Cars are a funny thing… A status symbol, a means of getting from point A to point B, and also one of the largest depreciating assets people purchase without thinking twice about. I’m 67% done with my car payments. I’m heavying up on my payments within the limits of my budget.

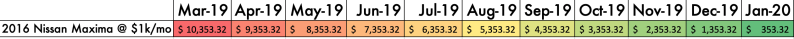

Much like before with my credit card debt I decided to make a spreadsheet to track my progress. If I can pay $1k a month now through the end of the year I will essentially have the car paid off by January 2020. In terms of $ amounts that’s $455/mo or $113.75/wk or $28.44 a day, not including the 1.9% interest.

At the time of this posting, we are still in the middle of a bull market. The S&P 500 is at $2,822.48, very close to its all-time high of $2,929 in September 2018. I expect a correction to happen at some point in the near future. When that happens I will start ramping up my invesments. It’s kinda hard to do that though when you’re sinking a lot of cash into a car.

Urgency – Yes, I’m lighting a fire under my ass. Is it sustainable? I’m not quite sure. Life costs money. Fixing cars, buying clothes, going on the occasional vacation, social events, medical expenses, rent, all that stuff. I’m going to give it damn hard try though.

Let’s look at a couple of statistics on millennial debt from CNBC. Look at this January 9, 2019 posting:

1 in 5 millennials with debt expect to die without ever paying it off

“The average millennial (aged 18 to 34) had about $36,000 in personal debt, excluding home mortgages, last year, according toNorthwestern Mutual’s 2018 Planning & Progress Study. That debt can feel both crushing — and endless.”

By that definition I am doing way better than the average millennial.

It’s fucking insane to think that 20% of people 18-37 are never paying off debt, and 42% don’t know if they can pay off debt. For Gen X, the folks who were working during the time of the greatest economic prosperity in the last 40 years are saying 28% are never paying it off and 35% are unsure. I can see if there were temporary hardships, but it seems like lots of piss poor planning to me.

Even if you invested $50k in the S&P 500 back in 1995 it would be worth 4.4x that with dividends reinvested or $220k in today’s dollars. If you started with the average price of a car ($12k) in 1989 dollars and kept in invested, that would be still be worth $91k 30 years later.

John Bogle founded the ‘First Index Investment Trust’ on December 31, 1975. He recently passed away but imagine you were fortunate enough to have been an early adopter, or if your parents were. The average price of a car back them was $5k, if they invested that amount, without ever investing again…. and just left it there… It would be worth $120k today.

My point is this, we are living in a time of the greatest economic opportunity for everyone. Index funds are extremely easy to acquire especially if you are an American.

Back to cars for a moment…there are a ton of overdue loans our there. Some folks think it’s a giant deck of cards waiting to come crumbling down. I can definitely see their point. According to a bankrate.com posting, auto loan delinquencies have recently surged past where they were during the Great Recession.

“Some 7 million Americans are 90 days or more behind on their auto loan payments, new data released by the Federal Reserve Bank of New York shows. The number of delinquent loans follows a trend of steady increases since 2011 and has risen to the highest level in the 19-year history of the bank’s loan origination data.”

If you do what other people are doing, you’re going to get the same damn results, myself included. People buy cars and homes they can’t afford to impress people they don’t like. You can have nice things, but be responsible about it. Get that loaded Toyota Camry instead of that Benz status symbol. Better yet, get a slightly used one someone else has taken the depreciation hit on. Unless you really can afford it.

Warren Buffet’s rules of investing: “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.”

My mom of all people shared two videos on YouTube with me, both of which I already saw before.

1. 3 Reasons Most Black People Don’t Become Wealthy | Valerie Love

I’ve been mostly Black my entire life and my have I seen the mistakes people make. Some people try to look all fancy, but overwhelmed with debt. One had to ask a relative for money to go buy diapers. Years ago he was riding around in a sports car, making music, along with a high paying job. Me personally if I wanted to rely on my credit cards I could go out there and rock designer clothes. I’d rather have the money in my bank account and be near debt free instead.

2.Roth IRA: How to be a TAX FREE MILLIONAIRE with $12 PER DAY – I love Graham Stephan’s work. He seems like a no bullshit, young successful guy. He’s like 10 years younger than me and made most of his money through real estate.

I’m 35 years old, when my father died, his net worth was ~-$50k. It’s kind of tragic in a way, my retirement now is basically as much as what he was in the red for when he passed at age 47. Even after Medicare / medicaid kicked in. I try to learn from his life experience, much of it was outside of his control really. I have the power to control my destiny so you better believe I will fight like hell.

I’ll end it with this, there are lots of people out there who don’t want you to succeed in life. Perhaps a bit of it is a crabs in a barrel mentality. They don’t know any better, what is considered safe and secure is really a recipe for adversity. Just because certain things worked for the baby boomers, doesn’t mean it will work for a Millennial or younger person coming up in an era where benefits are shrinking, wages are staying pretty stagnant, student loans and home prices are ridiculously high, and we don’t have a cushy pension to rely on.

No matter how deep you are, you can take steps today to improve the situation. I’m living proof of that, along with millions of others. It might take time but there is a light at the end of the tunnel. I posted a video on a new YT channel I put together. I keep saying I’ll post more content to it. Just want something a bit more scripted and to the point. My first video, essentially another I don’t know what the heck I’m trying to say without rambling post is here.