So there are three times where I almost died.

First: About 1992 I had a BMX bike, maybe it was a Mongoose I don’t fully recall. My overprotective (and rightfully so…) mother and grandmother were adamant about me wearing helmet. Two blocks over, a group of kids in my neighborhoods, being 90s kids and all set up a ramp in the middle of the street.I pedaled hard as I could to gain speed, went up the ramp. My bike flew up in the air and I landed right on the helmet…. which SNAPPED in half. My hands, legs and ankles broke some of the fall. Crazy road rash. A neighbor poured some peroxide on my wounds. I was visibly shaken and in some of the worst pain of my life. I was able to walk my bike home and miraculously broke no bones, a fact that still holds true in 2016.

Second: Winter 2010. On my way to my banking job. I am caught in a police chase. My car was doing about 40. The Toyota Camry passed me at such a high rate of speed (more than twice as fast as me) I felt everything shake. About a mile down the road I saw the car flipped over on fire and several armed officers approaching it. Later I found out the driver and passenger died on impact after hitting a tree.

Third: November 2016. Gastroenteritis I thought due to food poisoning, ending after 2 days. Then again a week later I had a pain near my navel. I went to a clinic, told the doc about my pain and got an sonogram. It came up clear, he said come back in 2 weeks since the Holiday break was upon us. Wednesday and Thanksgiving I thought I was fine. Friday the sharp pains came back, Saturday was a little less manageable. Sunday… let me tell you about Sunday. I got this fancy blood pressure monitor on Amazon. Before I left the house I was at 158/106 with a 115 pulse. Not great and cause for concern. I drove my car to the hospital and walked into the ER. No ambulance, no friend around to take me there. The number jumped to 193/128 and 119 resting pulse. My temperature 102°F.

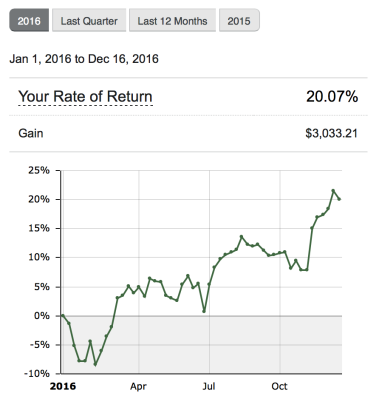

I put off going to the ER because I was concerned about the money. I didn’t want to waste thousands of dollars only to find out they didn’t know what was wrong. That happened to me once in 2005. The bill was $3k at the time but still.

Baylor took me right away. I think the admitting nurse was surprised I drove there, could still walk and have a normal conversation. I was given pills to lower my temps, blood pressure and oxygen tested multiple times. They gave me a contrast drink mixed with lemonade to show better results on the ct scan. My diagnosis? Appendicitis, an abscess on my appendix and Peritonitis.

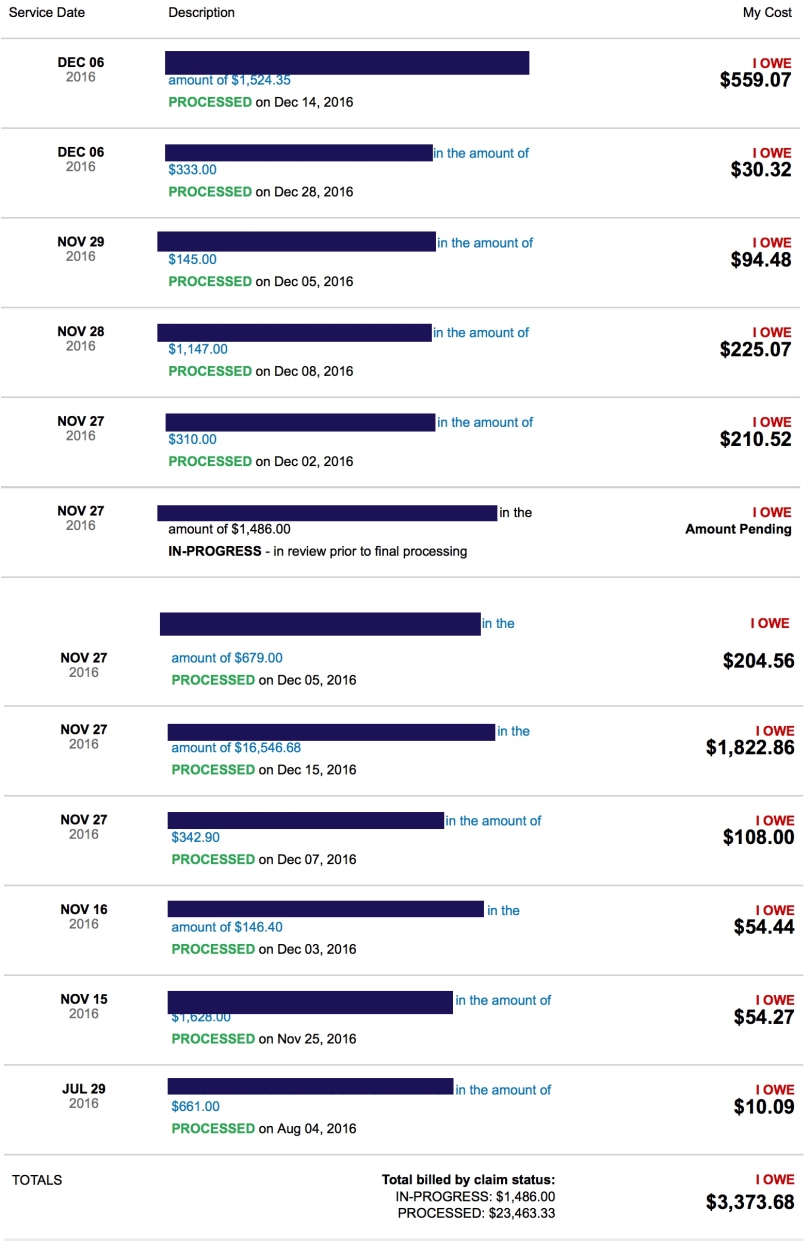

I stayed in a hospital bed for two nights. Barely eating any food, getting antibiotics pumped into me and having to take several hits of morphine medication just to allow me to sleep. I have coverage through Aflac for ER overnight stays as well as my normal medical coverage. I’m not looking forward to the bill of course..

Make sure you have insurance. If you have sharp pains near your stomach, go see a doctor. If you get misdiagnosed and the pain is still there, go back. If I stayed stubborn and didn’t go to the doctor when I did, who knows… I might not be here home on Late 2013 MacBook Pro typing this message. I could still be in the hospital or perhaps dead.

I still have to get my appendix itself removed as well at the catheter that is plugged into it. Even if the inflammation is gone, I never want to experience that pain ever again in my life. Maybe this is a sign to keep my blogging up and continue making other changes in my life?