Looking back, January 3, 2023 my net worth was $173k, was aiming to hit $200k. Here we are now at the end of 2023 and I’m reflecting on the year.

Accomplishments , Big Purchases and Life Changes:

-Got promoted in August and now earning the most of my entire life. Stress levels go up and down but overall I’m satisfied with where I’m at for now, 3 years from now might be different story. The top 10% in the state have an income of $239,765 according to an article on Yahoo Finance. Maybe one day I’ll get there, but even if I don’t I can have an amazing life without it.

-Weight – Literally the same weight I was a year ago. The fact that I didn’t gain any I suppose is an accomplishment, but I really was hoping to lose a significant amount.

-Switched phone plans – T-Mobile has been a really good experience overall, much improved over the distaster that was AT&T. Basically hey we’re going to charge you for 5G even though there isn’t a tower where you live and not tell you at all about it.

-TV – Bought a 65″ TV and had a friend help me mount it to the wall. Mini-LED, bright colors, deep blacks and really makes the room look a lot cleaner. Crazy good deal on it at $649.99. The TV I bought in 2017 is now what I keep in the bedroom and gets used on rare occassions.

-Gym – Switched from Anytime Fitness to Equinox. I was going to CVS and the first Anytime Fitness location I went to which was rundown, super tiny and never had any of the equipment updated wasn’t there anymore. I just saw a For Lease sign in the window. So far it’s been a great experience, it’s clean, new, never super congested and has some nice amenities. Still haven’t registered for any classes yet but I want to give it a go for something lighter intensity.

-Car – Bought a CPO one to replace the lemon-adjacent 2023 Acura Integra. The TLX wowed me between the extra power, SH-AWD handing, comfortable seats, 17 speaker ELS audio system. It did involve me financing an additional $16,700 and putting $2k down. I used money from a cancelled warranty to go right to the principal. The total amount I’ve financed has dropped from $21,500 down to $17,746 or -$3,754

-Dog – I told her once that I’ll keep fighting as long as she wanted to. I knew that day was coming and tried everything possible within reason to prolong her life as long as possible. Losing her on Oct 31 was one of the biggest life changing events of mine since moving into this apartment in 2014. I still know I made the right choice after having her on 3 medications, battling 3-4 health issues at once. I didn’t go into a deep depression or anything but went through several waves of grief. The apartment still feels eerily quiet without her. Between the noise she would make eating or drinking from her bowl, the baby growling at me when she wanted a treat, the snoring, the very specific way she would sniff out treats like a pig. Still not sure if I’m going to get another dog anytime soon.

-401k – For all practical purposes I maxed out my contributions for 2023. Came in about $200 short due to a calculation error on my part. I didn’t listen to all the people saying the economy was going to implode. I mean it still could in the future but dollar cost averaging has worked in my favor

-Roth IRA – Contributed to it but still working on closing the contribution gap. Have $2,587 to go by April 15. $3,913 of contributions so far for the year is nothing to scoff at though

-Concerts – Saw Janet Jackson live in June which was significant since I’ve been listening to her music for over 30 years. Buying tickets on presale is a game changer given these incredibly high prices.

-Movies – Since getting my AMC Stub’s membership I’ve seen 20x more movies in the theater than I used to. In order from most to least recent – The Color Purple, Saltburn, Wonka, Wish, Hunger Games; The Ballad of Songbirds & Snakes, Next Goal Wins, Priscilla, The Marvels, The Exorcist: Believer, Strange Way of Life, The Creator, Dumb Money, A Haunting in Venice, Bottoms, The Equalizer 3, Teenage Mutant Ninja Turtles: Mutant Mayhem, Strays, Gran Turismo: Based on a True Story, Barbie, Mission: Impossible – Dead Reckoning Part One, Joy Ride, Indiana Jones And The Dial of Destiny, Elemental, The Flash, The Blackening, The Little Mermaid, Guardians of the Galaxy Vol. 3, Air, Chevalier, Renfield, The Super Mario Bros Movie, Dungeons & Dragons: Honor Among Thieves, Creed III, Cocaine Bear

Other Items / Reflections:

-I didn’t do any traveling this year. I was supposed to go to Chicago in August for my 40th and got sick with a double ear infection.

-Last week I got Covid-19, for the 3rd time. I thought about doing a last minute trip, but my mom would still be working so that kind of defeats the point. A New York Spring 2024 trip is in the cards. Also want to plan some type of trip with my boyfriend since he loves travelling and is good company

-I started a new Instagram account to track my fitness. That will essentially be my accountability partner along with the YouTube content. Short updates only, I can ramble on and get off topic with the best of them so nothing more than 5 minutes a video is ideal.

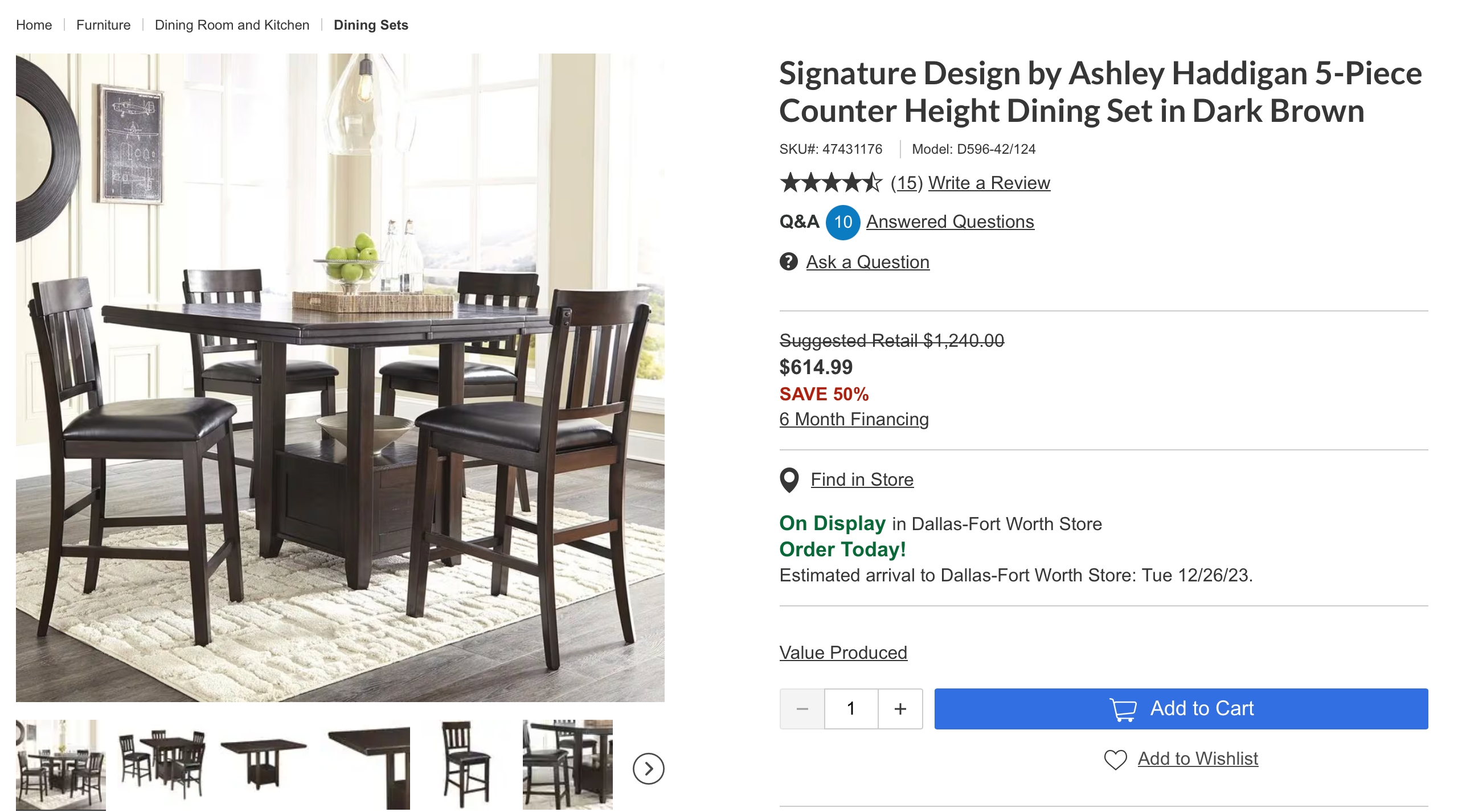

-Dining Set – Guy came on time and was kind enough to drag each of the three boxes to my living room instead of just leaving it “on the street” or outside door. Tipped him $10 as a thank you. Assembled 4 chairs yesterday after a bunch of mini mental breakdowns. Got dizzy between outgassing of the equipment and only having cold brew coffee to drink while intermittent fasting. A neighbor saw me struggling with carrying the old dining room table to the curb and offered to help. Not even 2 hours later the table and all of the 5 chairs were gone. I view that as a donation to charity.

-Credit Cards – Effectively down back to 0 again. The M3 Max MacBook Pro paid off, car insurance for 6 months, 1 years of renters insurance, all the clothes I bought for Black Friday / Cyber Monday

-Met an amazing guy I first matched with on July 10th through Tinder and met in person with on Sept 24th. Lucked out since he easily could’ve unmatched me or met someone else after I went silent since I thought someone else wanted to be exclusive and dumped me 2 weeks after my birthday. No one is perfect but I feel like we have a lot in common and he actually shows an interest in dating me.

-Turning 40 was a huge milestone for me. I’ve taken a long hard look at where I’ve been and where I plan to go on this journey called life. I see people who are successful financially but they look old and some of them are in really poor physical shape. Others don’t let go of the party scene and they’re still getting crazy and drunk every weekend. My body no longer lets me do that so I’m mostly a non or semi-social drinker.

-Time is a precious resource – Whether it be regarding chasing after people who show no effort, or simply how I use the hours in a given day. I think back to the year 2000 sometimes and about all that was happening in that era and how far things have progressed since. The reality is the difference between 1976 and 2000 is the same as 2000 and 2024. People get old, have kids, move, die, move up, lose everything, become politically extreme or one-sided about everything. Or they just want to find peace and experiment with something different.

-Cars are expensive. Even a moderately higher end car like my 2023 Acura TLX for $46k + tax. I put $2k down and still increased my loan balance to $21,500. The BMW I wanted was impossible to find and too expensive, maybe in a few years. Lifestyle creep is a real. Be reasonable but get something you like is how I like to approach larger scale purchases. The author Ramit Sethi whom I’ve looked up to for some time drives a 20 year old Honda Accord but will spend thousands on a jacket he will keep for years and years. We all prioritize spending in different areas.

-Doing the math saves you a lot of trouble down the road. It helps negotiating salaries, large scale purchases like a vehicle or a home, or how to plan to hit a debt payoff goal by a certain date. Even on my salary with interest rates the way they are I can’t afford the $325k home I was looking at. With a minimum amount down still looking at over $3100/mo in expenses. To get to the well-respected 20% down I’d have to start saving now for 3-4 years down the line. I did a little quick math. It would take $81k to be able to do a 20% down payment and cover the buyer’s closing costs. Even if I don’t buy a house I should start setting aside some fuck you money just in case things go south.

So $81,000 in…

4 years is $1,687 / month or $844 biweekly

3 years is $2,250 / month or $1,125 biweekly

2 years is $3,375 / month or $1688 biweekly

1 year is $6,750 / month or $3,375 biweekly

| 12/31/23 | 12/2/23 | Difference | % Change | 1/2/23 | |

| 401K | $227,680 | $215,535 | $12,145 | 5.6% | $155,964 |

| Roth IRA | $33,551 | $31,319 | $2,232 | 7.1% | $23,403 |

| M1 Account | $1,863 | $1,712 | $151 | 8.8% | $446 |

| Cash | $2,739 | $2,522 | $217 | 8.6% | $7,002 |

| HSA | $2,637 | $2,494 | $143 | 5.7% | $3,100 |

| Total | $268,470 | $253,582 | $14,888 | 5.9% | $189,915 |

| Credit Cards | $336 | $1,407 | -$1,071 | -76.1% | $0 |

| Auto Loans | $17,746 | $18,697 | -$952 | -5.1% | $16,909 |

| Net | $250,389 | $233,478 | $16,911 | +7.2% | $173,006 |

My overall net worth is up about 45% YoY or $77k. Month-over-Month it’s +7% or $17k. I feel really good about both of these. Life isn’t all about money and I think often about my health, and future. Focus on what you can control, everything else is up to chance in a lot of ways. $250k net worth, the little piece of paper in my home office had $150k written down for 2023. Started this blog in April 2012 at -$42k or -$63k in current dollars.

Some pictures from December 2023. North Park Mall, new dining room set from Nebraska Furniture Mart, standing at Granite Park in Plano outside of Surburban Yacht Club, and on the way back from the Equinox after doing a crazy hour long set on the elliptical.

Wish you all a Happy, Fun-Filled, and Healthy 2024. My #1 piece of advice to both you and myself is to spend more time living life, focused on you and your loved ones, life goals, and less on social media worrying about what other people are doing.