Not entirely sure where to start. November has been a rough month. I say it’s only money because in some cases that’s exaclty what it feels like. A tool and something I should enjoy while I’m still relatively young. So what’s been up with me?

- Less than a week ago I said goodbye to my beloved canine companion Sasha. She was ~16 years old and was with my since January 2013 so almost 11 years together. This is an extremely long time for a day to have and just 2 years shy of the max life expectancyfor the breed. I was devastated, fortunately a friend drove me to the animal hospital and was there to console me. She was in the vet’s office at least once every 2 months and on 3 different medications toward the final days.

My last visit to the vet was $180 for medication she needed, and her Hills Science Diet food was averaging around $44 for a 2 week supply of the wet food. She wouldn’t eat the dry if she got hungry. All of a sudden her health took a toll for the worse and she stopped eating, didn’t want to walk, poop messes on the carpet would happen 1-2 times a day, she didn’t want to go outside and would just look me when I asked her. Not even a week earlier she would bark, wag her tail, all of that behavior ceased in the final days. Even the tiny steps leading to my front door I had to hold her legs otherwise she’d fall over. Her body was starting to get frail overall, from a once slightly overweight size.

I got $30 probiotic dog bites to get her to eat again, I threw treats at her, even gave her a high calorie gel for $15 from PetSmart that she only ate because I spread it on her paws. Eventually I admitted defeat and acknowldged any further treatment to keep her alive would be extremely risky and had a low probability of success. The fee for the procedure was $332.75. I should get her ashes and paw print next week. I’ve cleared out a good chunk of things from my apartment that were hers including dog beds, food, crate, and medication. I also put my Christmas tree up early to try to focus on the present.

2. Car update…. I wasn’t planning to trade my car in after a year only $4800 away from paying it off. I had enough cash to pay it off in full. In 12 months in addition to the 9 issues I mentioned in last month’s post, there is one big one. Sticky steering. You’re driving like normal and all of the sudden the steering wheel sticks in the middle of a turn, or while dead center. I have enough strength to overpower it but why is a relatively new car doing this?? Lane keep assist is turned off and it keeps on sticking. The issue has 100s of reports on for various Honda Civic models and 40+ for my particular model of car.

1. With a $2k down payment and the equity on my trade my debt increased from $4800 to $21,500, $16,700 more of debt to take on which yes is a significant amount. Also includes sales tax of just over $1k and I negotiated them down a bit down on the price of the car and up on the value of my trade-in.

2. The amount of total debt on the car is still a fraction of my annual pay. I could have it paid off in 9 months if I really hunkered down. My required monthly payment is $356.17 but am going to start out paying $750 per paycheck or $1500/mo possibly more to speed up this process.

3. Interest rate is up to 5.99% from 3.99% which isn’t great but still a lot lower than what I’ve seen out in the marketplace.

I did have a bit of drama with the dealership. They outsource a third party to do wheel repair. On the left is what the wheel should look like. On the right is what mine looked like after they used the wrong paint code to paint it. I waited 11 days for them to repair the wheel properly and get my car back, this is after driving my car for only 3 days. They did give me a loaner the whole time though and the final product looked fine..

So what I bought was a 2023 Certified Pre-owned Acura TLX A-Spec SH-AWD with about 6800 miles on it. First car I’ve owned without a CVT transmission since 2008, the audio system is amazing and sounds like studio on wheels. It handles incredibly well around corners, the seats are a lot more comfortable, 72 more horsepower / 88 ft/lb more torque, the seats don’t hurt my back. It comes with LoJack which I didn’t want but I guess I’ll keep it now. Missing the heads up display, remote start on the keyfob (I can activate it in the app however), and not as good mpg but I wasn’t spending much working from home anyway.

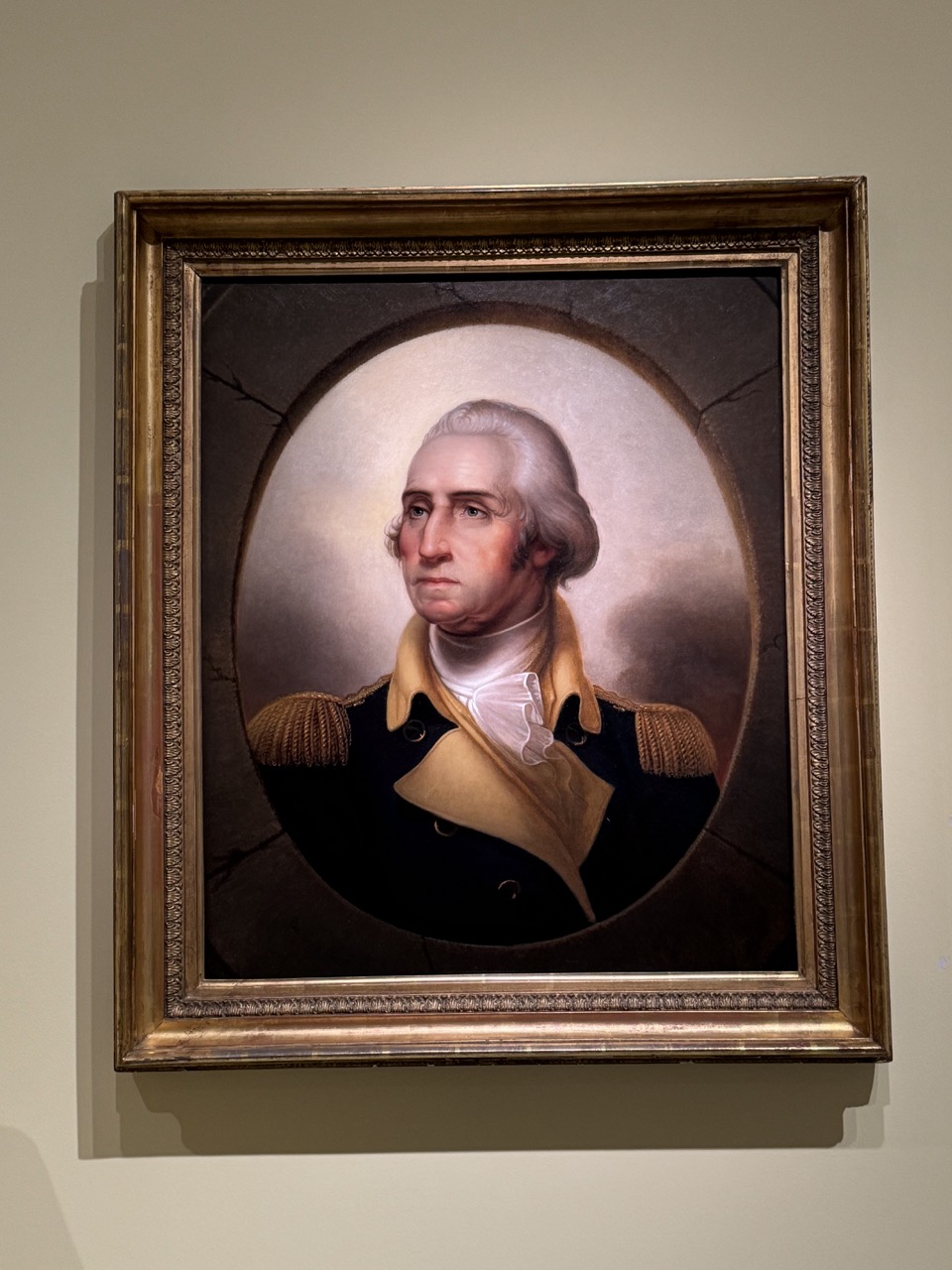

Had an amazing date with a guy I’ve been dating about 6 weeks. Love how down to earth he is and he’s much more open to exploring new things than I am. It’s kind of funny even though he’s 10 years younger than me he’s a bit of an old soul. He was singing I Am What I Am and Hello Dolly in the car yesterday. Here are some pics we took at the Dallas Museum of Art.

More Dallas Museum of Art Pictures.

In the coming week I’m upgrading my laptop to the latest and greatest M3 Max MacBook Pro 16″. Even with the student discount it’s not cheap. I fortunately was able to secure a $2,250 price on my current model. It’s 0% 308.25/mo or $305.17/mo for 12 months plus tax but the old model sale covers about 7 months of that. Planning to paying it off early after a month or so. I don’t need it but the Mac is my only gaming platform. I get 4 more CPU cores, 2 more GPU cores, 16GB more memory. A lot of benchmarks I’ve been consider it desktop-class in a laptop. This is something I use everyday for multiple hours a day so I’ll be getting a ton of use out of it.

I feel guilty spending money sometimes but what I spend on is reasonable proportional to my income. The car is another $16,700 financed, not $50k. The computer is another $1,754 not $4k. I’m cutting back on retirement short-term to get some of these debts down but then full-force. The first car loan payment is due 12/3 and I’ve already made a $750 payment. I just made my December rent payment so I’m good for the rest of 2023.

| 11/4/23 | 10/1/23 | Difference | % Change | |

| 401K | $200,424 | $195,147 | $5,277 | 2.7% |

| Roth IRA | $29,157 | $28,748 | $410 | 1.4% |

| M1 Account | $1,564 | $1,277 | $286 | 22.4% |

| Cash | $4,330 | $3,234 | $1,096 | 33.9% |

| HSA | $2,414 | $2,140 | $273 | 12.8% |

| Total | $237,889 | 230,547 | $7,342 | 3.2% |

| Credit Cards | $151 | 115 | $37 | 32.1% |

| Auto Loans | $20,803 | 5,368 | 15,435 | 287.5% |

| Net | $216,934 | $225,064 | -$8,130 | -3.6% |

There you have it. No student loans, basically no credit card debt. A car loan that I’m quickly chipping away at. Experiencing life more and investing but not being worried about money. Thankful for all the supportive people in my life. Still missing my beloved dog but she would want me to be happy and I’m doing things to make that a reality. Much love!