Hey there, knock knock. It’s me, the 30 year old guy in Dallas paying off his debt.

Been a while since my last post and I wanted to bring you all up to speed on what I’ve been doing lately.

So I bought a brand spanking new 15” Retina MacBook Pro with Iris Pro graphics for $1929.06.

Laptop: $1891.49 (this is the lowest possible price I could find and no tax )

Overnight Shipping: 37.57

Grand Total: 1929.06

What is he insane? He owes $34,342 on his student loans?! Suze would deny you! Hypocrite.

So take the 1929.06

Subtract 810 for 13” MacBook Air (paid $1560 shipped June 2012), might’ve gotten more if apple didn’t cut prices $200

Subtract 40 for the Apple Wired Keyboard sold

Subtract 70.50 for the Apple TV I have listed (got this with my credit card rewards points)

Subtract $30.00 for the USB Foot Pedal I sold. Originally I was going to do speech dictation work, then I saw how much it paid. It goes back to valuing your time / effort. I’d rather learn something technical that could help me in my current career / provide backup it I were to lose my job tomorrow.

Leaves ~$1000 for a brand new laptop not including my shipping fees or the cut eBay gets. I also sold a PhotoReading speed reading course for $99. All of these items were literally collecting dust, even the newest of the bunch the AppleTV rarely got used with our PS3 / Chromecast I was given as a gift hooked to the living room TV. Selling stuff on eBay that is worth money and I don’t use is a little bit of a high. My computer and phone are my two most used electronic devices.

Why did I buy the 15” Mac Book Pro?

- Retina display. It’s super crisp, 220 pixels per inch, capable of resolutions up to 2880 x 1800.

- Bigger screen. I use a mechanical keyboard with my laptop to avoid wrist strain. This puts me an additional ft away from the screen. With the 13” it was a lot harder to read. I kind of went from one extreme to the other going from a 17” laptop to a 13 inch.

- Faster – Dual core vs quad core. The CPUs are more capable at multitasking and running CPU intensive programs in general. The graphics are over 2 to 300% faster than what I was accustomed to with my HD 4000 graphics card. I’m starting to play more games to pass my time and the performance boost really comes in handy.

I wanted to buy myself something nice. I won’t be getting rid of my car for a while, my wardrobe is decent, I’m making more and more meals at home. Since I use the computer so frequently I could justify this at least in my own mind.

I’ve been somewhat on a roll with regard to my overall cash flow. Just completed my taxes and I’m getting over $1600 back between my two jobs and student loan interest deduction. That will be at approximately the same time as my next paycheck and I spent almost nothing eating out this week. I’m starting get more acclimated to bringing lunch with me to work. Maybe not every day but four out of five isn’t bad. Making meals for dinner is sometimes more of a challenge but I work through it.

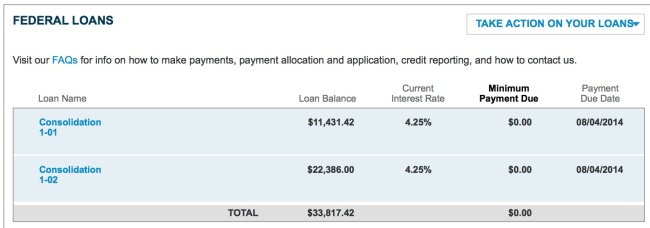

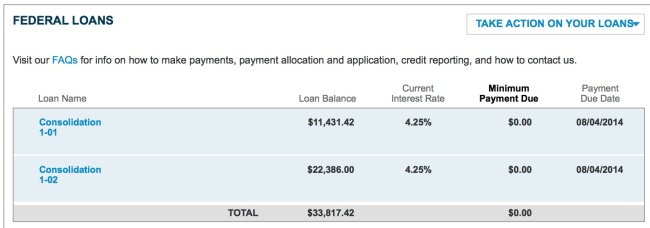

I had a couple of exchanges back and forth with Sallie Mae, basically my account says it’s prepaid until July 2014 however I’ve been making payments towards the principle not future payments. Long story short when I make an additional payment that exceeds my monthly minimum payment it advances their payment to counter by one even though the additional money still is applied toward principal… Then there was a separate issue of my student loan interest calculation not matching my estimations, Apparently there was over $800 in capitalized interest paid by me on account of my loans being in deferment previously. Although it helps with my tax refund I’m still mildly annoyed about how it was applied.

This month February I’m going back to my $1000 per month strategy since I’m well caught up versus wherever was at the beginning of January. After the money I’ve been waiting on from my old employer comes in I will use that money an emergency fund and apply an additional $500-1000 per month of each paycheck toward making principal payments. Time to get gazelle-like intensity as Ramsey puts it.

As of this writing, I have $155 in my wallet, 2435 balance on my credit cards and $1750 in my bank account. I scheduled payments totaling $1350 for tomorrow and the rest will come right out of my tax refund money.

Having some bathroom faucet hot water issues. Hopefully I can fix it on my own and not have to rely on a plumber. Stay tuned…