In 5 days I turn 41. I stared this blog when I was 29. That’s a long ass time. Despite few people reading, keeping track of things helps with my own internal motivation.

- Most recently my employers was offering a 2 for 1 match on charitable donations. I chose to invest a tiny amount in the National Kidney Foundation, in honor of my late father.

- Almost a month ago me and my boyfriend went to beautiful Hochatown, Oklahoma which is adjacent to Broken Bow. It was a great balance of tourist town, quiet and serene. I definitely would consider doing another cabin weekend. Maybe in a few months. Also doing some initial planning around a Europe trip next year.

- Friends and I saw Missy Elliott in concert a few weeks ago in Fort Worth. Also performing were Busta Rhymes and Ciara. So much energy and strong performances. We planned the trip back in April and the price was really reasonable. $136.50 per person including parking.

- I’ve been getting more into biking but definitely taking another hiatus. My body let me ride without major issues once this month but the second time not so good. Considering selling the bike and taking up other hobbies.

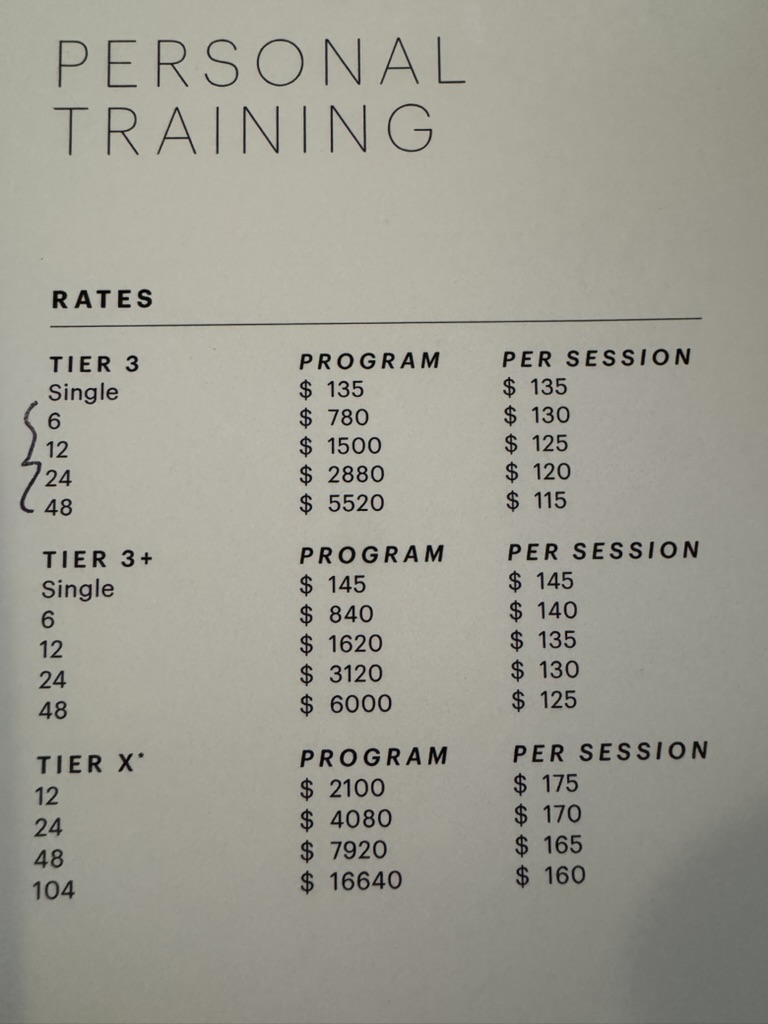

- Equinox recently increase prices to $221 per month up $10 from what I was paying previously. There are plenty of amenities that I really was not taking advantage of including the unlimited classes, spin classes, the saltwater pool, sauna, showers and locker room area with the big kicker is if I wanted to use a personal trainer that would be $135 per session on the low endso for a “”normal for session per month training regiment I would be paying $540 plus the $221 or $761 per month. To me that amount seems egregious when roughly 70% of fitness results are diet related and not training related. So I instead chose to join a more no-frills type gym that works out too roughly $53 per month and has more convenient hours. I estimate my annual savings at roughly $2000 per year. That’s the equivalent of my annual vehicle fuel expenses, or one to two vacations per year.

- At a macro level I’m considering what the next steps would be in my career. One potential area would be to work on or at least consider a masters degree in marketing. Well I do have an MBA, I earned that all the way back in the late 2000s so much has changed in my industry since then, I also selfishly have some slight paranoia about being surpassed by someone younger with either more industry experience or stronger, credentials than myself. Western Governors University offers such a program for roughly $4800 for a six month term and on average or I should say roughly 61% of students complete the program within an 18 months that would make it more likely for me to be eligible for either a senior director or vice president of marketing role. According to salary.com, the average Senior Director of marketing in my state earns between $166,000 and $209,000 per year. At the vice president level, the range is between $214,000 and $288,000. One of the big questions is how much I want to push myself particularly since I’m starting to slow down a bit in my 40s. Would pay for itself, and then some what I think, in terms of the power of compounding. Think defensively especially in this economy. Anything to help me stand out in the event I need to look for a new role seems like it would be a smart decision.

- Without going into a ton of details, I do have a tiny windfall over the next year or so. I will gladly take this over the other alternative, which is $0. There are certain stipulations that I must adhere to you, but overall, I think it will help me get to my goals a tiny bit faster.

- I have been dealing with an ant infestation earlier in the month. Loyal readers may recall that I originally started encountering this problem all the way back in fall of 2023. The management of the complex has been empathetic toward me and did give me the option of canceling my contract with just a 30 day notice. I have the paperwork sitting on my dining room table but have not yet signed it. The most recent update is the pest control company came drilled some holes in the walls sprayed in some foam along with treating the exterior by sealing some additional cracks that the ants were walking through to enter the building. I don’t wanna make a hasty decision that will cause me to suffer financially. Moving to a two bedroom apartment given the options I’ve seen would be somewhat expensive and cause me to take significantly longer to set aside money for a home if I choose to go down that path.

- I’m really starting to think more about how much money goes out versus how much I earn and I would like to keep more money in my pocket instead of having it go to other people. That is one of the fundamental reasons why I’m opposed to buying a Tesla vehicle. Why should I make Elon Musk richer? I’m currently shelling out $1400 a month in car payments, that should go away in December 2024. Then add $170/mo in savings by going to the cheaper gym. That’s the equivalent of a $1500/mo I can set aside for other things like saving for a home. After eight months worth of that $12,560 set aside or at the bare minimum working harder for me. Assuming a home purchase price of 280,000 that’ll be about 4.5% and I should be able to set aside another $7,500 on top of that. Another option would be to rent a home and let those dollars just keep working harder for me.

- Also why am I paying $62/mo for a cell phone in perpetuity? There is the Apple One Premiere cloud backup subscription $37.95, then T-Mobile $70/mo. Altogether that too is around $170/mo. 🤔

- Despite things not being 100% perfect in my life, I’m super grateful for everything that I do have. I read stories about high salary, individuals getting laid off from popular companies and I really do feel for them. The latest is with Intel, which is laying off roughly 10,000 workers. I see the videos, read the blog posts and I know how rough it is out there. One guy on YouTube was trying to find a corporate job for eight years, and lives with his parents at 48. Totally boggles my mind. A relative of mine who doesn’t really talk to me anymore was going through some stuff too. I see panhandlers on the road daily.

- Got my 0w20 oil change, rear differential fluid replaced, and tires rotated all under my certified preowned package. I knew the oil change was covered but not the other 2. Saved about $115 off of that.

Here is an update of my financial numbers. The market took a nosedive on Friday otherwise I would’ve been up quite a bit. Then again you have to look at these things long term. Flat month over month isn’t end end of the world. I do have about $2500/mo going into investments though so technically I’m down. Who knows in a week or two I could be back up again. Paying over 15% on my car monthly is extreme but will keep the repo man away so I stick at it. It feels like I’m moving at a snail’s pace but… YTD I’ve paid my car loan down by over $10,000 or 58%. Most people probably wouldn’t do that.

| 8/3/2024 | 7/1/2024 | Difference | % Change | |

| 401k | 271,447 | 273,612 | -2,165 | -.8% |

| Roth IRA | 42,544 | 42,536 | +8 | 0% |

| Brokerage Accts | 4,120 | 3,079 | +441 | +14.3% |

| Cash | 2,499 | 3,222 | +537 | +16.7% |

| HSA | 3,617 | 3,799 | -182 | -4.8% |

| Total | 324,888 | 326,248 | -1,360 | -.4% |

| Credit | 0 | 0 | 0 | 0 |

| Auto Loan | 7,497 | 8,853 | -1,356 | -15.3% |

| Net Total | 317,390 | 317,395 | -5 | 0% |

August 2024 Net Worth Update

Sharing a few pictures from the month of July. Enjoy life.