as much as I can within reason. $77,151 for the year working on my financial future. Plus the $4,150 going to my HSA so really $83,301. That’s a lot of money. If I feel like I’m stretched too thin I can always change some things. And over $15k of that is through money my bf gives me toward expenses.

Overall I wish I was up more in the past month and $500k is still a stone throw’s away. Maybe next month if the market goes up. My ultimate freedom number is $2.5M. I’m happy my mortgage balance is down $932 in the past month. The interest is a pain in the pass so I’m going to keep doing the triple payments thing while investing and saving more.

In a year my net worth is up $95k or +24%. In a month I’m up $3.3k or .7%. Important to note all my 401k investments since the year began are not yet reflected in my balance. That’s being worked on and 99% likely will be fixed by the time I share my February update. I estimate I’d have another $2,300 between my contributions and the employer match.

Speaking of hard times Amazon went through a bunch of layoffs his week and there are rumblings of Oracle laying off a bunch of people. It fucking sucks no way around that. I hope I still have more time. Also hope 2 people I know recently impacted by layoffs get back on their feet soon. Hope you guys are safe out there and getting closer to your goals.