Major milestone for me:

401k – $49,674

Roth IRA – $4,019

Total Retirement: $53.6k

Credit Card: $0 (at least the day I paid it off last week)

I decided to make a large contribution to my Roth IRA for 2018. Depleted my emergency fund in the process. I can replenish it in less than 2 months. I’m living a life of no regrets and not contributing as much as I could to my Roth would’ve been one.

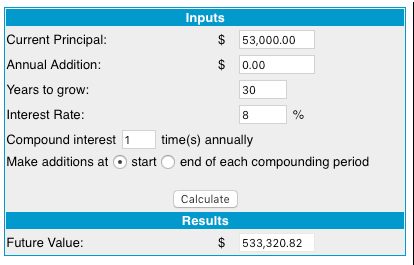

It’s fun to think about how much this will earn over the next 30 years even if I completely stop. $533k making me a half a millionaire.

Major milestone for me:

401k – $49k

Roth IRA – $4k

Total Retirement: $53k

Credit Card: $0(at least the day I paid it off last week)

I decided to make a large contribution to my Roth IRA for 2018. Depleted my emergency fund in the process. I can replenish it in less than 2 months. I’m living a life of no regrets and not contributing as much as I could to my Roth would’ve been one.

It’s fun to think about how much this will earn over the next 30 years even if I completely stop. $533k making me a half a millionaire. Even just maxing out the Roth for the next 30 years. Assuming everything holds true I’ll have over a million dollars saved.

If I can swing maxing both out, which for the record is my goal starting 2020 I’d have over $3MM.

Realistically though I plan to be retirement-optional by the time I turn 50. One of my online acquaintances retired at 50 and has also gone completely off the grid. Can’t say I blame him, it’s important to do what makes you happy in life. For some it means leaving the tech sector completely and doing not sitting in front of a computer.

I am still fascinated by the early retirement movement and hope to be one of the lucky ones who plays his cards right. Joe paid off his condo 3 years ago and has been maxing his 401k out for years before that. I’ve always been inspired.

I looked at condos and townhomes at $200k or under. What I saw is grossly overpriced. Even with renovations, a place I was looking at sold for $121k in 2010 is now selling for $200k…I find a 65% increase in value a bit hard to swallow. I don’t think my rent will exceed $900/mo come August. I still want something a little nicer, safe, ample parking, and closer to work. In the past what I’ve been looking for doesn’t exist…There is the option of moving in the building right next to my job. Between tolls and gas I’d save about $200/mo. The *cheapest* studio goes for $1,460 though, 72% more than I’m paying now.

In a few places downtown people have continually said they don’t feel safe. Cars have been broken into, there have been shooting incidents (including one with an off-duty police officer) issues with a growing homeless population. So many choices available.