So a friend in New York posted a few pictures to Facebook. We dated briefly in 2007/8 but have remained friends since. The apartment he lived in for several years was engulfed in flames. He moved out a few weeks ago after things went south his now ex-partner…

I don’t own many worldly possessions at least in the grand scheme of life. The suspected cause is due to something electrical, but not truly known. Some say things happen for a reason. He’s pretty lucky though, this easily could have happened while he was at work with his dog in the home…

The father of a college friend of mine passed away 2 weeks ago. He was 74 years old and his son is a spitting image of him. Aside from that I don’t know much about the guy. My friend though is one of the nicest guys I’ve ever met. He gets along with almost everybody and is really the kind of person you could not see for a decade and then continue like nothing happened.

I did a very *non* Debt Free Alpha thing the other week. I went to Best Buy, hoping to walk out with a 4k television. Yes, it’s additional debt that will slow down my progress but….

- Prior to this purchase…I used a 2010 32″ 720p LG TV in a 10’x10′ bedroom. While fitting for the time and my budget. That’s 7 years ago and I’ve been in this apartment for about 3. Years before that I didn’t have a TV of my own at all. It’s tiny for any type of movie watching, outside of my bedroom, particularly in the kitchen or dining room area.

- I got a fairly good deal from Best Buy, $599.99 for a Samsung 49″ 4k HDR Class UN49MU7000FXZA. It’s not curved, but in 2014 a 1080p 48″ from Samsung was priced at $1,999! That’s almost 70% cheaper. I complained about the sales tax and they took it off the Chromecast 4k I also bought with the TV.

- I rarely go to the movie theaters anymore. Yes for major titles like Star Wars – The Last Jedi I make exceptions to the rule, but I prefer to stay home with my own food,

I did manage to get a good deal on the TV. It was $599 for a 49″ Samsung 4k with HDR. Plus a Google Chromecast I got to help me stream online content from different sources. The screen is crystal clear, the audio fills up my living room even without one of those fancy sound bars. My living room finally feels like one.

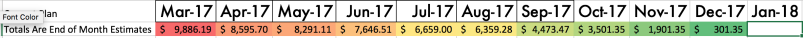

I received a small, unexpected financial windfall yesterday. The company that laid me off in early 2012 finally settled its case with WARN Act settlement. My cut was $314. Not a huge sum of money but nice to finally get back what was owed to me.

I pulled my Roth IRA original investment out, about $1,001 transferred it to my checking account. There should be no tax implications, but I did contribute it to my HSA. After the transfer clears I will pay myself back to cover a chunk of my medical expenses that are currently on my credit card.

As my earnings go up, I’ve come to the realization that taxes suck. I’m going to take more steps to legally lessen my short term burdens there. The amount I’m paying is kind of insane.

Call me delusional but by 2019 I don’t want a car loan or any more debt anymore. Time to truly be debt free!! More to come…